TMTB Morning Wrap

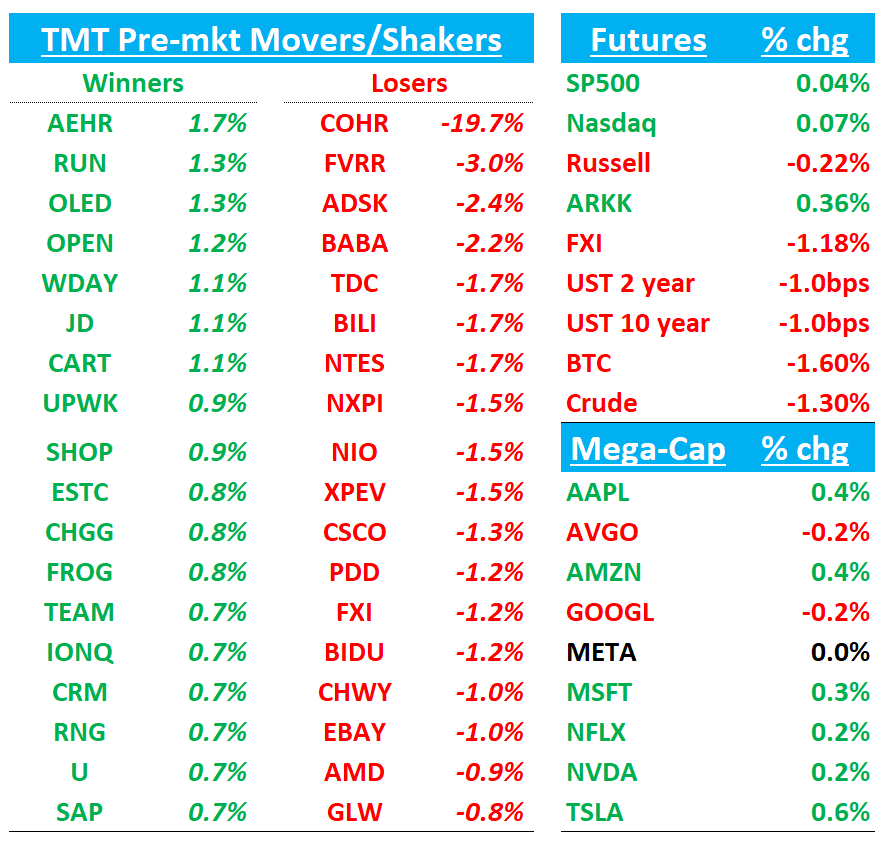

Good morning. Futures sleepy this morning so far as we await PPI at 8:30am. BTC hit new highs but now hovering around $120k, down 1.6%. China -1%. Yields ticking down slightly.

We’ll hit up CSCO COHR and Adyen earnings then dive into research/news.

Let’s get to it…

EARNINGS

CSCO -1%: Looks solid as AI order wave lifts Q4; Q1 guide > street; FY26 inline

Bull vs Bear Debate:

The bull case argues Cisco is now a clearer beneficiary of an AI‑driven networking cycle: webscale AI orders >$2B FY25 with revenue starting to flow (~$1B recognized already); Networking is comping above the long‑term 2–5% growth framework, aided by webscale strength, enterprise routing, and a coming multi‑year campus refresh (Cat 9K successor, Wi‑Fi 7). Bulls also point to Q1 and FY26 guidance in line to slightly ahead, resilient margins, healthy cash returns, and Splunk cross‑sell traction (new logos +14%) as proof the model can compound while AI ramps across webscale, enterprise inference, and sovereign. This quarter reinforces that narrative with Q4 at the high end, double‑digit Networking, and another step‑up in AI orders, supporting the mid‑single‑digit FY26 path.

The bear case focuses on mix and durability: Security growth trails the 15–17% long‑term ambition (management remains optimistic but acknowledges a slower ramp and U.S. Federal headwinds); growth is more AI/Networking‑weighted than many expected, leaving Cisco exposed to potential hyperscaler capex moderation; the campus refresh may ramp gradually; Services growth has decelerated and typically lags product cycles; and macro/tariffs remain variable. This quarter adds fuel to that debate by showcasing “more AI and less Security than investors presumed” even as the headline guide holds, keeping execution in Security and the cadence of hyperscaler deployments squarely in focus.

Key takeaways

Clean Q4 beat at the high end: Q4 revenue of $14.7B (+8% y/y) vs. Street $14.6B; non‑GAAP EPS $0.99 (+14% y/y) vs. Street $0.98. Gross margin 68.4% (+50 bps y/y) vs. Street ~68.2%; operating margin 34.3% vs. Street 34.1%. product orders +7% y/y. Management flagged strength across Networking and solid profitability.

AI momentum accelerated: Webscale AI infrastructure orders >$800M in Q4; >$2B in FY25 (vs. prior $1B target); ~$1B of AI revenue recognized in FY25. Mix >⅔ systems, remainder optics.

Guides FY26 to mid‑single‑digit growth: FY26 revenue $59–$60B and EPS $4.00–$4.06; Q1 revenue $14.65–$14.85B.. Q1 midpoint above street, FY26 largely in line.

Networking is the engine: Q4 Networking revenue +12% y/y; orders double‑digit for a fourth straight quarter. Webscale orders +triple‑digits again; two hyperscalers >$1B each in FY25.

Security mixed but improving ex‑Fed: Security revenue +9% y/y; new/refresh products >20% order growth; Splunk new logos +14% y/y in Q4; ex‑U.S. federal security orders grew double‑digits.

