TMTB Morning Wrap

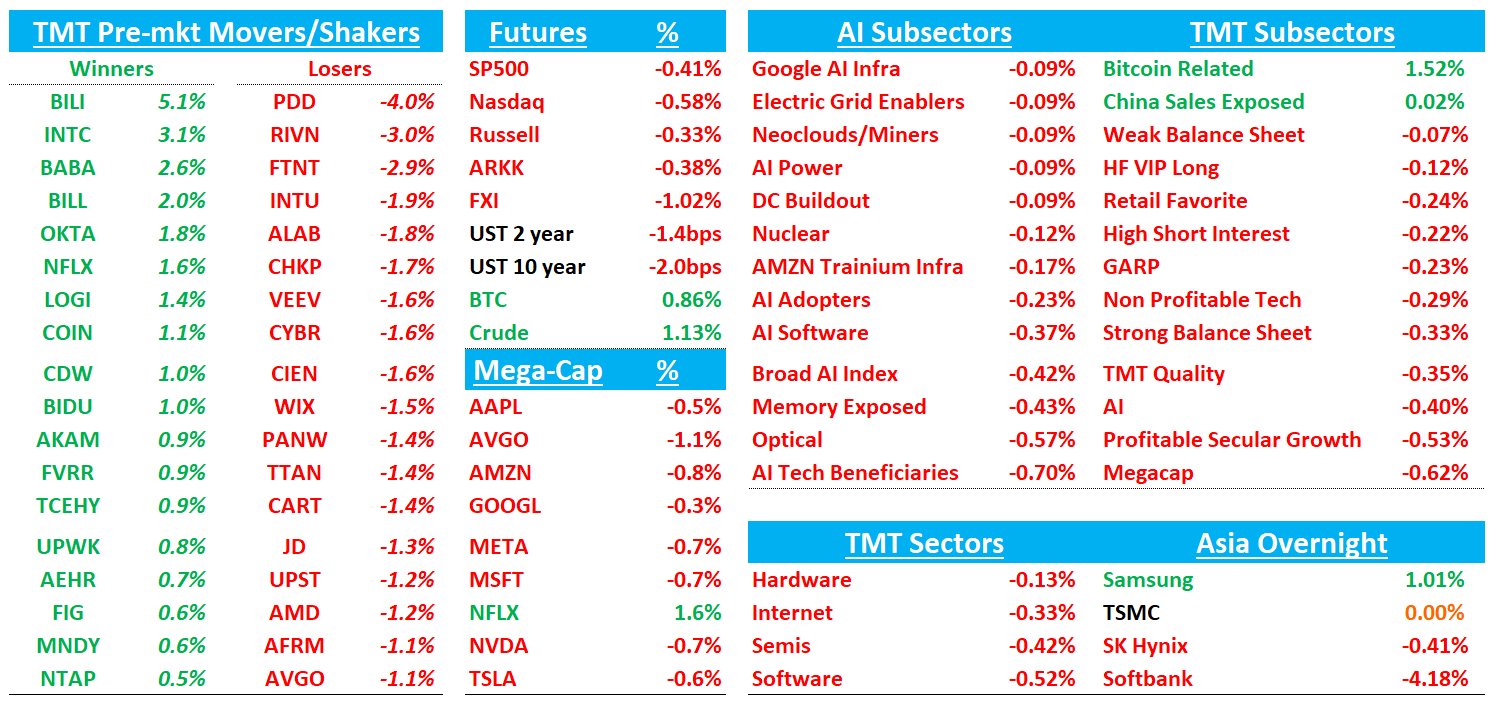

Good morning. QQQs -50bps to start. BTC +1% to $95k hitting 2 months highs while other commodities (Silver, Gold, Copper) continue to hit new highs as oil seems to be having a moment as well. Asia mostly saw gains: TPX +1.26%, NKY +1.48%, Hang Seng +0.56%, HSCEI +0.32%, SHCOMP -0.31%, Shenzhen +0.65%, Taiwan TAIEX +0.76%, Korea KOSPI +0.65%

The Claude Code is “early AGI” rumblings had been going on somewhat under the surface since before the new year, which we think — along with the OAI fund raising news in late Dec as a close 2nd - have been the two main drivers of AI semi strength to begin the year. But yesterday felt like the Claude Code hype finally hit everyone’s radar if it hadn’t already been on there, likely catalyzed by the Claude CoWork release (although we think this tipping point was likely to happen regardless).

