TMTB EOD Wrap

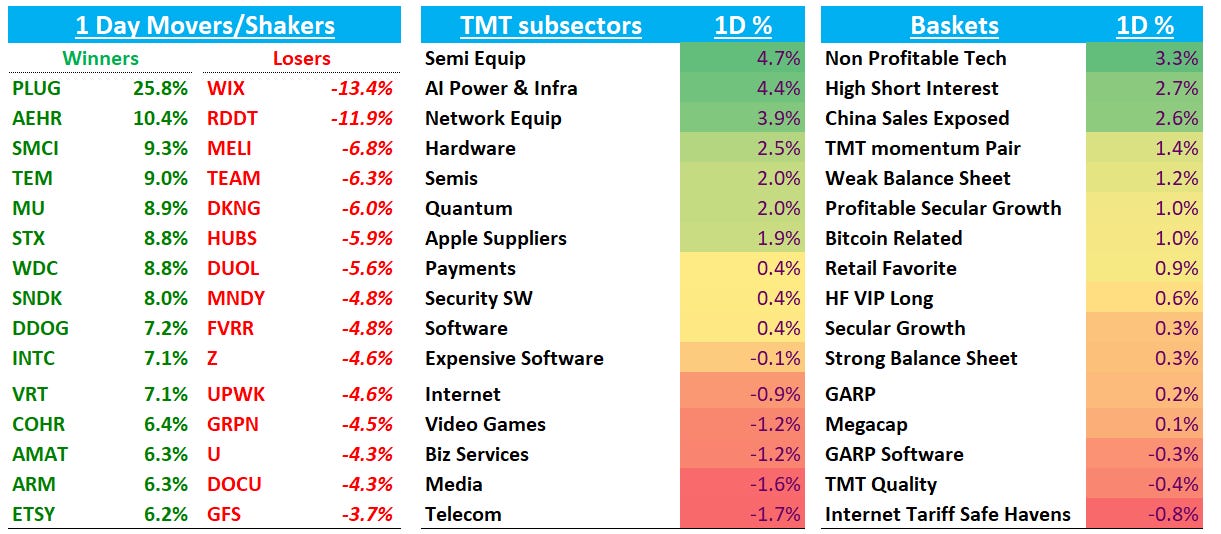

QQQs +48bps as Q4 started out with a similar theme we’ve encountered all year: AI winners vs. AI losers.

This theme has only built-up energy throughout the year. In early august, we wrote in a weekly:

We think the HOT AI Summer likely turns into a HOT AI Fall/Winter. We also think a slower macro widens the performance gap between AI winners and non-AI winners.

We think we are entering a prolonged market environment where companies perceived as AI losers will face significant multiple compression. The last time we had such a ripe era of structural/secular shorts in Tech was in the post-iPhone era where mobile ended up disrupting companies like Blackberry, Nokia, Kodak, Printers, taxis (UBER), etc.

In other words: multiples are widening at both ends of the spectrum.

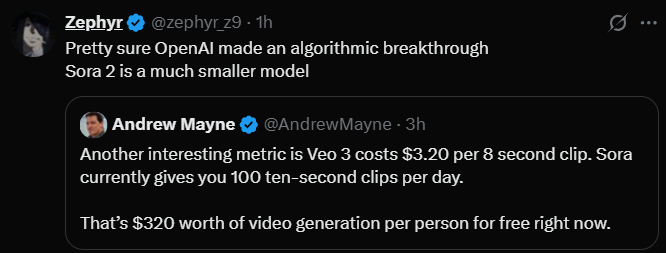

Take memory stocks (SNDK +8%; WDC +9%; STX+8%; MU +9% today) as an example: stocks are ripping as hyperscaler and near-term pricing datapoints continue to paint a very positive picture while AI product releases such as Sora 2 are driving the point home that we are still very in the early innings of demand (a 1 min video file requires 20,000x more storage than a text file). Compute is very supply constrained. Multiples in these names are exploring new heights as investors continue to come to grips with this AI cycle being very different from previous semi cycles - and the velocity of AI product releases is helping drive home the point. As we put it a couple days ago in reference to these names:

Our argument has focused on cyclicals trading at higher multiples than previous cycles given unprecedented demand visibility…MS put it in a similar but different way saying HDDs are transitioning from cyclical commodities to oligopoly-like assets critical to powering AI, warranting a structural re-rating

It’s not that these stocks have magically changed their business model and become non-cyclicals overnight (it’s why we prefer the two-company HDD industry over the Samsung-competitive memory industry). It’s that investors are realizing the demand drivers are likely to stay strong for a long enough period of time, meaning they’ll look like secular growers (AI critical enablers) for the foreseeable future. Supposedly Sam Altman was an Asia and said OAI, “is expected to require around 900,000 wafers per month of high-performance DRAM.” (for context, entire DRAM mkt is only ~300k wafers/month - h/t BNP). And that’s just OAI!

On the flip side, price action in potential AI losers continues to be horrid. App sw names like TEAM -6% and HUBS -6% continue to get hit. DUOL -6% can’t catch a bid despite improving NT user data. WIX -13% showed the risk of overstaying your welcome in an “AI loser” name. Minefields are everywhere and investors are looking i their portfolios and throwing out anything that might look like a potential AI loser - shoot first, ask questions later type action. As we said in that same weekly we quoted above:

Easy, simple, powerful narratives are very hard to disprove in Tech. Given the future unknowns and pace of AI advancements/adoption, we think Tech investors will find it hard to put any real credence on the “E” and so “P” (multiples) will dominate P/E.

First the vibe, then the valuation - that’s Tech investing (and life!). Some of this even began to creep into META -2% as fears over what Sora 2 social virality means for them.

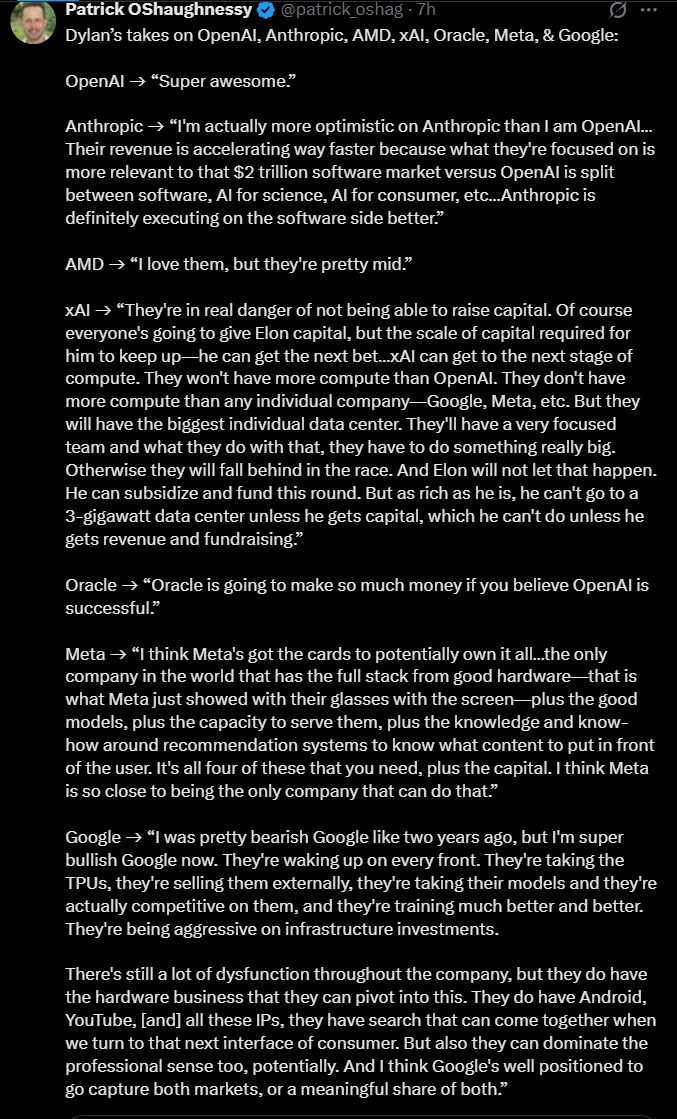

We liked this comment from a very smart investor friend:

Tech is starting to feel closer to zero sum. Remember in 16/17 when amzn killed all of retail and all you had to do was be long amzn and short any traditional retailer around. Now it’s OAI and basically every single product they iterate on. GPT is becoming the onramp to so much of my engagement with a computer. The problem is OAI isn’t public!

