TMTB Morning Wrap

Good morning. The good news: It’s Friday! The bad news:

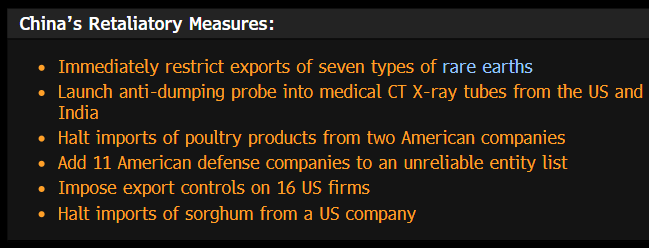

China hits back at Trump with 34% tariff on U.S. imports - link

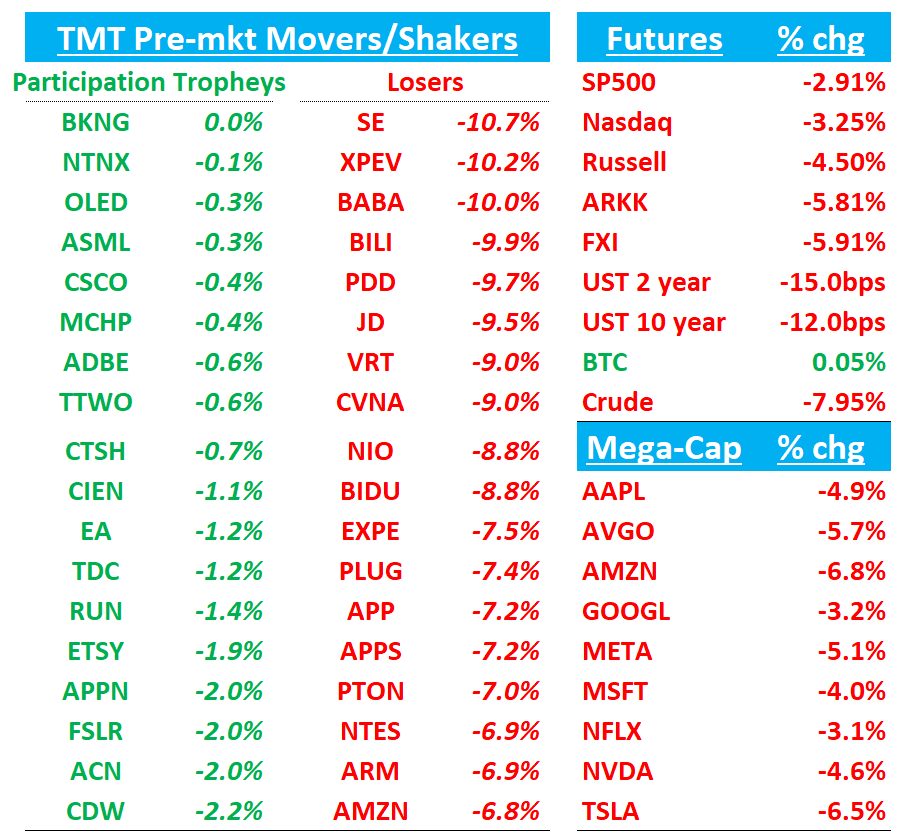

QQQs -3% selling off most of the morning on the news (we were already down close to 100bps before China announced tariffs). China -6%, BABA -10% as fears of an all out trade war has investors even more skittish than yesterday.

Trump re-posted this on Truth social a few minutes ago:

TradeTheNews has rundown of banned rare earths and end markets (H/T Rocha at Wells)

Samarium (Sm): Used in samarium-cobalt (SmCo) magnets for high-temperature stability in military equipment (e.g., jet engines, missiles) and some industrial motors. Also in samarium-153 for bone cancer pain relief in medicine.

Gadolinium (Gd): Essential as a contrast agent in MRI scans (gadolinium-based compounds). Also used in neutron shielding for nuclear reactors, semiconductors, and phosphors in displays.

Terbium (Tb): Enhances neodymium-iron-boron (NdFeB) magnets for heat resistance in electric vehicle motors, wind turbine generators, and consumer electronics (e.g., speakers, hard drives). Also used in phosphors for fluorescent lights and LEDs.