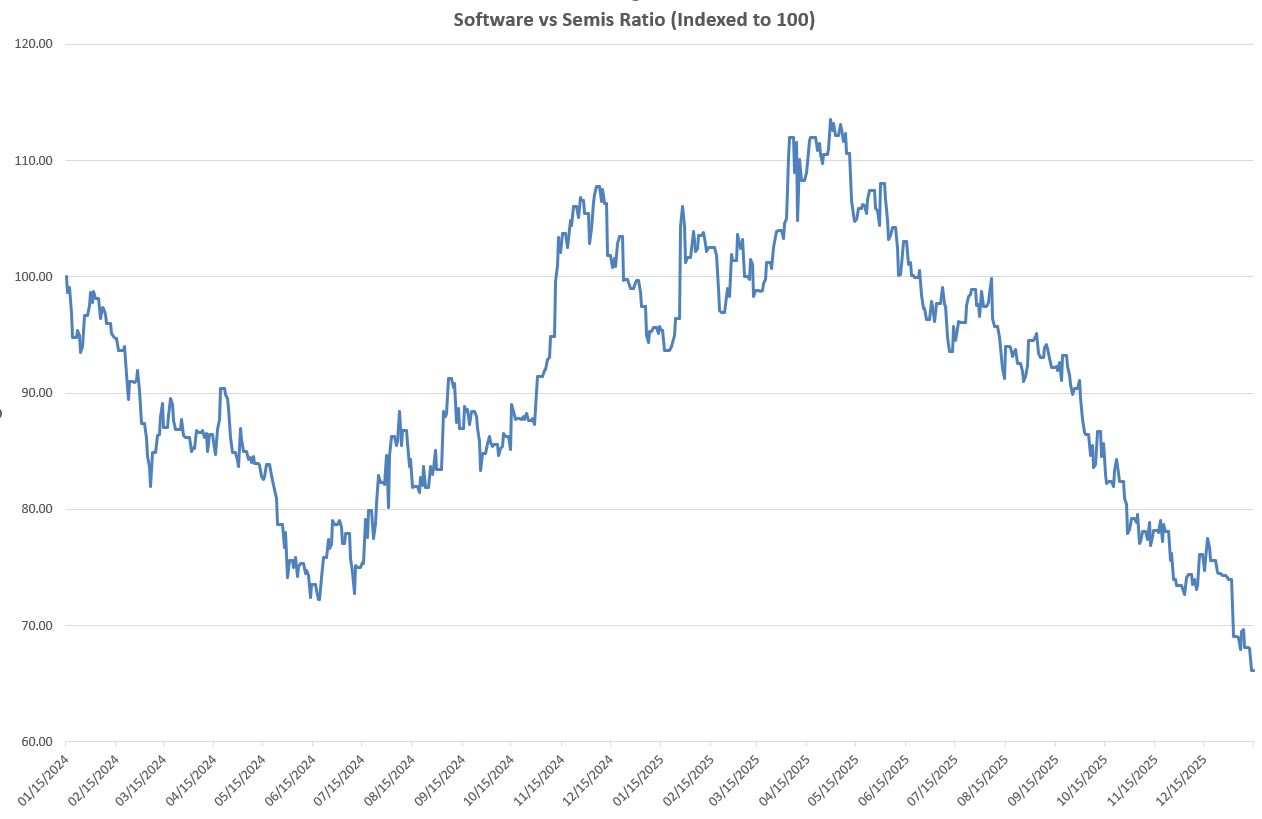

Software had another awful day yesterday with CRM -7% the standout as Semis/Software ratio hit new lows:

