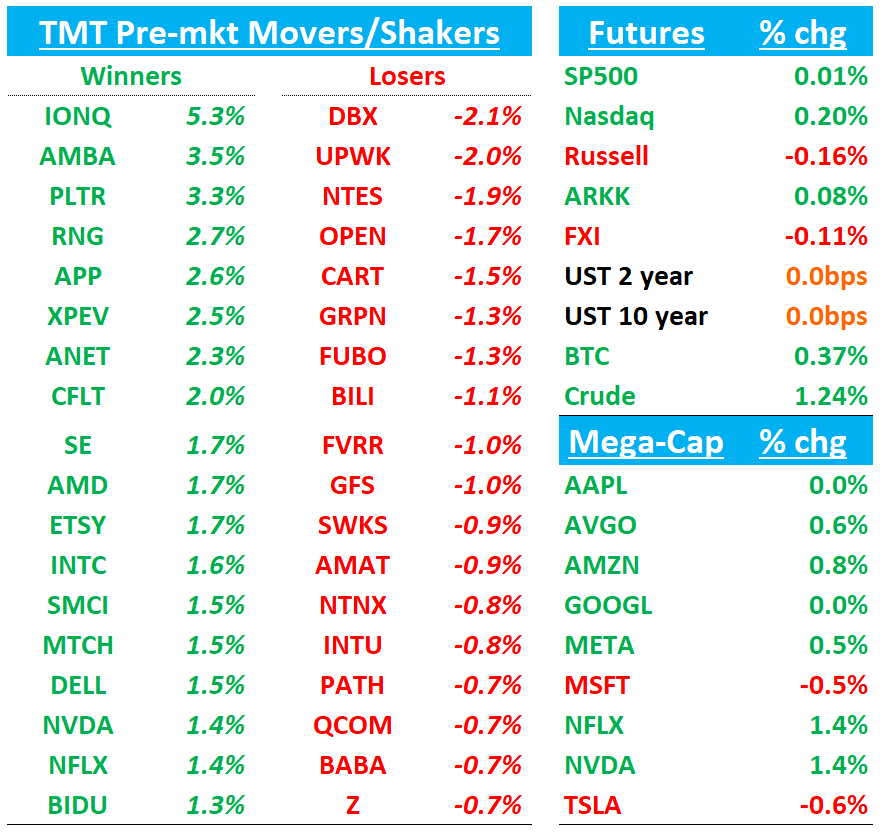

QQQs +15bps. China/BTC/Yields flat. GTC starts today and runs through the week with Jensen keynote is tomorrow at 10am pst.

Let’s get straight to it…

NVDA: UBS says GB300 BW Ultra pulled in by 1Q after talking with 30 companies in APAC supply chain over the last week

UBS reports Blackwell demand remains strong, B200 rack bottlenecks resolved, and NVDA pulling in B300/GB300 (Blackwell Ultra) timing by ~1Q with significant volumes likely in Q3'25. UBS notes slightly less aggressive TSMC CoWoS expansion plans for YE25/YE26 (70k/110k vs prior 80k/120k), but attributes this to improving CoWoS-L yields rather than demand issues. UBS maintains NVDA GPU shipment projection at ~6.1MM units, with mix shifting toward B300/GB300. UBS also notes it seems likely that the US DOC will probably place additional restrictions on compute meaning NVDA will have to further modify H20 to ship - AI diffusion rules scheduled to be enacted on May 15th.

NVDA: Barclays comments on NVDA checks after Asia meeting with ODMs, OEMs, vendors and supply chain partners

Barclays reports Blackwell Q1 volumes match November update at 20k wafers monthly (300k chips). Capacity increases to 40k wafers (~600k chips) monthly in Q2. Testing runs above-normal utilization due to ramp constraints. Q3 capacity increasing 30%+ per recent NVDA update, reaching ~780k chips monthly. Barclays notes Ultra production starting with August/September shipments. Shares B200 capacity but has better test times from B300A mix, with clarification coming to supply chain April/May.

NVDA: MS has some thoughts ahead of GTC event

NVDA remains MSCO's Top Pick and after 3-4 months of concern about transitional issues, business indicators are all positive, with the only risks outside of their control. There are several underpinnings to MSCO's positive view - Cloud commentary makes it clear that everyone in cloud was hardware constrained last qtr, indicating clear pent up demand for Blackwell; Near term business is strong, both Hopper and Blackwell; CoWoS commentary (cuts on Hopper) reflects on things that it published about in November, and reflects the upside in Blackwell supply; GB200 ramping nicely; GB300 launch at GTC.

3p Roundup:

AMD: Edgewater positive saying server builds tracking better in Q1 - pot’l for 1H25 AI GPU upside but focus still on Mi350 launch in 2H.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.