AI: Cisco frames three pillars—training infrastructure (webscale), enterprise inference/cloud (NVIDIA partnership, Secure AI Factory), and AI network connectivity—and expects sovereign AI to build in 2H FY26; product mix in AI orders >⅔ systems.

IT spend environment / macro: Enterprise orders +5% y/y, SP/Cloud +49% y/y, Public Sector –6% y/y (U.S. Federal the drag). EMEA orders +10% y/y. Management saw no pull‑forward ahead of tariffs.

Tariffs noted but small impact: Q4 tariff impact “small” (slightly favorable to guidance). FY26 assumes China 30% (with semiconductor exemptions), Mexico 25%, Canada 35%, plus small metals tariffs.

Capital returns robust: $12.4B returned in FY25 (94% of FCF); dividend raised for the 14th consecutive year. Priorities: fund growth → dividend → offset dilution → opportunistic returns.

COHR -20%: AI/Networking growth cools; Sep‑Q outlook lacks upside and gross margins still sub‑40%

Expectations were high following results from other peers & given its big stock run, so this isn’t good enough as Datacom +5% q/q and implied DC optics growth not good enough

Bull vs Bear Debate:

Bears much louder this morning:

The bear case is that Datacom momentum is decelerating relative to expectations and peers, with sequential growth not re‑accelerating as much as hoped; transceiver pricing and competition could cap margins below 40%, and Industrial remains macro‑sensitive. Bears also note that A&D sale creates a top‑line headwind into FY26 and that newer drivers (OCS, 1.6T, Apple VCSEL) are more meaningful in CY26+, not immediate. This quarter, the flat revenue guide (ex‑A&D), “lumpy Datacom” tone, and comparisons versus LITE reinforced those concerns, implying potential share loss vs competitors

The bull case is that COHR sits squarely in front of secular AI datacenter bandwidth growth with a deep photonics stack (EMLs, InP integration, 800G→1.6T→3.2T roadmap) and new adjacencies (OCS, CPO) that expand TAM. Bulls also point to self‑help: the A&D divestiture, FX‑masked GM progress, the 6‑inch InP cost/volume curve, and an Apple VCSEL ramp in 2H’26—all reinforcing a credible path toward >42% GM and EPS compounding. This quarter’s beat on EPS/GM, first 1.6T and OCS revenues, and the InP production start in Sherman underpin that narrative; the guide’s GM midpoint (38.5%) and “DC&Comms up q/q” framing also support near‑term resilience.

The Numbers:

Revenue of $1,529M +16% y/y, +2% q/q vs Street $1,513M.

Non‑GAAP GM 38.1% vs Street 37.7%;

non‑GAAP OM 18.0% vs Street 18.4%;

non‑GAAP EPS $1.00 vs Street $0.92.

By market: Datacenter & Communications $942M +39% y/y, +5% q/q; Industrial $587M −8% y/y, −2% q/q.

Guidance:

Revenue $1.46–$1.60B (midpoint $1.53B; excludes ~$20M A&D) vs Street ~$1.55B.

GM 37.5–39.5% (MP 38.5% vs Street ~38.0%).

Non‑GAAP OpEx $290–310M;

tax 18–22%. EPS $0.93–$1.13 (MP $1.03 vs Street ~$1.02–1.03).

Mgmt expects Datacenter & Comms up q/q and Industrial down q/q (incl. A&D impact).

Key Takeaways

Product road map executing: first revenue from 1.6T pluggables; OCS shipments began; 6‑inch InP production starting now in Sherman, TX (world’s first; cost/volume tailwind).

Portfolio cleanup: agreed sale of Aerospace & Defense for $400M; EPS accretive, proceeds to debt pay‑down; removes ~$50M/quarter of lower‑margin revenue (−$20M impact already assumed in Sep‑Q).

AI/IT spend visibility healthy: management cites strong AI DC bookings/demand; hyperscaler visibility normal to higher vs prior quarters.

Macro/tariffs: Near‑term caution in broad industrial given macro and tariff uncertainty; company expects minimal tariff impact and even a competitive advantage due to U.S. manufacturing and semiconductor‑tariff exemptions

Gets a dg at BofA, citing slowing momentum in the data center segment and only “modest” gross margin improvement despite multiple restructuring moves. BofA also flags a ~$170M FY26 growth headwind from the sale of the aerospace and defense unit, with new Apple contract revenue not arriving until FY27. Offsetting some of the near-term pressure, the firm raised 2026 and 2027 estimates by 5% and 12%, respectively, on lower interest expense.

ADYEN: -16%: : FY25 Growth Trimmed on Tariff Impact

Adyen’s 2Q revenue growth slowed to 20% in constant currency, down from 26% in 2Q24 and 21% in 1Q25, with processed volume coming in 3% below street. The company cited US tariffs as the key driver of softer demand, particularly hitting online retailers in APAC:

In recent months, the macroeconomic environment has grown increasingly uncertain - following lower-than-expected market volume growth in the first half, we now consider the previously anticipated acceleration unlikely. We expect this trend to persist through the remainder of the year

Management lowered its FY25 outlook slightly, now expecting growth broadly in line with 1H levels (+21% CC vs. prior view of a slight acceleration), compared to the Street’s 22.7% consensus. EBITDA margin guidance remains unchanged at above 50%, with 1H margins up 340bps to 49.7%. Previously shared targets for 2025–26—revenue growth in the low-to-high 20% range, >50% margins, and stable capex—are unchanged.

RESEARCH/NEWS

MSFT: Citi Sees Modest Tailwind from Price Hike to M365/D365

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.