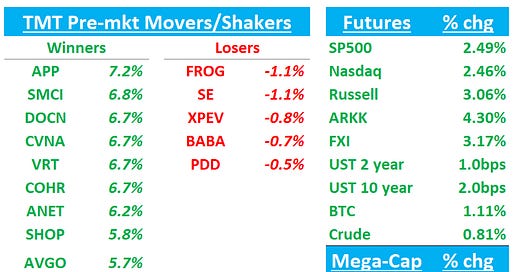

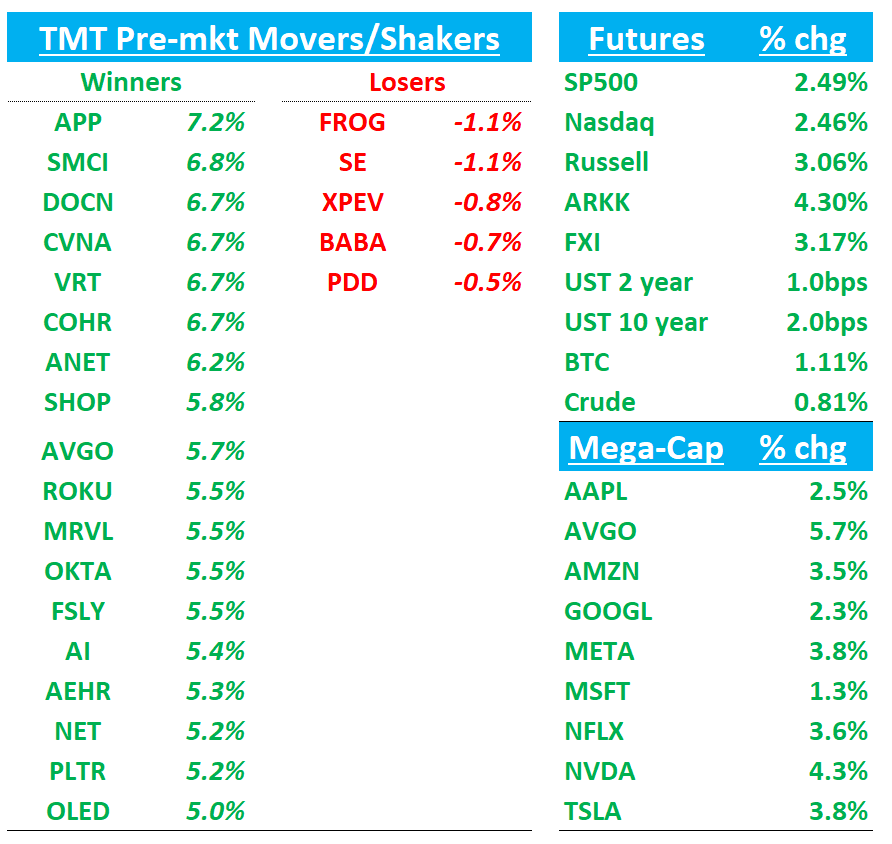

Good morning. QQQs +2.6% as market following through on yesterday’s bounce from the lows. AI semis seem to be leading the way higher again, helped by AVGO buyback. News flow slightly better overnight with Bessent leading negotiations with Japan, going to FL to tell Trump to dampen rhetoric for stock market’s sake (Politico), and saying “If we're successful, the tariffs would kind of be like a melting ice cube. Countries that didn't escalate will get talks priority and solid proposals on tariffs could lead to some strong deal.” In other words, the narrative has shifted back to “it’s a negotiation” and it does seem like rates will come down for many countries, although investor focus remains on China and EU. Yields ticking up again slightly. BTC +1% to $80k. China +3%.

Some of the tea leaves we mentioned yesterday and over the weekend for a pot’l ST bottom seem to have played out. We really like the stuff macrocharts has been putting out - worth a visit.

BTIG:

Over the past ten years, the four prior largest notional volume days all marked tactical lows, but all of those were re-tested and in some cases meaningfully broken over the ensuing weeks. How far could the bounce go? All four of the prior dates saw SPX recover at least 50% of the drop before moving lower. That would imply SPX could reach ~5500 before turning back lower.

Let’s get to the good stuff: Tech…

MRVL: Marvell sells automotive ethernet business to Infineon for $2.5B in cash

Marvell (MRVL) "announced that it has entered into a definitive agreement under which Infineon Technologies AG (IFNNY) will acquire Marvell's Automotive Ethernet business in an all-cash transaction valued at $2.5 billion or 10x 2026 expected revenue. This business in fiscal 2026 is expected to generate revenue in the range of $225M-$250M. The acquisition includes Marvell's Brightlane Automotive Ethernet portfolio and related assets. This transaction has been approved by Marvell's Board of Directors, and is expected to close within calendar year 2025, subject to customary closing conditions and regulatory approvals."

Rosenblatt says they see this as a good deal for both companies as the infra market has growtn to 75% of MRVL’s total revs in Q4 and they see room for additional growth - with 50% rev exposure to autos, they think Infineon can add impt ethernet products and design wins to its product line up.

AVGO announces $10B accelerated repurchase through Dec 31, 2025 (1.5% of market cap)

“The new share repurchase program reflects the Board's confidence in our strong cash flow generation and allows us to deliver value to our stockholders.”

AMD: AMD downgraded to Sector Weight from Overweight at KeyBanc

KeyBanc is reducing AMD's rating due to: 1) sustainability concerns regarding China's AI business; 2) gross margin pressure from potential Intel price war; and 3) limited opportunities for share gains as Intel advances on 18A. Despite AMD trading at a reasonable 13x 2026 EPS, KeyBanc notes semiconductor stocks typically struggle when gross margins are at risk. While raising revenue estimates on stronger MI308 and PC demand, KeyBanc remains concerned about China AI demand sustainability, Intel's aggressive pricing forcing AMD to respond with margin-impacting price cuts, and Intel's 18A progress potentially narrowing AMD's competitive edge in server/PC markets.

NVDA(-)/MU(+)/MRVL(-)/AVGO(+/-): KEYB also comments on a few other semi stocks post their supply chain checks

They have neg takeaways for NVDA:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.