TMTB EOD Wrap; ORCL ORCL ORCL

Gotta start it off with ORCL - such a massive RPO number had to triple check it: $455B vs street at $167B, saying they signed four multi-billion dollar contracts with three different customers in Q1.

The scale of our recent RPO growth enables us to make a large upward revision to the Cloud Infrastructure portion of Oracle's overall financial plan which we will be presenting in detail next month at the Financial Analyst Meeting. As a bit of a preview, we expect Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years. Most of the revenue in this 5-year forecast is already booked in our reported RPO. Oracle is off to a brilliant start to FY26."

Makes the NBIS / MSFT deal from yesterday look like peanuts. They also guided IaaS out 4 years:

The word I’m hearing from many investors right now is “unreal.” Everyone had to check the numbers more than once.

This is obviously good for the whole AI semi complex (and ORCL ain’t doing ASICs yet…so NVDA getting bulk of this)— things are definitely not slowing down. The HOT AI Summer goes on!

If these numbers don’t convince you, not sure what will, but CRWV said something similar at GS when asked about AI demand:

"That problem is continuing to persist in, is honestly worsening. I would say what we've observed over the past four to six-weeks is yet another inflection in-demand"

And we also had this today: GOOGL’s Nanobanana driving big signups to Gemini:

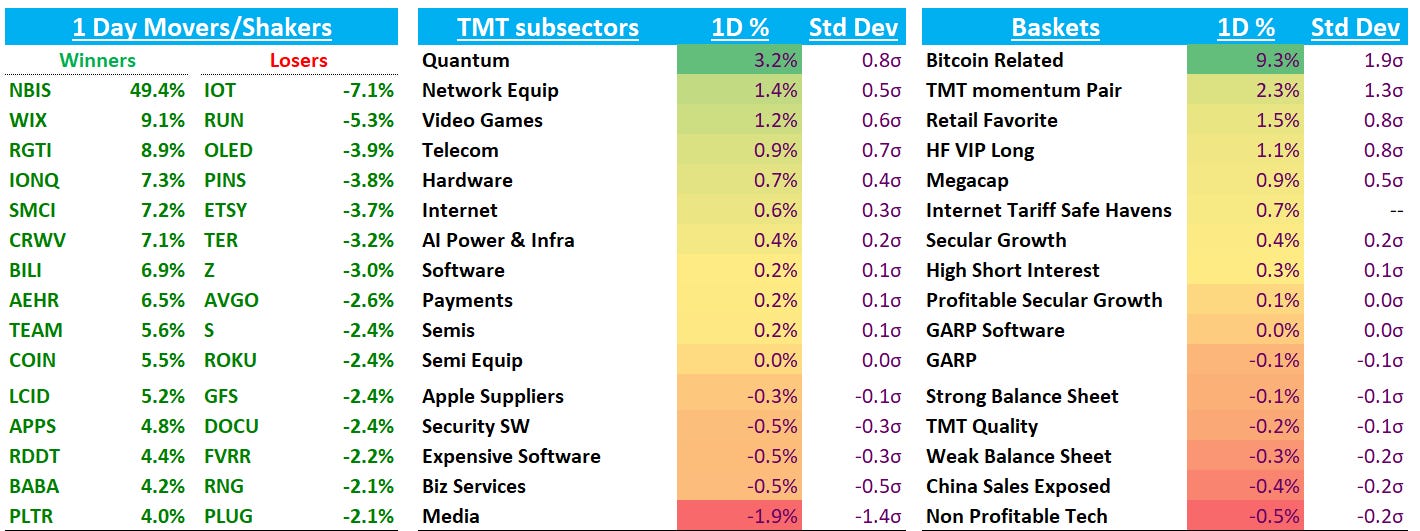

QQQs finished the day +28bps in what was another busy day with Day 2 of the GS TMT conference along with the AAPL iPhone event. We’ll touch on some specific feedback from presos in our recap below, but overall most companies have presented a solid tone. You can find summaries from presentations here

On the macro front - wait, who cares about macro - it’s the AI supercycle!