One can push back on price moves in a lot of these names, but perception is winning out over fundamentals near-term as it becomes hard to disprove bear arguments given pace of the AI supercycle. And hey — blackwell clusters haven’t even ramped yet!

This all makes for a very tricky trading environment. Or…

This all makes for a very easy investing environment: Just Buy more AI winners.

Guess it depends from what lens you are looking at things…

TMTB Chat really hitting its groove lately. Lots of good discussion all day. In case you missed it:

Onto the recap…

INTERNET

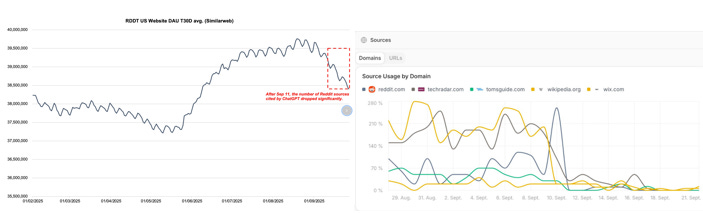

RDDT -12% the name on everyone’s radar. A few things being passed that pointed to ChatGPT throwing less traffic to RDDT, leading to a drop in traffic. This was posted by reader K. in TMTB chat early morning:

What added fuel to the move today was the chart showing similar web data also slowing around similar time the changes were made. Despite ChatGPT being <1% of RDDT incoming traffic, investors were already skittish given weaker SensorTower mobile data, so now that desktop data turning as well, not a good look. Add to that the read-through on ChatGPT counting less on them = less leverage in licensing negotiations...That Sam Altman tweet from a couple weeks ago calling out Reddit AI Slop takes on more relevance now…

I heard various explanations for these charts today:

One is that ChatGPT to cut costs and push commercialization restricted free users search functionality around mid-Sept, which would explain why all sources dropped. Another guess is that mid sept was a one time “reset” to fix spam like content on RDDT that was gaming the LLM results. The latter would explain why RDDT slowly climbing in citations again in the chart very recently. Last explanation is that a couple weeks ago GOOGL changed their SerpAPI query response to serve 10 sources instead of 100 sources, which caused all outbound traffic from ChatGPT to fall, but that it has been reversed recently (haven’t confirmed this), which is why you see RDDT inbounds from ChatGPT starting to tick up again in the last week.

Another pushback I heard on the Similar Web data was that RDDT user seasonality is usually down in the last two weeks of September so it’s not necessarily a big deal.

We sold most of our position well near the top and sold the remaining sliver today — set up isn’t clean now, more top-down concerns around ad spending, and you can begin to smell some of that “AI loser” stench begin to creep back into the name. We also checked in with the Oxford DP data to see how their panel was tracking. While Q3 is showing a nice beat ($545M vs $510M), revs have slowed from 110%+ y/y to mid 80s y/y in the last week as they’ve seen a large customer — HIMS — churn off the platform recently.

SHOP +65bps: Heard an interesting snippet from our friends at FundaAI saying that after talking with some SHOP customers, they think the OAI partnership with them will expand before Black Friday, potentially with a dedicated e-commerce tab, which could drive accelerating GMV. I think internet investors are looking for any exposure to OAI and this provides some. We really like the LT AI tailwinds on this name. 3p data tracking decently for the quarter as well.

ETSY +6% bouncing back after yesterday’s decline

ROKU +3% on better Yipit data showing a LSD beat to the Q and Needham calling out a potential new revenue driver for ROKU: LLM licensing (first time I had seen this idea thrown about)

MELI -6% on AMZN’s FBA push into Brazil and the below…

NFLX -2%:

China names up again: BIDU +4%; VNET +4%; BABA+2%

CVNA +4.5% on the Jefferies upgrade - data continues to look good here with units tracking to mid 40s QTD vs street in mid 30s and accelerating to 50% y/y in the last two weeks

WIX -14% on news CRM was launching vibecoding competitor. Bolt also released v2 today.

