TMTB Morning Wrap

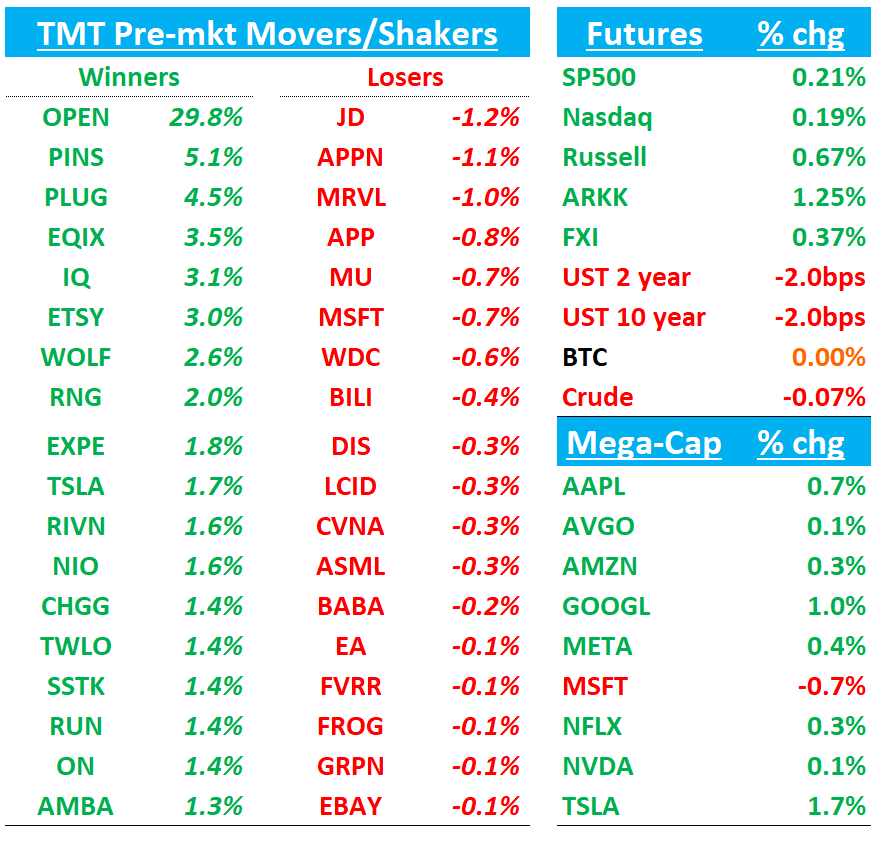

Good morning. QQQs +20bps while yields tick lower (10 year down 5 bps) ahead of a busy week of earnings as 20%+ of SP500 reports and 70% of TMT will report over the next two weeks with TSLA GOOG and NOW the highlights this week. GS notes “the average tech stock is implying an earnings day move of 4.7%, the lowest level in two decades (it hasn’t been this cheap to hedge tech earnings in 20 years).”

US TSY SEC. BESSENT ON AUG 1 DEADLINE: TALKS ARE MOVING ALONG; PRESIDENT HAS CREATED MAXIMUM LEVERAGE. WE ARE MORE CONCERNED ABOUT GETTING QUALITY DEALS, THAN DOING IT BEFORE THE DEADLINE -CNBC

Let’s get to it…

PINS: Morgan Stanley Lifts to Overweight, Sees 21% Upside from GPU and Engagement Tailwinds

Morgan Stanley upgraded Pinterest to Overweight with a $45 price target (~21% upside), turning constructive as recent ad checks and product investments begin to show signs of payoff. MS believes Pinterest's multi-quarter GPU-enabled improvements are now translating into stronger relevancy, performance, and monetization. The firm highlights new ad tools like Performance+, visual search, and item-level bidding as contributors to accelerating growth. MS also sees upside to revenue and EBITDA in 2H:25, with PINS well-positioned to follow the path of other tech names that benefited from GenAI tailwinds and margin leverage. At current levels, the stock trades at a meaningful discount to peers like SNAP despite a stronger growth and margin profile.

TMTB: We mentioned last week we’ve warmed up to the name given street estimates that look too low for 2H (13% y/y revenue), and we think it’s likely that # is in high teens (MS models 17%). Engagement and ad checks have also been positive for PINS recently.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.