TMTB EOD Wrap: Winners keep Winning...ESTC ADSK MRVL DELL First takes

QQQs +63bps as the AI Summer is ending HOT despite NVDA finishing in the red today. Despite the price action, we thought Jensen did a good job bulling everyone on the AI supercycle calling out a 50% CAGR and $3-4 T in total AI spending through 2030. And it looks like Jensen is all-in on getting some chips approved for China:

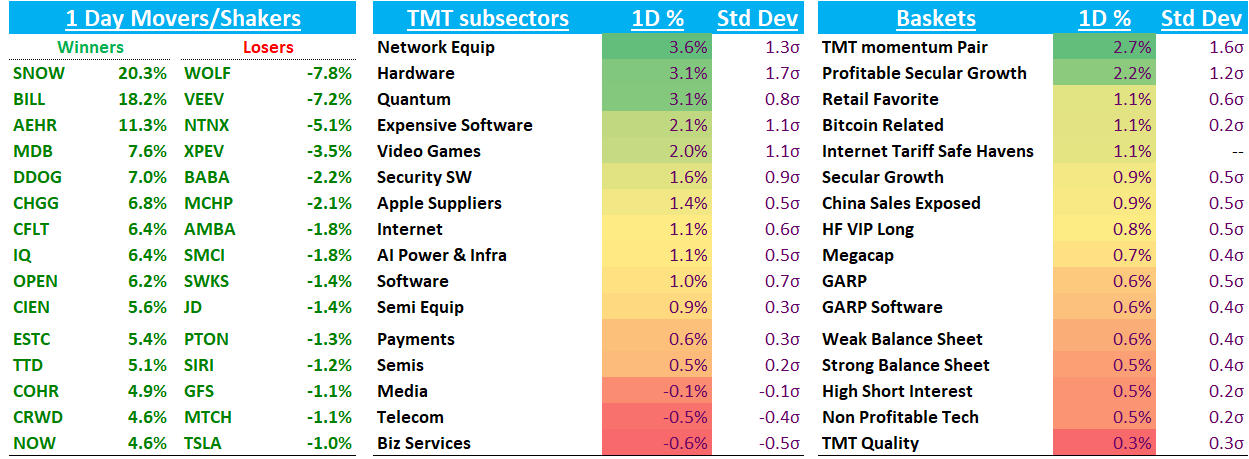

Every % allocated out of NVDA is a huge boon to other stocks given its massive $4.4T market cap. Outside of other AI semi names, where are those dollars going?

Today a lot went to software as the reversion trade is back in force. Specifically, investors are moving down (or is it up?) the risk curve in infra exposed names after SNOW and MDB’s accelerondo beat and raises: DDOG +7%; CFLT +6.5%; ESTC +5.4%. ESTC’s beat after hours likely to continue that trend.

High level, SNOW’s (+20%) beat reminded us of MDB’s yesterday as the setup is very similar: accelerating core product revenues/consumption followed by a continued easy comp path as the AI narrative/revenues continue to ramp. MDB +8% also followed through nicely.

However, we don’t think it’s all clear for names facing secular/competitive issues — that was evidenced in more mixed price action for that bucket, including some app sw names: SAP +11bps; NOW +4%; CRM +2%; WDAY -50bps; INTU +75bps; ADBE -70bps; ACN -40bps; CTSH -80bps.

We think the scarcity value afforded to infra plays are likely to keep a bid on those stocks — it’s why PLTR and NET have been afforded such hefty multiples and we think that dynamic will help names like MDB and SNOW, which are the next two cleanest infra plays. If this ends up playing out, multiples of these names could have much further to go…I think the oversized moves in the past two days is pointing to this being the case.

This is SNOW’s historical EV/Sales multiple:

Yes, SNOW was growing 100% in early 2020s and 70% as recently as 2023. But many other SaaS names were also growing very fast so there were plenty of high growth stock with no secular/structural hair to choose from - now there is scarcity value at play. 20x doesn’t sound that unreasonable in this context.

Winners keep on winning - it’s been a big driving theme the past 2-3 years and we think the gap of winners vs. losers will only continue to grow as you are finally seeing early impacts on some companies facing AI structural headwinds (eg. MNDY, DUOL)

Post-close Earnings

MRVL -8% missed on DC revs ($1.49B vs $1.51B) and Q3 guide light $2.06B vs street at $2.11B although Q3 outlook includes the divesture of Auto Ethernet biz on 8/15 on IFX. Networking beat by 5%. Sentiment/positioning was mixed going in, but DC miss a cause for concern. CEO Matt Murphy will do his best to convince investors about future Trn 2/3/4/53 ramps

DELL -5% as the beat and raised FY outlook. AI servers revs of $20B well above street at $15B but inline with high end of bogeys. However, softer server/storage revs + GMs headwinds caused stock to sell off as investors continue to worry about AI server margins. Op margins for servers/networking was only 8.8% vs street at 10.3%.

ESTC +18% crushing numbers with subscription beating by 5% and cloud by $5M> Q2 and FY guide also raised above. Subscription revs accelerated 4ppts to 20% while Cloud accelerated 2ppts to 25%. Similar to SNOW and MDB, comps continue to get easier for a couple quarters. Plenty offsides on this one even after the 2 day move stock only trades at 5x revs.

AMBA+15% on a beat and raise citing strong growth in the Edge AI market. Q2: $95.5m/$0.15 vs $90m/$0.05…Q3: $100-108m/NA vs $91.1m/$0.06

ADSK +10% looks solid with better billings (36% vs 34%) and guide slightly above. They came in ahead on revenue by 2%, which is better than their usual ~1% beat, while EPS was also solid at a 6% upside. The Q3 outlook topped Street expectations, and they lifted the full-year guide by more than just the quarterly beat. For revenue, they’re now calling for 9–10% cc growth adjusted for the new transaction model, versus the prior 8–9%. Full-year guidance moves up to 17–19% (from 16–18%), and operating margin is now set at 40%, versus the previous 39.5–40% range.

Let’s get to the recap…

INTERNET

RDDT +7%: Didn’t see anything new here. User data continues to hold up fairly well and intra-q checks positive so far from what I’ve heard from investors. We trimmed mid Aug near highs and said “now we wait for the pullback to the 20d.” Well it got there yesterday, so added back what we trimmed this morning as it crossed back above. Kind of in a sweet spot factor wise.

GOOGL +2% continues to grind to ATHs — tomorrow is the last day in August so one would think DOJ decision should get released, but your guess is as good as mine. GF securities had an interesting note this morning saying they think TPU could be sold externally in 2026. giving TPU’s general purpose nature on tensor/matrix Ai workloads and lower upfront cost vs NVDA. Spotty track record from the analyst so take with a grain of salt.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.