Salesforce launches enterprise vibe-coding product, Agentforce Vibes -TechCrunch

Enterprise giant Salesforce is looking to ride the vibe-coding wave — where developers describe what they want in natural language and AI agents write the code — with its new AI-powered developer tool.

Salesforce announced its new vibe-coding offering, Agentforce Vibes, on Wednesday. This new coding tool helps developers work autonomously on Salesforce apps and agents by handling much of the technical implementation automatically. Agentforce Vibes can help developers from the app idea phase to building to observability with enterprise security and governance controls baked in.

SEMIS

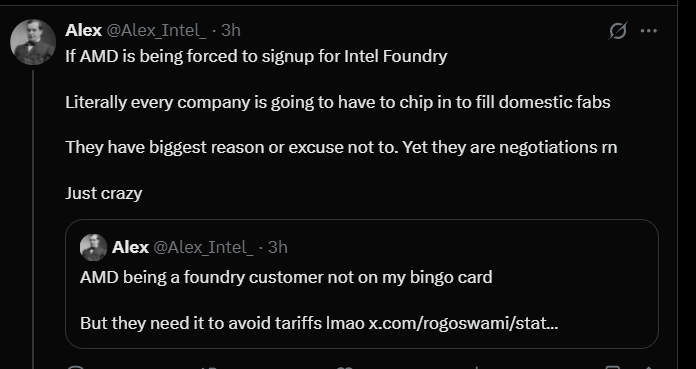

INTC +7% as Semafor reported mid day that AMD is looking to become a foundry customer of theirs. The NVDA/INTC partnership did make any mention of a foundry relationship so this would be the first real external customer.

Memory stocks ripping: SNDK +8%; WDC +8%; STX +8%; MU +9%

AI stocks generally up: VRT +8%; ARM +6%; NBIS +3%; NVDA +35bps; CRWV +15bps; AMD +1.4%

No love for analogs: ADI -2.6%; ON -2%; TXN -2%

BE +7% with some nice follow through as others on the sell-side caught up to RBC calling out the 900mw application

SOFTWARE

Same story we’ve seen since early June here: infra stocks outperforming at the expense of app sw

