TMTB EOD Wrap; GTLB CRM HPE CRDO First Takes

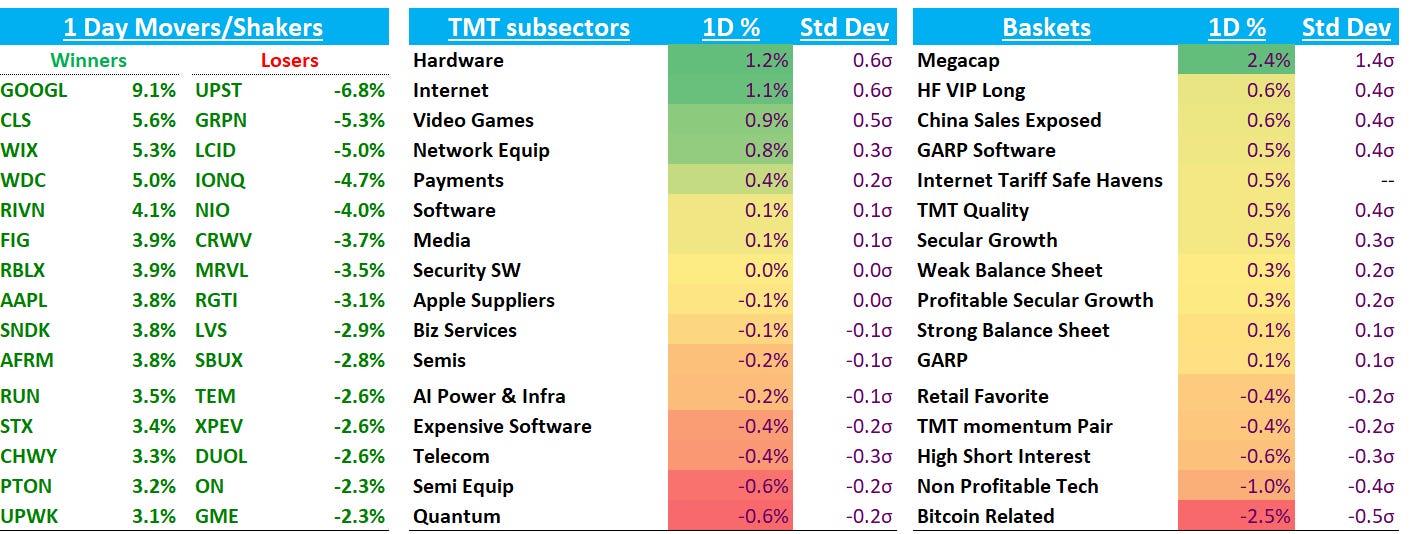

QQQs +80bps helped by GOOGL and AAPL post-slap on the wrist DOJ ruling. Treasuries rallied on the JOLTs report with yields falling 2-6bps across the curve (we get ADP tomorrow and NFP on Friday). Fed expects continue to price in about ~60bps worth of cuts in the final 3 meetings of the year.

Let’s get straight to it…

POST-CLOSE EARNINGS

GTLB -6% beat on the quarter but guided down Q3 slightly and did not flow any revenue beat to the FY guidance. CFO is resigning to go to SNOW. Lower guide could be a function of conservatism given CFO leaving and some pull fwd demand, but will need to go through the call to see how they explain it way. The guide implies a big deceleration despite the acceleration seen in Q2. Optics disappointing. I sold some of my small position in the post, and will re-evaluate tomorrow, but doesn’t seem like this q did much to add excitement for the bulls.

Q revenue of $236m vs. Street of $227m, which is slightly above the ~2-3% baet buyside was expecting.

GTLB guided 3Q revenue of $238.5m vs. Street at $241m

GTLB maintained FY26 revenue of $939m.

CRDO +5%: Looks good. Buyside wanted at least a HSD beat as expectations had crept up into the print and numbers topped that with a mid teens beat and raise. GMs also look good at 67.6% vs street at 65%

F1Q revenue/GM/EPS of $223m/67.6/$0.52 vs. Street at $190m/65.0%/$0.35.

Guided F2Q revenue/GM of $235m/65% vs. Street at $202m/64.9%

CRM -5% Another mixed print. cRPO beat slightly and guided Q3 cRPO just above 9% cc about in line with expectations although some arguing a bit light. OMs also solid at 34.3% vs 33.8% and data cloud ARR +120% y/y. $20B Buyback. FCF looks weak and FY guide ok.

$10.24b vs. Street at $10.14b. cRPO of $29.4b (+11% in CC) vs. Street at $29.04b and buyside at ~10.5%

Guided Oct revenue/EPS to $10.265b/$2.85 vs. Street at $10.29b/$2.74. Oct cRPO growth to slightly above 9% in CC.

For full-year CRM slightly raised low end of full-year revenue guide from $41.0-$41.3b to $41.1-41.3b, raised free cash flow growth from 9-10% to 12-13%

HPE +50bps looks ok with a solid rev beat although guide a bit light. Don’t think many here too focused on the quarter and this is good enough to keep focus on analyst day in mid-oct and pro-forma JNPR financials. AI backlog slightly better…

July-quarter revenue/gross margin/EPS of $9.14B / 29.9% / $0.44 vs Street $8.65B / 30.1% / $0.43.

Free cash flow came in at $790M vs Street $1.275B.

AI server revenue was $1.6B vs Street $1.55B, with backlog of $3.7B vs Street $3.6B.

Server revenue reached $4.94B vs Street $4.71B.

Hybrid Cloud posted $1.48B vs Street $1.47B, while Intelligent Edge was $1.73B vs Street $1.33B.

For 4Q, HPE guided revenue to $9.9B vs Street $10.1B and EPS of $0.58 vs Street $0.59.

INTERNET

GOOGL +9% as DOJ decision amounted to basically what was a simple slap on the wrist as worst case scenarios were averted. Bulls argue that removing regulatory overhang means stock should re-rate higher than 22x to something closer to 25x. For example, back in 2013 when FTC dropped its case, the multiple expanded 40% and bulls will say that GOOGL always used to trade at a premium vs. the market. The narrative is definitely on GOOGL’s side: search revenue remains in dd territory, investor perception has shifted to GOOGL as an AI winner (AI products top of class, talent bench, TPUs, GCP advantages, Gemini 3 early reviews really good, etc.), and you get optionality with Waymo. We don’t think the argument that GOOGL should trade closer to 25x is completely unreasonable, but we also have trouble underwriting something more than 22-23x, especially because there are some search risks that still remain unresolved in our minds. Still it has momentum on its side and stock still remains under owned among LOs. We’ll stay with our small long and be a bit flexible with the multiple as long as 3p search continues to track well.

Bloomberg was also out saying: “Apple Plans AI-Powered Web Search Tool for Siri to Rival OpenAI, Perplexity:” The underlying technology enabling the new Siri could come in part from Alphabet Inc.’s Google, Apple’s longtime partner in internet search. The companies reached a formal agreement this week for Apple to evaluate and test a Google-developed AI model to help power the voice assistant, the people said.

Couple good takeaways from the chat:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.