TMTB EOD Wrap

QQQs +45bps as investors liked the better than feared trade developments: 15% deal with Japan and reports EU was going to follow suit with their own 15% deal. Here’s FT:

US and EU close in on 15% tariff deal tariffs on European imports, similar to the agreement Donald Trump struck with Japan this week. Brussels could agree to the so-called reciprocal levies to avoid the US president’s threat to raise them to 30 per cent from August 1, three people familiar with the situation told the Financial Times. “The Japan agreement made clear the terms of the shakedown,” said one EU diplomat. “Most member states are holding their noses and could take this deal.” Both sides would waive tariffs on some products, including aircraft, spirits and medical devices, the people said.

VK put the implications on the bull case well today:

Tariff rates (which seem to be settling in the 15-20% range) are a lot better than the worst-case scenarios, and (more importantly) two of the biggest sources of Washington uncertainty (tax policy and tariffs) might finally be resolved (with passage of the reconciliation bill and the recent trade deals), clearing the way for improved economic conditions (and more M&A activity) in H2 and 2026

Yields rose 3-5bps across the curve while Fed expects continue to stay at 45bps worth of cuts for the year.

GOOGL looked great (beat across the board and mgmt sounds good on the call - paid clicks +4%).

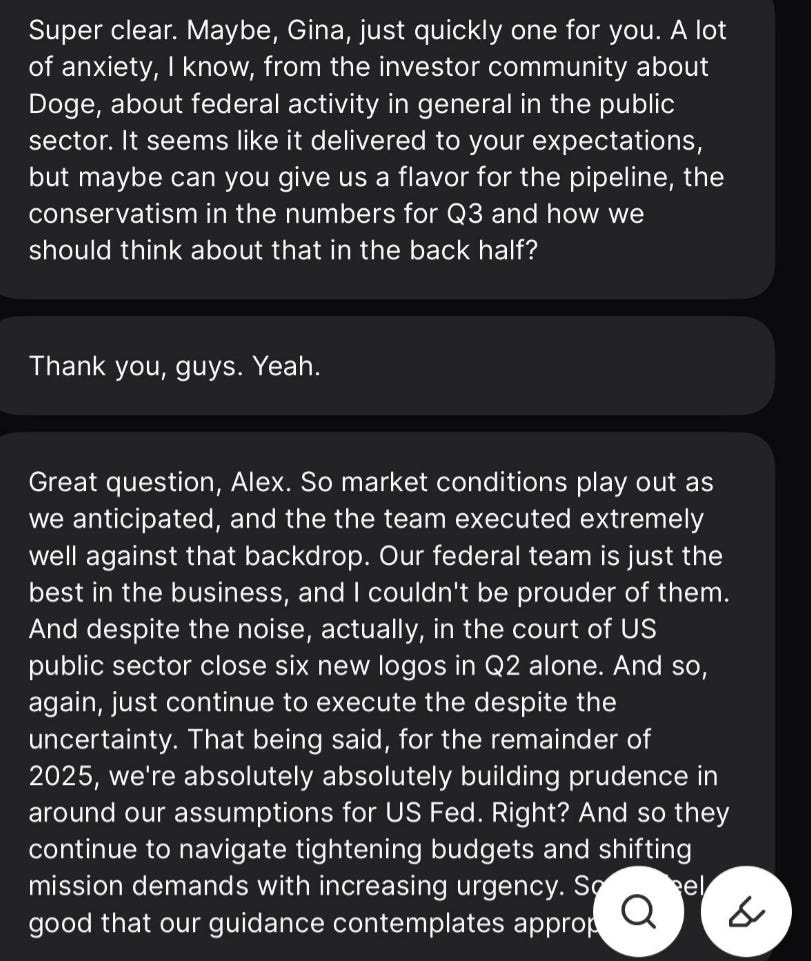

NOW solid vs. low expectations — q3 guide a bit weaker, calling out “prudence for US fed”…key quote on federal below (h/t reader Brad):

IBM not as good with sw miss. TSLA inline-ish. We’ll have more thoughts tomorrow morning on all.