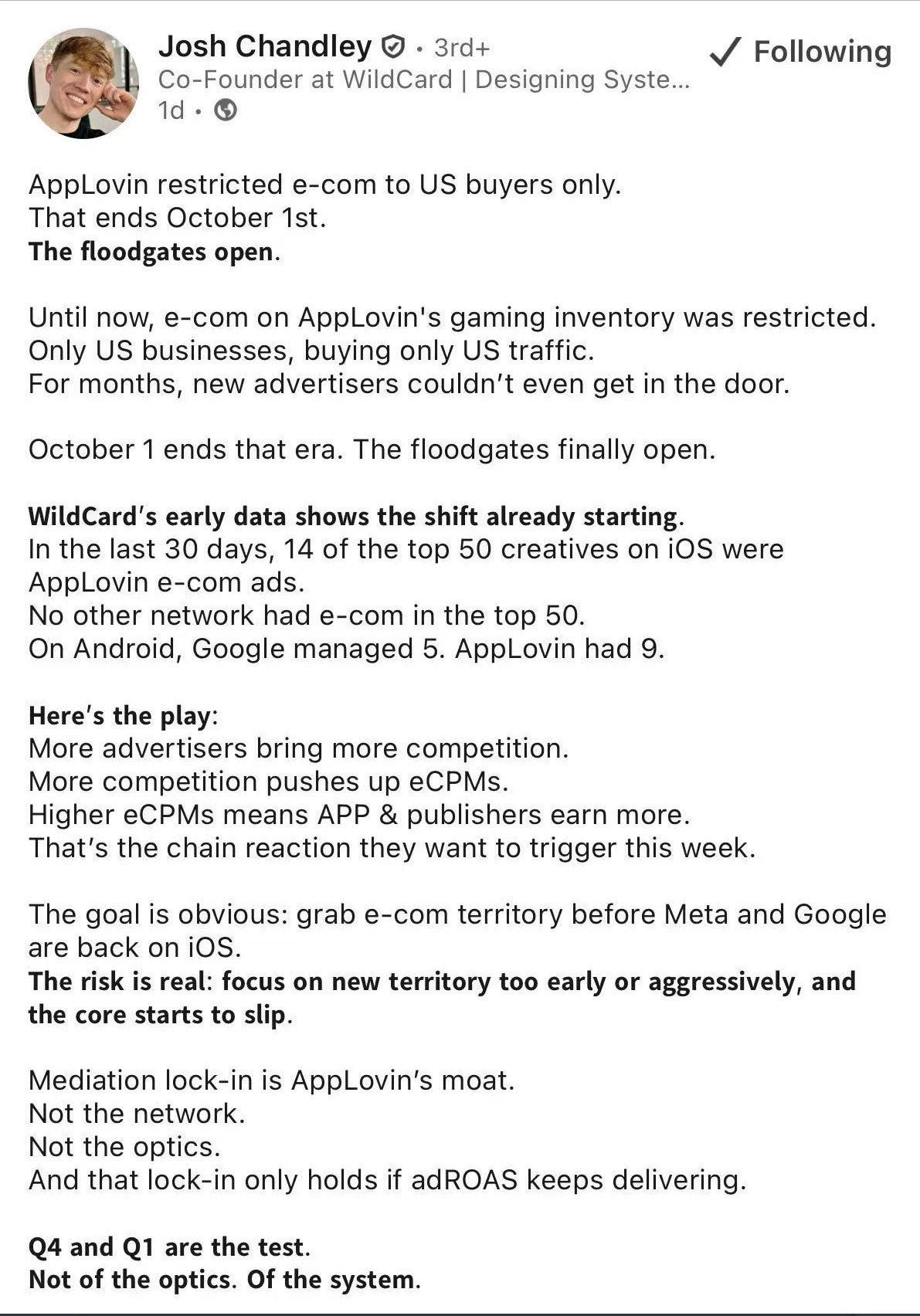

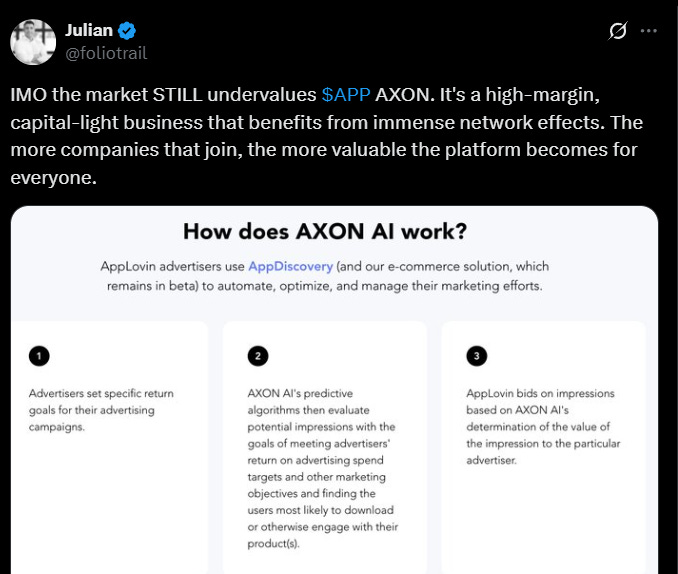

APP -2% as self-serve launched internationally today. We took some profits today as our view is easy money is always made before the catalyst and we’ve just had an 80% rally in APP with no earnings risk — just seems right to take some off the table, especially with some burgeoning top down concerns on advertising. Some pushback on the name here by @TechFundies.

U -4% fell as some saw the Sora 2 as a potential threat to their game engine. We don’t think that’s a right read as if anything, creators might use Sora-style tools for storyboards, trailers, etc. while still building the game in Unity. The bigger long-term risk to engines would be true interactive “world-model” systems (what Google DeepMind is publicly hiring for…although Deepmind uses Unity extensively for AI simulation), not something like Sora.

DDOG +7% on Wells Initiation and read-through from more compute usage for AI - also heard Yipit was out saying revs tracking ahead driven by SMBs. Some good discussion in TMTB chat here.