Dysprosium (Dy): Critical additive in NdFeB magnets to boost heat resistance, vital for EV motors, wind turbines, and defense systems (e.g., actuators in aircraft). No direct substitute in high-performance applications.

Lutetium (Lu): Used in lutetium-177 for targeted cancer radiotherapy (e.g., prostate cancer treatment). Also in high-refractive-index glass for optics and as a catalyst in petroleum refining.

Scandium (Sc): Alloyed with aluminum to create lightweight, strong materials for aerospace (e.g., aircraft frames) and sports equipment (e.g., bike frames). Emerging use in solid oxide fuel cells for clean energy.

Yttrium (Y): Key in phosphors for energy-efficient LEDs, CRT displays, and fluorescent lamps. Also used in yttrium-aluminum-garnet (YAG) crystals for lasers and in high-temperature superconductors.

Do we see a spike in big ticket consumer items over the next week before China Tariffs go into effect on Apr 10th?

NFP came in better than expected at 228k vs 140k although likely seen as backward looking at this point…

10 Year finally has a 3 handle with 2 year dn 15bps and 10 year dn 12bps:

BTC flat the one risk asset hanging in there as Crude -8% getting close to $60.

Really not much out there on the Tech Research/News front, and not that it matters much on a day like today but let’s get to it…

Macro: Harnett at BofA lays out the Big Picture succinctly

70% of global stock market, up from 40% during GFC ; on Jan 1st everyone "all-in" on US exceptionalism, few positioned for recession, bear market, full-blown trade war; since Jan 1st DeepSeek + DOGE + Liberation Day...new secular bear market in US$ + end of US equity market leadership.

Notes $250 x 20x = 5000 first “recession floor” for SPX, which is basically taking a 15% haircut to SP500 EPS. 20x is first stop but ultimate bottom could be lower

Nomura:

“In the medium-term, my view remains largely the same – we are operating in a much more uncertain world in term of the macro landscape and this is NOT a short-term volatility episode. Yes, there is some hope for an exit ramp on tariff escalation but thus far the Trump administration has not indicated any eagerness to engage and, if anything, we’re heading in the wrong direction with China’s “reciprocal tariff” announcement this morning. There is a real risk that this administration’s policy is on a path to undo 30 years of globalization and jeopardize decades more of global alliances. While that may sound draconian, it’s a scenario that must at least be discounted to some extent”

SaaS/software: Citi comments on impact of Tariffs on software

Citi's tariff impact analysis across SaaS sectors identifies SHOP and KYVO as most vulnerable in e-commerce, while front-office vendors with high B2C/SMB exposure (AMPL, BRZE, HUBS) face early consumer weakness impacts. Cloud hyperscalers MSFT and ORCL will likely see the highest direct cost increases from datacenter components sourced from heavily-tariffed regions. Communication software remains mixed, with Zoom and Weave relatively insulated due to limited international exposure. In data analytics, ESTC, TDC and CFLT face greater risk from 40%+ international exposure, particularly in EMEA (~20% tariffs) and vulnerable sectors, while SNOW and PLTR appear better positioned with less international presence and early AI spending benefits.

Internet: Mark Mahaney at ISI comments on impact of Tariffs on Internet

ISI notes the internet sector has limited direct tariff exposure, though AMZN and SHOP will need to manage international retail product sourcing, potentially affecting margins. ISI recommends near-term caution while favoring Recession Resistant names: 1) NFLX with its "ultra-cheap" $7.99 ad-supported plan; 2) SPOT offering music for $11.99 with improved monetization; 3) UBER, now functioning as a utility with secular adoption trends; 4) DASH benefiting from convenience demand throughout economic cycles; and 5) META, where performance marketing platforms typically face less severe budget cuts during downturns. Conversely, companies with exposure to discretionary spending (SHOP, ABNB, BKNG, EXPE, EBAY, ETSY) and brand advertising (TTD, SNAP, ROKU) face the highest recession risk.

Third Party Data Roundup:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.