Let’s get to the recap…

INTERNET

RBLX -1.3% taking the RJ downgrade well - rarely do you see a stock peak on a sell-side valuation dg although we agree with RJ expectations are high for the q

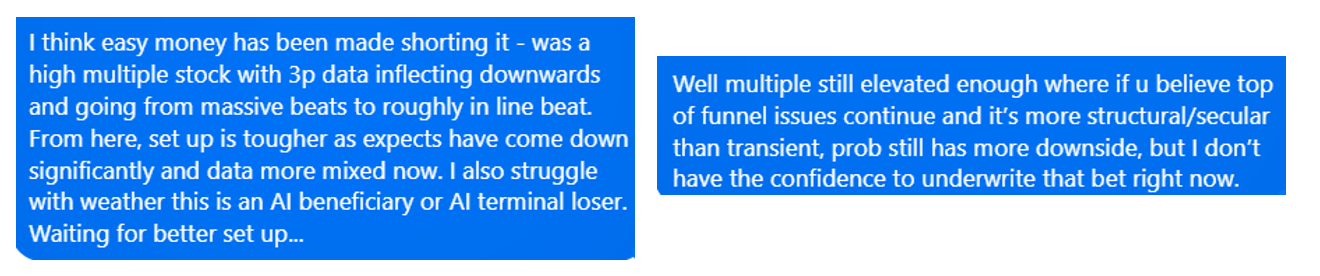

CHWY -2% as Mahaney as ISI downshifted the stock to #2 SMID pick in favor of DUOL +1%. On CHWY, MM emphasized that fundamentals remain solid: Y/Y GM expansion, four straight quarters of positive Net Adds, and resilient consumer data support the core thesis. On DUOL, MM said ISI sees 50% upside and “dislocated high quality” 30%+ revenue growth, 70% gross margin, and ~30% EBITDA margin. The firm believes DAU weakness was transitory, tied to Q1 marketing virality and April messaging shifts, and sees a path back to upside. Our current view of the stock (not excited either way from here…):

ETSY - 1.3% as 3p data continues to remain weak

META +1% as Edge was positive on July paid social feedback

SPOT -20bps: Missed yesterday that Clev said they are hearing noise that Music Pro (which SPOT was going to charge $5.99 extra for) is being delayed to 2026.

UBER -2% as news TSLA in talks with Nevada as it explores Robotaxi expansion

W +4% helped by better 3p data and continue positive housing datapoints: US existing home sales were +4% in June inflecting positive for the first time since January and an improvement vs. May’s -4%. Lots of EBITDA torque here in the model if you believe demand will inflect higher.

SEMIS

CLS +7.5% and up another 3%+ in the post-market on GOOGL’s capex raise to $85B. Their closest comp Accton grew revs >40% qq and CLS expects only for 5% q/q.

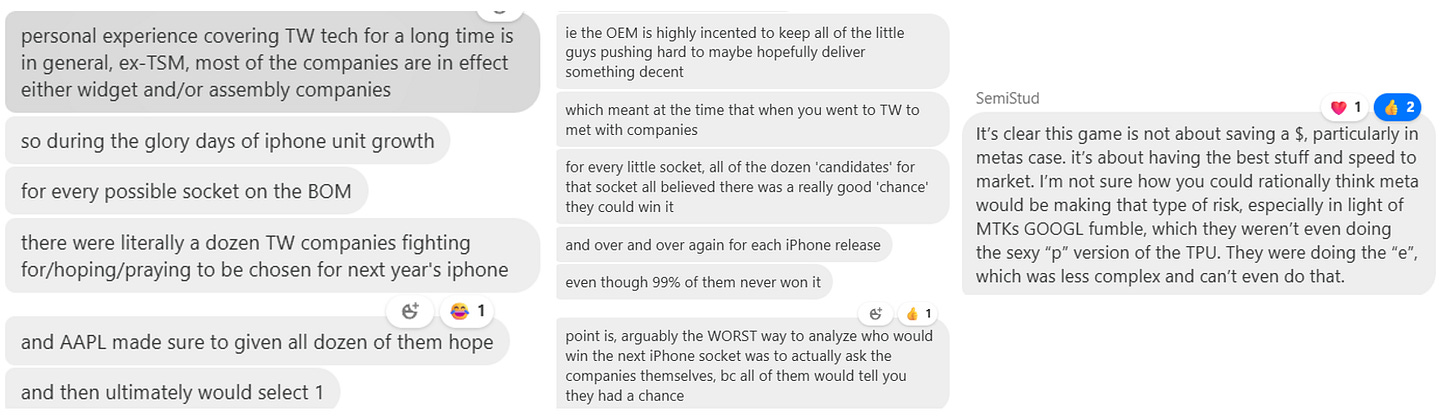

AVGO +2% and up another 2% in the post on GOOGL’s capex raise, shaking of a Digi report that META considering going with MediaTek on 2nm ASIC order. Some good color in TMTB chat on why Digi article is just noise. We liked this anecdote on why news out of Taiwan press should always be taken with a grain of salt — from reader JT in TMTB chat:

AMD +2% as Lisa Su said that demand was strong particularly from OAI and Musk companies in her speech in DC. Erste (?) also upgraded to buy.

