TMTB: GTLB the latest sw fumble; AAPL neg news; CVNA +3p data/CFO comments; LYFT ug at Argus; SE ug at JPM; ADBE Barclays +ve; AMD China roadblock; Wolfe CART accel bull case; 3p roundup (AMZN MSFT W)

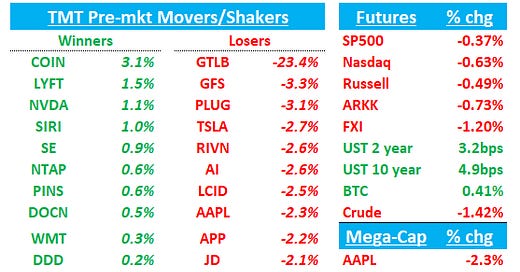

Good morning - QQQs are down 60bps, BTC up 1%, yields down 4-5bps and china is down 1.4%. Early price action points to a continuation of yesterday’s trends with NVDA +1%, AAPL down another 2.2% on more negative news flow, and TSLA -3%. GTLB is down 23% after pulling their “conservative” guidance methodology — another sw fumble which is adding fuel to the fire to trend/shift in flows we’ve been writing about: investors asking why they are paying mid teens sales multiples for sw stocks w aggressive growth expects when you get cheap hw/semis cos with AI exp trading at attractive FCF multiples. Let’s see if that continues today…

Slow news today as most focused on MS TMT conf: Key presentations I’ll be paying attention to today: AMD/IBM at 8am, DDOG CEO 9:30am, Iger at 10:15am; WDC/MTCH at 11am; PANW CEO at 11:45am, LYFT CEO at 1:20pm, SNOW CFO at 2:50pm and CRM CFO at 3:35pm.

Let’s get to it…

GTLB -23% on lower FY guide and pulling their “conservative” guidance methodology

The Q actually looked good with revs 4% ahead of street, and billings 10% ahead with RPO strong at 55%, cRPO up 40%, DBNR higher seq to 130% but their FY guide was lower at $725-$731M vs street at $732. The stock hung in there ok at first only down mid single digits as investors had come to expect conservative guidance from GTLB, but then they dropped this bomb on the call:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.