TMTB EOD Wrap; SNAP(-) BKNG (+/-) SMCI (-) QRVO (+) Earnings takes

QQQs +66bps adding to last week’s gains as administration continues to soften the edges on its trade policies, with latest rolling back some elements of their 25% auto tariff plan. Lutnick said a preliminary deal has already been struck and is awaiting final approval before it is announced (I think everyone will believe when they see it). Yields slid 4-5bps after a set of softer econ data points and Fed expects continues to price in around 4 cuts this year.

We’re running a bit late, so let’s get straight to the recap (earnings first, then the usual recap…)

Post-close Earnings:

SNAP -14%: Despite a solid Q1 (one nitpick is decline in US MAUs), SNAP selling off given lack of Q2 guide, staying: “Given the uncertainty with respect to how macro economic conditions may evolve in the months ahead, and how this may impact advertising demand more broadly, we do not intend to share formal nancial guidance for Q2. While our topline revenue has continued to grow, we have experienced headwinds to start the current quarter, and we believe it is prudent to continue to balance our level of investment with realized revenue growth”…on the call alluded to some advertisers that has been impacted by the changes to the de minimus exemption…SNAP never the best read for other ad names but in this uncertain environment, META -1%, PINS -3%, RDDT -3%, ROKU -1% etc all getting hit.

BKNG -3% fairly solid quarter: RN +7% vs guide +5-7%, GBs +10% cc vs guide +9-11%…Q2 guide inline/a touch weaker: 4-6% RN growth (St +7%), 10-12% GBs incl ~4%pts points of FX tailwind (i.e. +6-8%cc vs St +7%cc) and EBITDA $2.15-2.20B (St $2.16b…"

Key quotes around travel trends:

“we observed notable changes in certain travel patterns. For example, we saw a moderation in trends for inbound travel into the US, particularly from bookers in Canada and to a lesser extent from bookers in Europe. However, we also saw an improvement in trends in other travel corridors, for example, from Canada to Mexico, resulting in stable growth overall. We saw a decrease in length of stay in the US, which could indicate that US consumers are becoming more careful with their spending. We also saw some evidence of a bifurcated economy in the US as higher-star rating hotels appear to be more resilient than lower-star rating hotels”.

SMCI -15% neg pre’d saying some customer platform decisions were delayed, shifting sales to Q4.

The company now forecasts net sales of $4.5B–$4.6B, below the Street’s $5.4B estimate and prior guidance of $5.0B–$6.0B. Non-GAAP EPS is expected at $0.29–$0.31, down from the Street’s $0.55 and previous guidance of $0.46–$0.62. Management pointed to a 220bps sequential gross margin decline (vs. Street at 12.0%) driven by higher inventory reserves and expedited shipping costs.