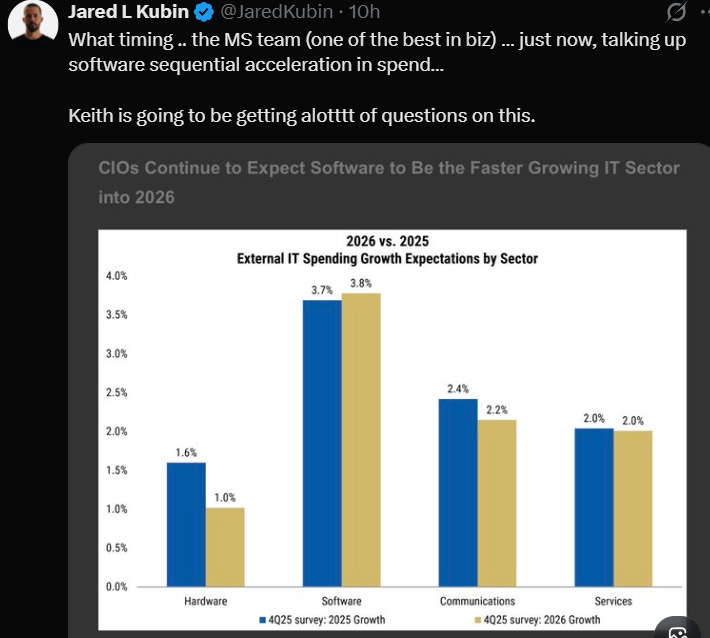

Investors have no appetite for app sw right now (good thread on the topic here in TMTB Chat). Interestingly, the MS CIO Survey that came out this morning actually cited ‘26 software spending expects going up:

Quite a start to the year - and it’s only 2 weeks in. Strap in!

APP: Initiated at Outperform with $835 price target at ISI on mobile gaming strength and e-commerce upside

ISI initiated coverage of AppLovin with an Outperform rating and an $835 price target, citing roughly 25% upside as the firm views APP as the dominant mobile gaming platform with a rapidly emerging performance-driven e-commerce channel. The analyst expects mobile gaming and e-commerce spend to drive sustained 30%+ revenue and EBITDA CAGRs from 2025–2028, with mobile gaming spend growing ~23% CAGR through 2028 and valuation supported at ~36x FY26 EV/EBITDA. ISI highlights improving DTC performance, strong momentum in 3P pixel checks, and expanding global DTC GMV, while arguing downside risk is limited absent a highly aggressive shift in ad-conversion enforcement.

FLEX: Upgraded to Outperform at Raymond James on cloud/AI datacenter upside

Raymond James upgraded Flex to Outperform from Market Perform and initiated a $75 price target, citing an improved entry point and growing exposure to cloud and AI datacenter infrastructure. The firm highlights $6.5B of expected FY26 datacenter revenue (+35% y/y), with roughly $2B tied to higher-margin power solutions, which the analyst says could carry margins more than double the corporate average and drive consolidated margins toward ~7% over time. Raymond James sees scope for upside to estimates as hyperscale demand accelerates, with an investor meeting in May flagged as a catalyst to clarify cloud/AI contribution, particularly power, and support multiple expansion. The $75 target reflects a ~21x multiple on FY27 non-GAAP EPS, incorporating a 2–3 turn premium for Flex’s higher-growth datacenter mix versus traditional industrial peers.

TSM: Charlie Chan at MS raised TSMC capex to $54B in ‘27 and notes still below mkt chatter of $60B, but thinks it will eventually get there given the strong AI demand

BABA +5% ahead of Qwen launch event tomorrow at 10am HKT

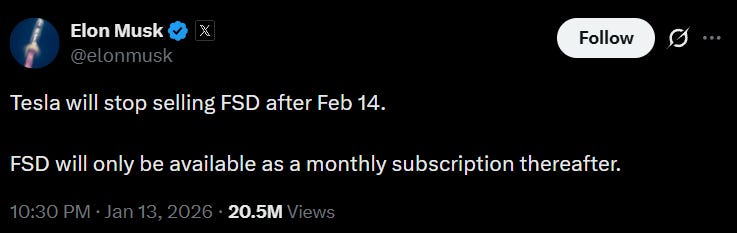

TSLA:

PANW/Cyber sw: Beijing tells Chinese firms to stop using US and Israeli cybersecurity software

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.