ORCL +3%; MDB +3.5%; SNOW +2% — AI winners bucket…Poor MSFT +35bps still not getting much love

Cyber names strong: PANW +1.5%; CRWD +2% as Wells added as a tactical long.

ELSEWHERE

TSLA +3% continues to act well ahead of deliveries

UPST +2% as BTIG updated their note saying delinquencies were only actually up 10bps in August vs previous note which said they were up something liek 500bps. NBD…

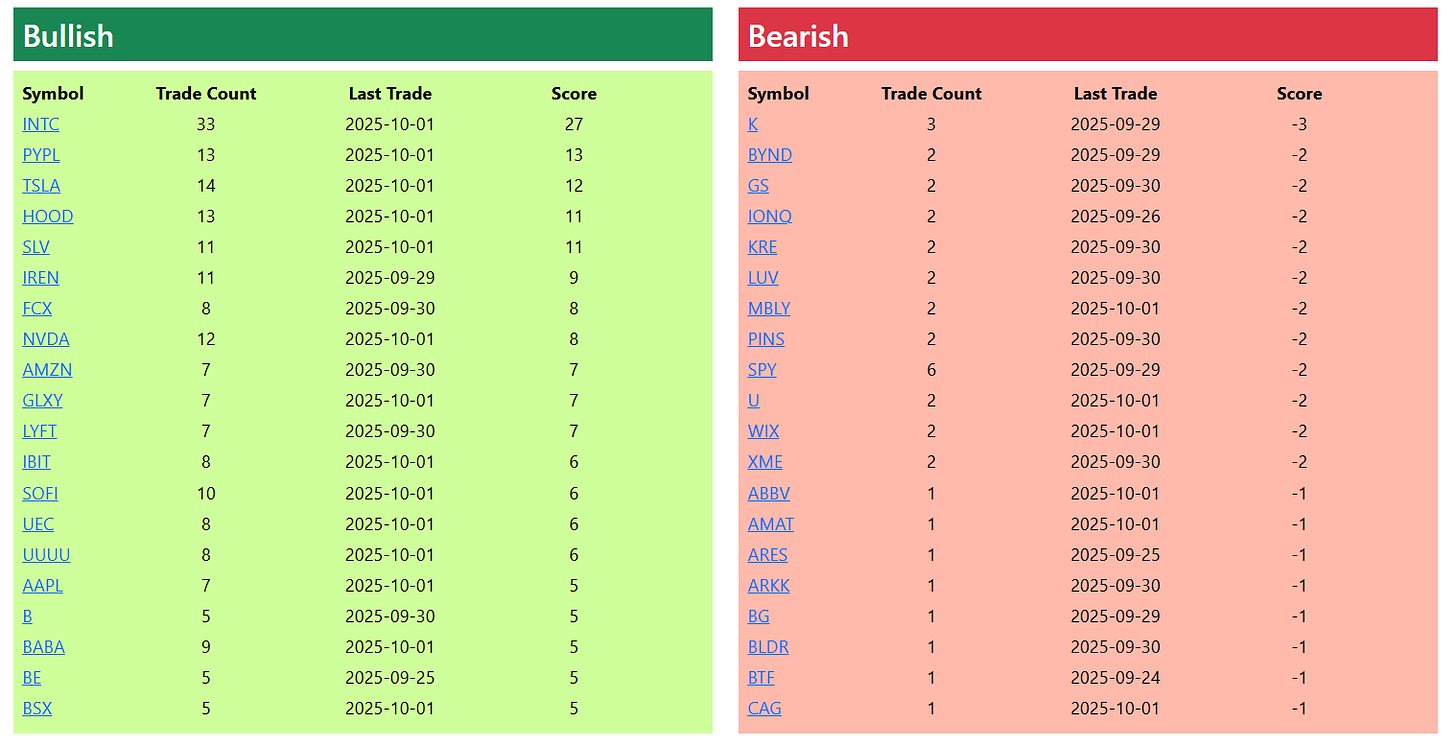

BULLISH AND BEARISH WEEKLY OPTION FLOW

TWEETS

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.