TMTB EOD Wrap; TXN First Take

TXN -1% Earnings: Q3 inline but top end of the rev guide missed street and more bearish bogeys (-7% q/q at midpt vs street at -2% and bogeys at -5-6%) Same with EPS. Bears will say typical seasonality only -4-5% over last 15 years, while bulls will say this might be a clearing event. Industrial continued to decline sequentially while all other end markets grew. Call ongoing…Details:

Q4 Guidance

- Guides revenue $3.70B to $4.00B, EST $4.08B

- Guides EPS $1.07 to $1.29, EST $1.35

Q3 Results

- EPS $1.47 vs. $1.85 y/y, EST $1.37

- Revenue $4.15B, -8.4% y/y, EST $4.12B

- Analog revenue $3.22B, -3.9% y/y, EST $3.17B

- Embedded processing revenue $653M, -27% y/y, EST $659.5M

- Other revenue $275M, -4.8% y/y, EST $295M

- Operating profit $1.55B, -18% y/y, EST $1.46B

- Capital expenditure $1.32B, -12% y/y, EST $1.27B

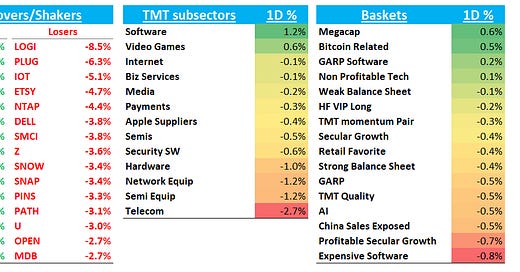

EOD WRAP

QQQs +11bps as yields and fed expects stayed roughly flat. Let’s get straight to the recap..

Internet

SPOT +1.5% / TTD +60bps as Axios announced SPOT is launching ad exchange and will partner with TTD

CART +2.5% as rumors continue to swirl around UBER (flat) and potential M&A

PINS -3% as Clev said near-term spend limited by brand pressure and moderation from retail/cpg although they said 2025 leans positive on plat

META +1% ahead of earnings next week

RBLX +2.5% as JPM raised PT to $51 making it a favorite pick in the video game space

Other large cap o/p slightly: GOOGL +65bps / AMZN +33bps as BMO raised AWS outlook to 20% / NFLX -1% consolidated recent gains

ETSY -5% as 3p weekly data downticked again

CHWY +1% / W +1% as Yip downticked on weekly data - stocks underperformed yesterday. Not surprising given some of the pods have their own data teams and sometimes can front run the 3p data releases

CVNA +3% as 3p data accel’d again in most recent week (we’ll see if Yip confirms tomorrow)

Semis

MRVL +2% as MS said MRVl’s CoWoS booking at TSMC is 3x higher in 2025 vs 2024, which means there could be 400k units of Tranium 2 in 2025 and 5-600k of Inferentia 2.5 in 2025. Also following through on px increase news yesterday and getting very close to ATHs again

AMD - 2.4% as same MS checks said they had trimmed CoWoS wafer booking at TSMC for 2025 given uncertainty around M325 demand, saying NVDA took up extra capacity

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.