AI names getting hit: DELL -4% NVDA -2%; AMD -1%; MU -2.5% etc…

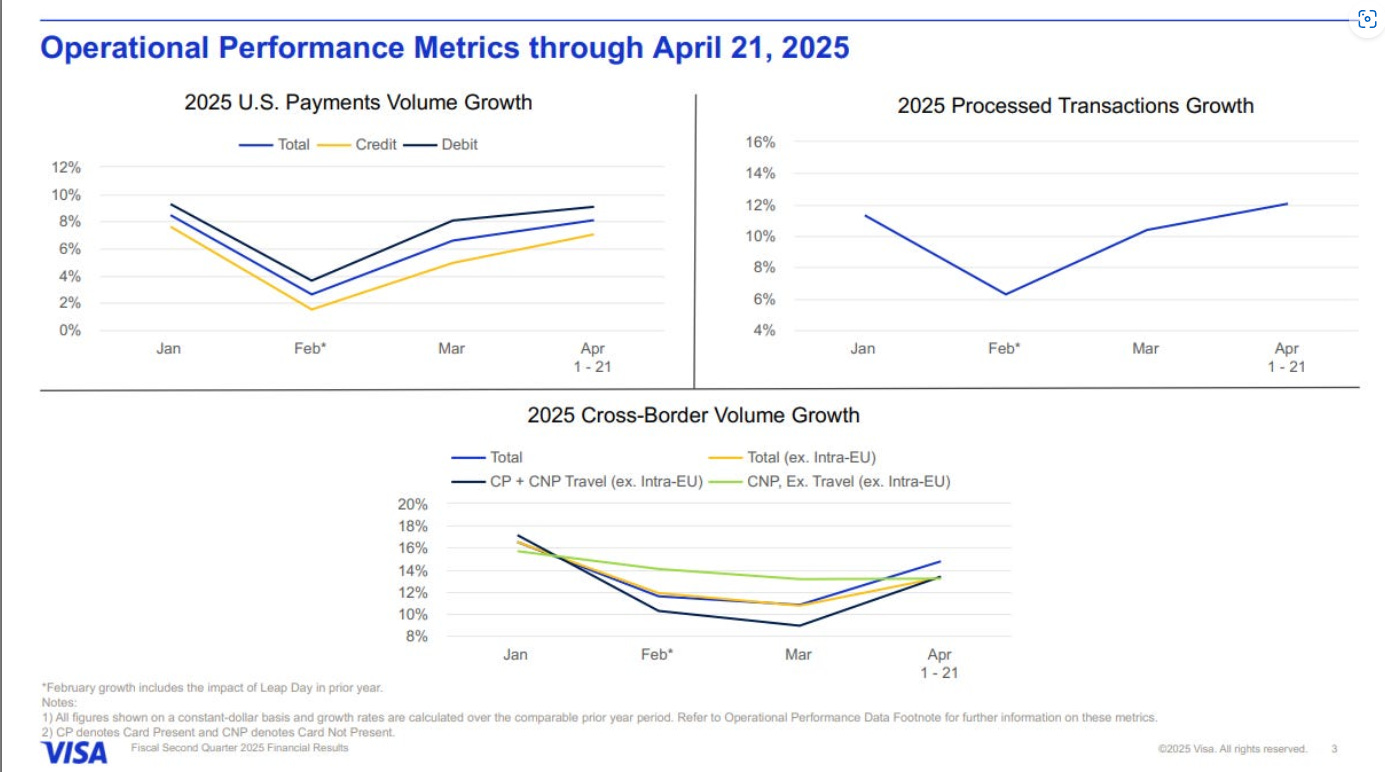

Visa data points to consumer spend holding up, although saw weakness in travel and lodging in Q2:

QRVO +9% with a solid beat and raise:

4Q25 revenue came in at $869.5M, ahead of the $850M guide and consensus.

Gross margin was 45.9%, beating the 43.5% forecast

EPS of $1.42 topped the $1.00 estimate.

1Q26 revenue guidance is $775M vs. $755M consensus.

Guided gross margin at 43%.

EPS guidance is 62.5c, slightly above street at 61c expected.

Internet

AMZN -20bps…Punchbowl (a DC blog) reported this morning that AMZN was thinking of running “tariff impact” next to prices. Press reporter asked a question about at this mornings WH briefing, and Press Secretary said it was a “hostile and political act by Amazon” holding up a reuters article that said the tech company had partenred with a “Chinese propaganda arm.” Stock got hit 2-3% immediately. Supposedly Trump called Bezos directly to complain. AMZN then released a statement: The team that runs our ultra low cost Amazon Haul store has considered listing import charges on certain products. This was never a consideration for the main Amazon site and nothing has been implemented on any Amazon properties…are you having fun yet?

SPOT -3.5% solid performance as bulls didn’t same fazed by fx/social charges driven op inc miss and lower than expected prem sub guide. Bull case here remains intact and remains one of the cleanest + tariff/china/recession stories in internet… Management framed the guide as deliberately cautious because of macro “noise” rather than company-specific issues. Advertising growth will face a ~500 bp headwind through Q3 as Spotify trims expensive owned/licensed shows (e.g., Call Her Daddy, Dax Shepard) and rolls out premium video podcasts that carry no ads. Offsetting that, programmatic demand is ramping: self-serve tools, added DSP integrations, and steady CPMs should lift ad momentum through 2025-26, with gross-margin leverage showing up most visibly in 2026….Bull case here remains: 1) Pricing power still under-monetised – the core plan remains cheaper than rivals in most developed markets, giving management plenty of room to nudge ARPU — on Friday we got news they were announcing a price increase in Europe 2) Multi-format flywheel – podcasts have proven the model; audiobooks and eventual learning courses extend listening hours and ad inventory 3) Marketplace leverage – two-sided platform tilts negotiating power away from labels as indies and self-serve tools scale 4) Margin runway - new formats will continue to drive GM - Every extra point of GM drops almost entirely to the bottom line…Other catalysts: Q2/Q3 Staged rollout of Deluxe / Superfan tiers (higher-quality audio, exclusive drops), Second wave of regional price increases once new tiers establish value perception, and Audiobook expansion into high-income EU/Asia markets with à-la-carte upsell.

NFLX +1.4% continues to grind to all time highs

RBLX flat despite M-sci calling out better bookings in April vs March

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.