TMTB EOD Wrap...late but some impt stuff to recap

Running around today and finally got back to my screens…

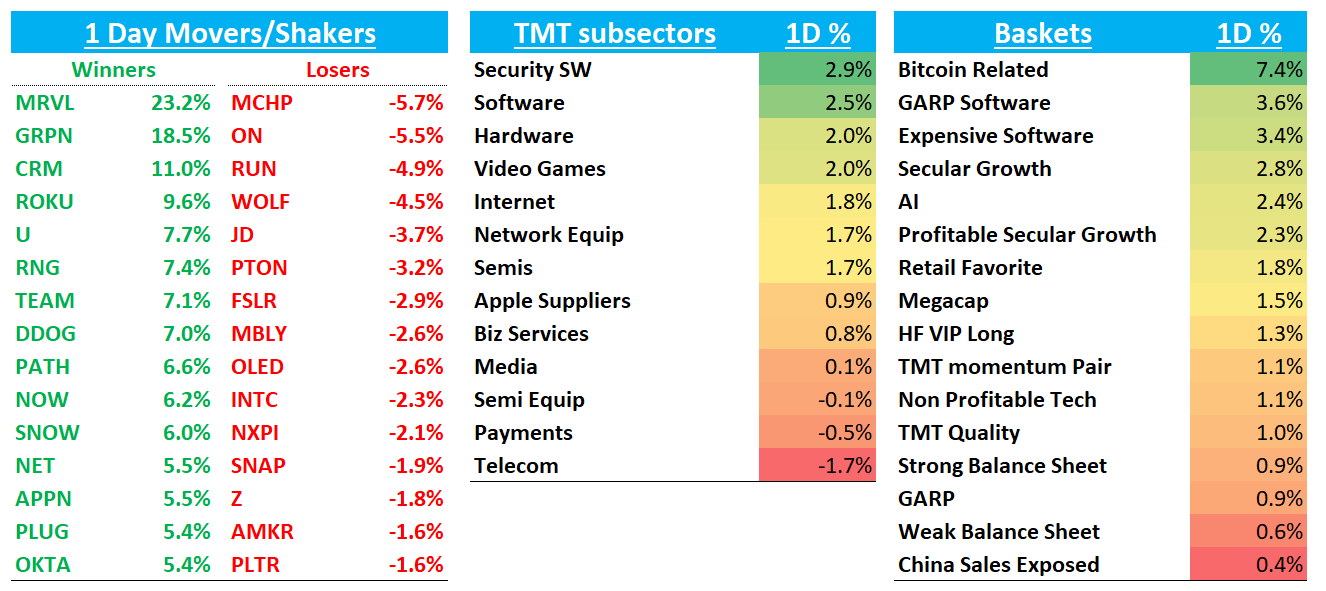

QQQs +1.2% on a day where everything rallied.

Semis +1.7% despite being weighed down by analog names (MCHP/ON -5%) as AI names ripped 2.5% led by MRVL’s monster 23% move. Lots of positive news flow in space, including AMZN announcements at re:Invent that included AMZN + Anthropic building massive 400k super cluster (h/t semianalysis), AMZN continuing to emphasize NVDA relationship while launching new Novo foundational model, NVDA CFO sounding good at UBS yesterday while Jensen sounded bullish in the Wired article, OpenAI CFO sounding bullish at UBS around scaling laws, FT article out post close saying xAI will build a cluster with 1M GPUs, up from current 100k (its clear musk doesn’t believe in scaling limits). And OpenAI teased 12 announcements in 12 days:

Software also ripped driven by CRM move (+11% on Agentforce optimism despite a roughly inline print) which in turn drove up other agent exposed names like TEAM +7%; HUBS +5% and NOW +6%. Here’s what we wrote this morning:

We’ve been writing how we are shifting into the year of AI Agents and yesterday’s print and today’s $CRM stock reaction to just a small beat is confirming that. Just like 2023 was a year where semis were largely driven by top down thematic moves (anything remotely AI ripped), we think software co’s with ramping AI agents are likely to outperform in this market. Names like $TEAM, $HUBS, $NOW, $FRSH and $MSFT likely to benefit. SaaS/Sw multiples have come in so much since 2021 - we’re in a similar “frothy” market environment and now you’ve added the AI Agentic theme on top and revisions/IT spend environment going up. In other words a perfect holy grail mix of secular + cyclical (the $MRVL's of sw) — could mutiples of these names re-rate back to where they were? That’s the dream sw bulls are envisioning this morning…

Sw names also sounding better at UBS. Karl, UBS’ sw analyst this morning:"At the UBS Tech Conf today, we picked up a modest tone improvement from ServiceNow, but also Datadog and Snowflake. Could overall software spending trends finally be perking up?"

So everything came into confluence today with high level secular combining with datapoints supporting the cyclical turn in IT spending. It’s clear why most sw names ripped today.

Despite strength in semis and sw, internet fared fine led by AMZN +2.2% as investors came away from re:invent bullish and bezos making overtures about being more helpful w Trump (one thing to watch going forward is big tech cozying up with Trump vs last time around)

Outside of tech, BTC +2% getting close to flirting with 100k again. In terms of macro, got a couple goldilocks data points (ADP and beige book) while services ISM was weaker. Yields +1-2bps across the board.

A quick recap of most impt moves, including some impt AVGO stuff…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.