TMTB: EOD Wrap

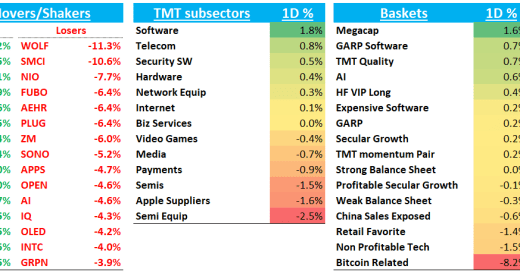

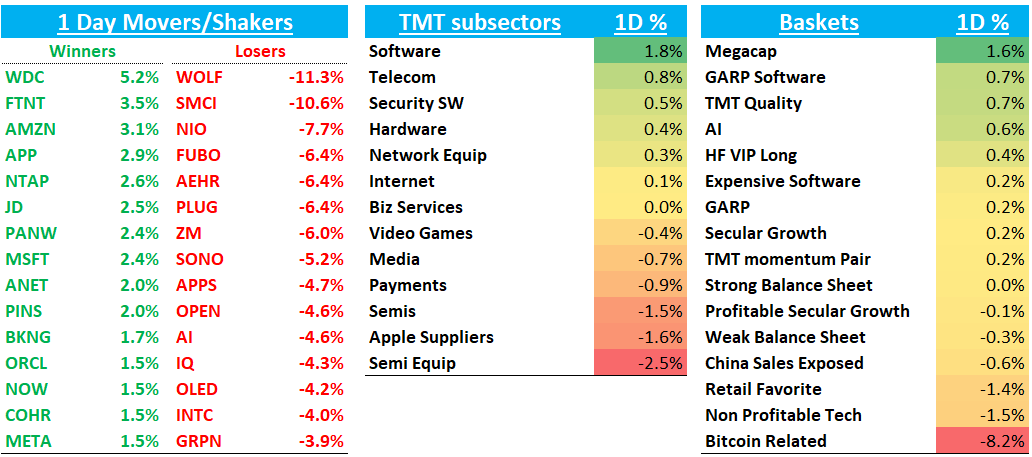

QQQs +60bps with a nice EOD rally . A bit of reversal of the price action yesterday as Megacaps led the way higher and non-profitable tech names declined. Semis continue to lag falling -1.2% and ADI saw some ugly price action going from +7% in the pre to -2% as mgmt talked down industrial recovery. The rest of analog space did the same green to red dance. NVDA +75bps managed to crawl to a positive day but relatively uninspiring price action given it’s down 7-8% in the last two days. Surprisingly, MSFT finally got a bit of a bid today +2% helped by bid to largecaps - didn’t see anything in particular but has a lot of room to catch up to other sw names as has underperformed IGV by 20% over the last few months. Large cap internet also got a bid led by AMZN +3%.

On the macro front, Fed minutes didn’t really change much vs the ongoing status quo and odds of a fed rate hike at 12/18 continue to hover in 50-55% range. Econ data mixed this morning: Case-Shiller shows cooling September home prices, new home sales decline (impacted by October weather), while consumer confidence edged slightly higher m/m. BTC - 3% getting close to $90k bringing down fintech names along with it. China - 50bps. Yields mixed with the 2 year -2bps but the 10 year +2bps. IWM -1% / ARKK -1

We have CRWD DELL WDAY and NTNX post close.

Let’s get to the recap…

Internet

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.