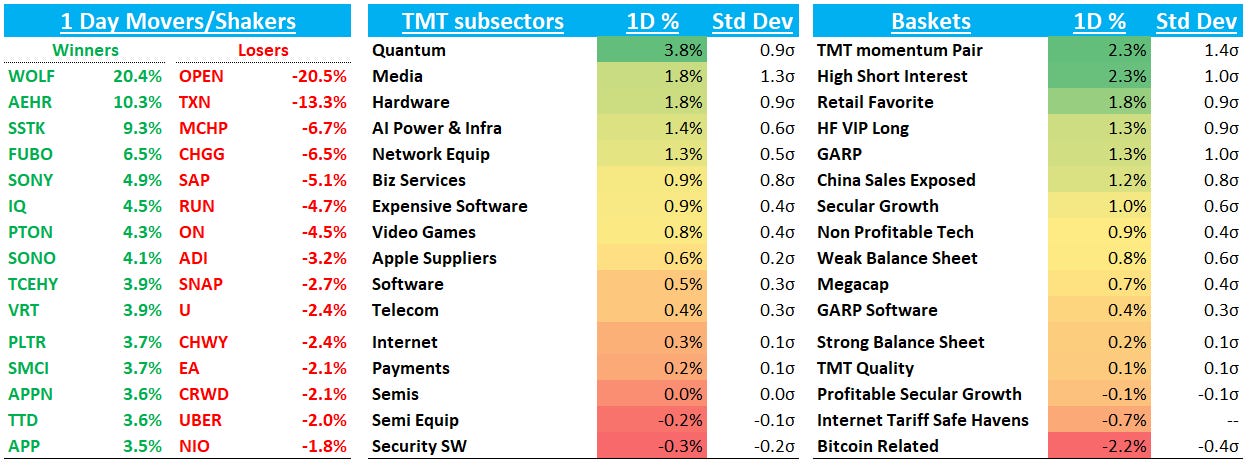

TXN -13% bringing down analog semis along with it (MCHP -6%; ON -4.5%; NXPI -1.4%; ADI -3%) as the analog bull case took a hit after TXN did a big about-turn in their commentary sounding more cautious around pull-ins, tariff and auto demand along with inventory ticking up.

NVDA +2.2% continues to grind higher as the Hot AI Summer continues. We outlined in our weekly why we think the multiple has further room to grow.

AI names strong: ANET +3%; ARM +2%; TSM +2.5% back above earnings gap while MU +50bps continues to lag

SOFTWARE

SAP -4% as Cloud ERP beat but mgmt called out trade uncertainty leading to prolonged sales cycle in public sector and mfg.

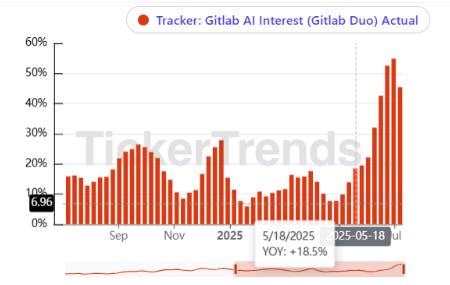

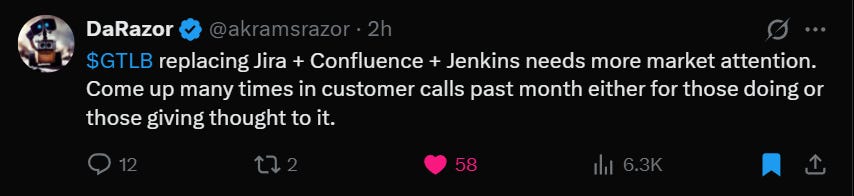

GTLB +2.3%: Checks been better here with interest in their AI product increase + M-sci was positive yesterday:

U -2.3% as BTIG downgraded to Sell. The analyst here thinks Unity continues to face structural challenges in scaling ad revenue, while Applovin maintains a more stable trajectory. For Unity, BTIG thinks spend from advertisers is not expanding meaningfully, and the firm sees no inflection in revenue or performance. BTIG points out Vector still only represents about 40% of the Grow segment and is being dragged down by declines in legacy ironsource and LevelPlay, which are both losing share. According to BTIG’s math, Unity would need to grow Vector 60–70%+ by 2027 just to offset declines in the rest of the Grow business and match Street targets. Not a bad downgrade, and similar to what we wrote a couple days ago that further improvements in Vector checks necessary to drive next leg higher - we’re still here with a small position looking for rt set up to possibly increase again.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.