TMTB Morning Wrap

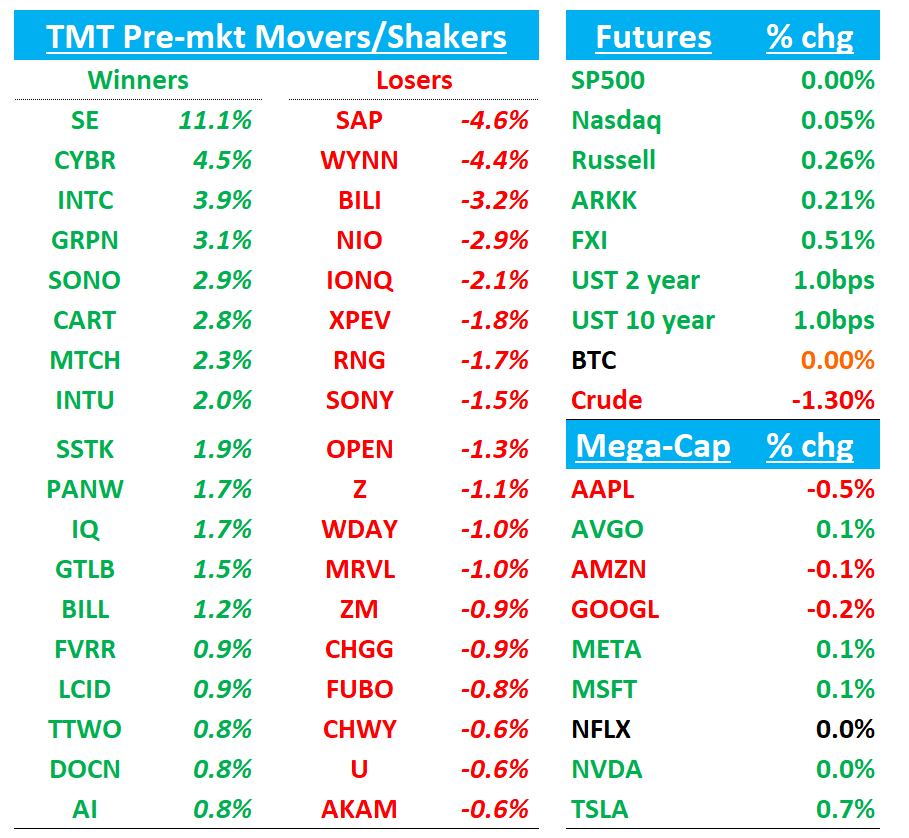

Good morning. Futures flat as all eyes on CPI at 8:30am est. Fairly slow Tuesday in August, but let’s get to it…

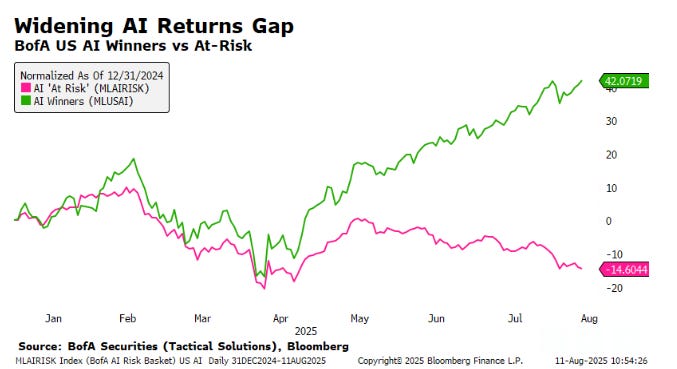

Name of the game in the market right now (h/t J. Kulina @ Wedbush):

Pre-open earnings:

CRCL +7% shares are up after the company delivered modest top- and bottom-line beats in 2Q, with USDC growth accelerating to +10% from +6% in the prior quarter and total USDC in circulation surging 90% Y/Y. Guidance mixed. Management projects USDC in circulation to grow at a 40% CAGR over the long term, versus consensus in the mid-40% range. For FY25, other revenue is guided to $75–85M (~3% below Street) and RLDC margins are expected at 36–38%, with consensus near the top of that band.

SE +10% posted a strong 2Q25 beat with revenue of $5.26B (+38% Y/Y), topping consensus by 6% and driven by upside in Digital Entertainment and Digital Finance, while E-Commerce EBITDA came in slightly below expectations. Shopee’s GMV grew 28.2% Y/Y (vs 23% consensus), accelerating ~7 points from last quarter, with management guiding for continued momentum into Q3. E-Commerce revenue rose 33.7% Y/Y to $3.83B, also ahead of estimates. Garena bookings climbed 23.2% Y/Y to $559M, prompting a full-year guide raise and expectations for >30% bookings growth in 2025. Digital Finance revenue jumped 70% Y/Y to $883M. Group adjusted EBITDA was $829M (vs $799.5M consensus), with Shopee delivering $227.7M EBITDA and a 0.76% margin, slightly ahead of expectations.

Both calls ongoing…

PANW: Piper Upgrades to Overweight, Sees Tailwinds from Platform Gains and CYBR Deal

Piper raised Palo Alto Networks to Overweight with a $225 target, citing strengthening platform adoption, improved free cash flow visibility, and the strategic CYBR acquisition. The firm highlights that platform momentum is accelerating bookings growth—projected to hit ~16% in 4Q25 versus ~9% when the strategy launched—while consolidation trends remain early, leaving ample runway for expansion in security’s most fragmented segment. Piper says FCF headwinds from the shift to annual payments should now ease, with PAN-FS inflows creating a more stable growth path. The CYBR acquisition, while not the core driver of the upgrade, is viewed as adding one of the strongest assets in security to PANW’s portfolio, supporting long-term consolidation benefits.

PANW: BWG Global Lifts View to Mixed on Stronger Q4 Setup

BWG Global raised its stance on Palo Alto Networks to Mixed from Negative, pointing to partner feedback that Q4 sales and pipeline trends are being supported by multi-year deals, better platform adoption, and discounting activity. The firm says these factors have helped strengthen near-term expectations compared to prior views.

PANW: Barclays Sees Solid 4Q Setup, Expects FY26 Growth Guide of 12–13%

Barclays says partner checks, a healthy pipeline, and a stable macro backdrop support expectations for $4B+ in 4Q RPO bookings, with a rising share of new products driving stronger NNARR growth. The firm expects PANW to guide FY26 revenue growth to 12–13%, supported by high-teens RPO growth and gains in NGS ARR, following FY25 bookings growth of roughly 15%. Barclays notes momentum in newer offerings is accelerating 2H NNARR and could provide moderate upside to 4Q NGS ARR. While the CYBR acquisition created dilution that pressured shares, Barclays likes the asset’s strategic fit and estimates PANW could repurchase 30–40% of that dilution within two years.

MNDY: Morgan Stanley Upgrades to Overweight, Sees 40% Pullback as Attractive Entry

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.