TMTB EOD Wrap; META MSFT NOW TSLA First Takes

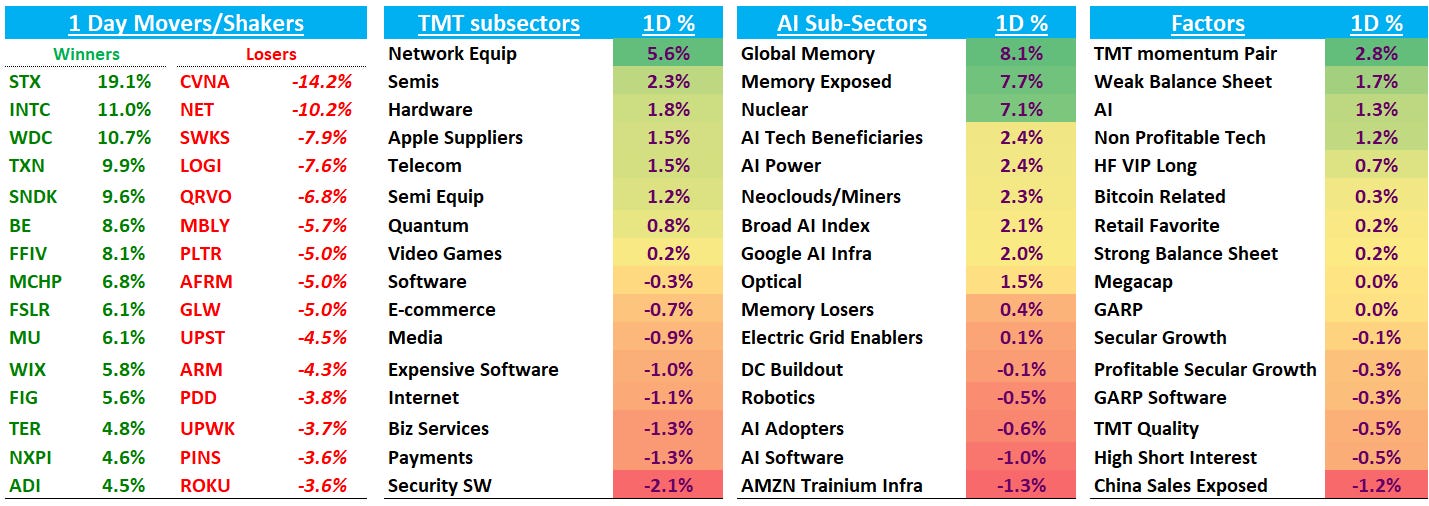

QQQs +33bps as semis led the way higher. On calls right now, so we’ll keep this part brief, dive into some first takes, then jump into the recap

Post-close earnings rundown:

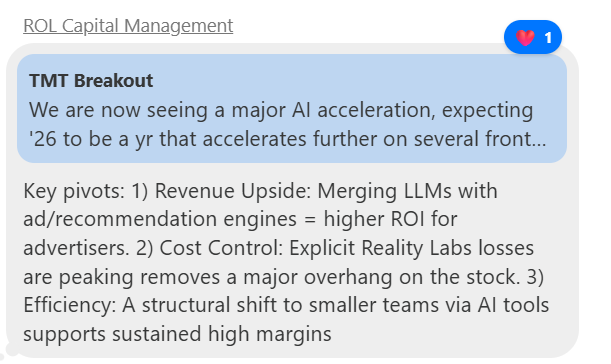

META +10% as an incredible first-quarter revenue outlook ouweighing any concerns regarding increased expense guidance for 2026. The company guided 1Q revenue to a high end of $56.6B (crushing expectations of ~$53B). That’s 33.5% vs expects of 25% (4% fx tailwind). Opex guide ($169B high end) and Capex ($135B high end) came in above bogeys of ~$160B and ~$122.5-125B but investors focused on the massive top line beat. This is Tech after all and by guiding EBIT $’s up y/y, proving the ROI of every incremental dollar worth of spend. Pods leaned short this one going in so scrambling to cover. Hearing buyside EPS going up to ~$34 after the print: Management confirmed that despite the massive infrastructure spend, they expect FY26 operating income to exceed 2025. Path forward looks clearer now with opex/capex guide out of the way and a low bar for Avocado. Accelerating rev growth goes a long way to improve the narrative. First cut bulls going to lean in on 25x $34 = $850. Game on.

MSFT -5% as Azure 38% cc missed bogeys of 38.5-39%. Commercial bookings +228% cc. Commercial RPO +110% with 45% driven by OAI. Capex $37.5B vs expects of $35B. Bulls were hoping for a 4 handle so this a bit of a disappointment. Everyone awaiting the Azure guide on the call shortly with focus on commentary if March is trough

NOW -5% despite cRPO of +21% which was in line with bogeys (although 100bps of inorganic benefit). FY26 sub guide +19.5-20% vs expects for 20% and 19% organic. NOW assist AI >$600M net new ACV.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.