Let’s get to it…

INTERNET

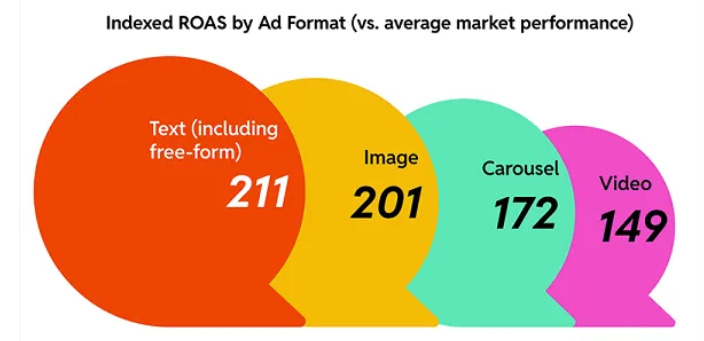

RDDT +4.4% as Cleveland was positive saying share momentum building and new advertiser acceleration on better ROI and Ad formats. SMT also had a good post highlighting the new ad formats. Key quote: ‘TransUnion’s meta-analysis showed that Reddit consistently outperforms other social platforms on return on ad spend (ROAS). Even with a smaller share of market spend, Reddit delivers disproportionately more marketing-driven sales. In fact, it was more efficient than 4 out of 5 other paid social platforms.’

So seems like ARPU has plenty of room to rise…

RBLX +2.5% as Arete upgraded to neutral and BTIG had a note with a positive recap of RDC and calling out bookings tracking at +60%+: “Medium-term, we believe Moments has the potential to become a significant ad surface for the platform, based on the scale of existing content creation/sharing from the community (one of every five TikTok [private] videos this summer was Roblox-related”…Sept so far tracking a bit better than -20% seasonality at -15% m/m

PINS -4%: lots of questions around what drove the weakness during the GS presentation. I didn’t hear any great answers as there wasn’t much difference vs what they said in their Q2 earnings call with consistent macro commentary, calling out some larger retail weakness int’l.

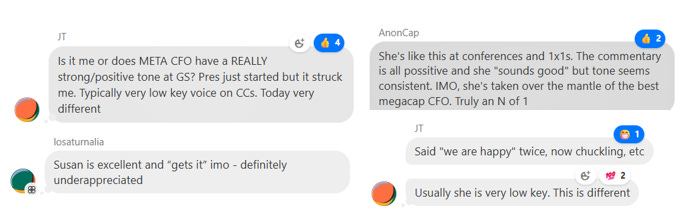

META +1.8% as investors thought CFO Susan Li sounded good as she walked investors through investment ambitions and expressed optimism around META AI. Some thought comments in TMTB chat were interesting:

BofA was also out positive this morning ahead of connect

DUOL +80bps. Story of the stock in a two chats:

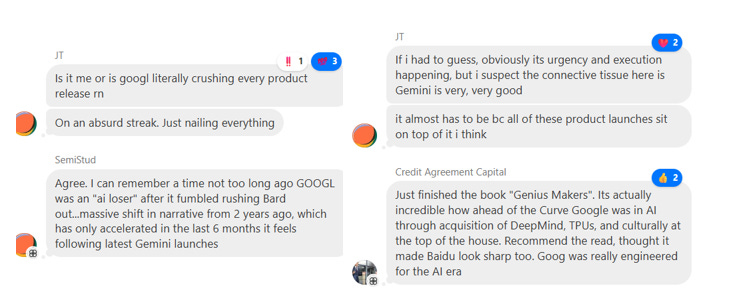

GOOGL +2.4% as Nanobananas is the latest AI Product Hit from GOOGL - how they’ve turned things around…Clev was also out positive on QTD trends…

Clev was also out positive on QTD trends…

WIX +9% we wrote this one up in our EOD Wrap yesterday — seems like investors finally catching up to the Base44 ARR ramp today…Great action breaking above the 150d on very heavy volume. Don’t think this one goes below 150 any time soon again given the emerging story

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.