TMTB Mid-day Wrap

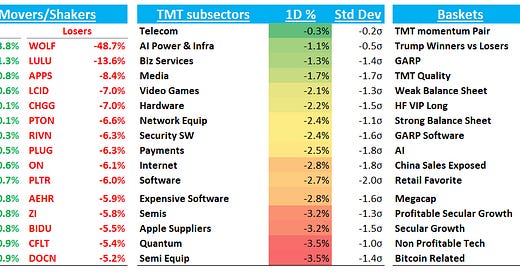

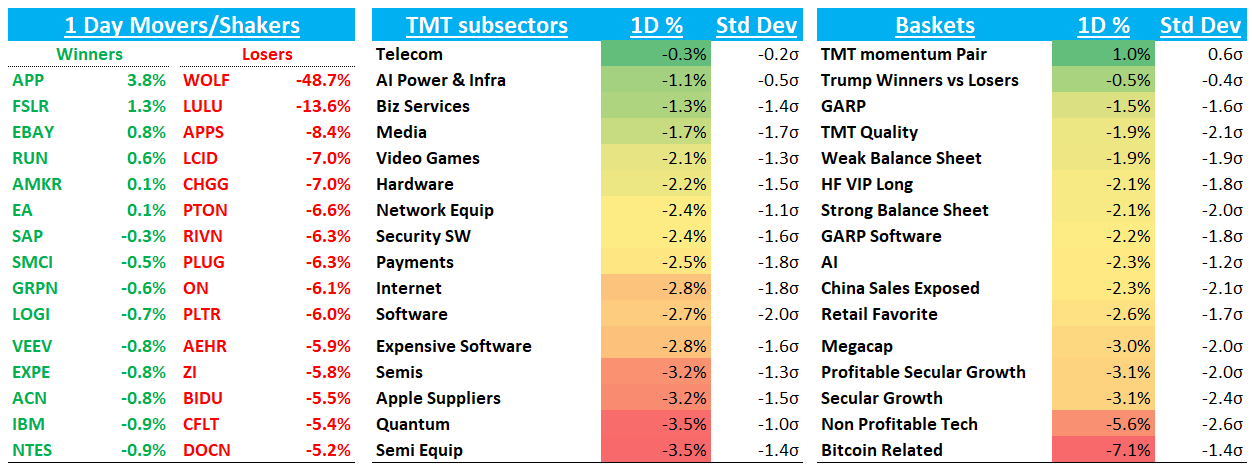

A bit of an early one today. QQQs - 2.3% as a hotter PCE, weaker Umich #s, and a downtick in Atlanta Fed GDP are fueling more growth scares even before Trump’s tariffs go into place. We had a couple of days of Trump optimism early in the week, but VK puts it well now: “it’s increasingly dawning on people that Trump is serious about tariffs, his pain threshold is high, there are no dissenting voices in the White House, other countries and trading partners will retaliate, and the economic fallout of all the trade changes will be material.” Yields are down 6-8bps across the curve and market now pricing in 70bps worth of cuts this year. BTC -4%

In addition to that, had some more weaker consumer reports from LULU and OXM.

In terms of factors, non-profitable tech leading the way lower although Internet Mega cap is also weak. No sector really immune from the sell off today.

Name of the game for us remains: 1) protect pnl (low gross/net but increase with high conviction ideas) 2) continue to be flexible/adjust as things change 3) FOMO will kill you both ways 4) take shots but bar for conviction has to be higher, don’t get greedy (time to focus on singles not HRs) and always risk manage.

Lots of red and flows usually dominate the moves on a big risk-off day like today, especially a Friday as this year has shown that holding over the weekend on a big red Friday has usually not paid off. So not a lot of idio stuff to call out, but here’s a few names we have our eye on:

APP +5% as CEO, sell-side, and others out defending the name after Muddy Waters short report yesterday - went over most of what was out there this morning. V likely co is in there buying back some stock today

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.