TMTB EOD Wrap

Good afternoon - QQQs -33bps. 2 year yields finished flat while 10 and 30 year yields rose 4 and 8bps. Not too much on the macro front so let’s get to the recap. Post-close we got earnings from PANW - looks ok to slightly light of bogeys…

PANW -4% looks ok. Q3 NGS ARR $5.1B inline with bogeys. RPO of $13.5B slightly light of bogeys. Q4 NGS ARR of $5.52-$5.57 vs bogeys of 5.5B and RPO guide of $15.2B-$15.3B slightly light of bogeys. Reiterated RPO and NGS ARR full year guide (some were hoping for a slight raise). Rev guide raised slightly at the low end.

Onto to the recap….

INTERNET

GOOGL -1.5% with a bit of sell the news as many had covered/bought into I/O as a trade and nothing really earth shattering although lots of cool AI releases. Really hard to keep up with everything announced: TheVerge and TechCrunch has full coverage if you want to geek out over everything.

Stocks hitting new highs: RBLX +70bps; CHWY +2%;

ABNB -3% as the Spanish government on Monday ordered Airbnb to remove nearly 66,000 listings from its platform, widening a crackdown on tourist rentals as it seeks to alleviate a housing crisis that has become among the worst in Europe (NYtimes)

RDDT -2% following through on Wells Fargo downgrade yesterday and seems destined for sub $100 — probably the most crowded short in internet right now, but continues to work…

UBER -65bps sold off on Musk comments around “thousands” of robotaxis in Austin in 2H of the year. BofA made a point that last earnings call he was talking about “millions” so seems like a downtick, but its Musk-talk, so not wholly surprising. They also started launching rides in Atlanta and JPM was out positive after hosting them at their conference. This has been a nice long since a couple months ago where we talked up “change in perception” to AV winner but we’re not involved any longer as this 180 in perception happened in a lot shorter time than expected and the launch in Atlanta seems like the last catalyst on the horizon for now. We still lean positive here and think long-term UBER has an important role to play in the future of autonomy given they are the largest rideshare platform — stock is by no means expensive (sub 20x FY’26 FCF) but we wait for a more interesting set up. Wouldn’t be surprised if it keeps grinding though.

CVNA -1%: BofA’s Fenske was out mid day defending early weakness. His pitch: The long-term growth story is intact—but now backed by a stronger, more disciplined company. After a solid quarter, EBITDA estimates were raised 6–10%, with 2025 EBITDA expectations climbing from $500M to $2B over the past 18 months. Once burdened by a shaky balance sheet and a brutal auto cycle post-ZIRP, the company has emerged in a much healthier position…Yup, co used to be on the verge of bankruptcy now viewed in the growth-y / garp-y bucket. If you believe LT numbers they gave out on their earnings call, stock still cheap…~$350 is ATHs from back in 2021 (low was ~$4! in 2022)

BKNG -1% despite positive BTIG note calling out better May trends

SEMIS

NVDA/AMD -1% both up a bit after hours as Musk says he will buy 1M GPUs from NVDA and AMD (doesn’t seem incremental given past talk of 1M GPU cluster)…Musk also tweeted this morning saying Colossus 2 will be the first Gigawatt supercluster

Stratchery had a good interview with Jensen this morning - full thing worth a read. China comments were interesting:

'This additional ban on Nvidia’s H20 is deeply painful ... We walked away from $15 billion of sales and probably — what is it? — $3 billion worth of taxes for the US'.

'Anybody who thought that one chess move to somehow ban China from H20s would somehow cut off their ability to do AI is deeply uninformed'.

'If we don’t compete in China, and we allow the Chinese ecosystem to build a rich ecosystem because we’re not there to compete for it, and new platforms are developed and they’re not American at a time when the world is diffusing AI technology, their leadership and their technology will diffuse all around the world.'

Finally, Cleveland was out saying GB200 demand and supply continue to improve m/m but they lowered estimates on H20 restrictions.

MRVL -2% as more confirmation from Jefferies Fubon that AIChip has won the turnkey service for Trn4

CRWV +4% seems destined for a meeting with $100

NBIS +4% after solid earnings…In TMTB Chat:

QBTS +25% / RGTI -1% / IONQ flat as JPM hosted a Quantum virtual day. Guess which one out of the 3 I didn’t buy?

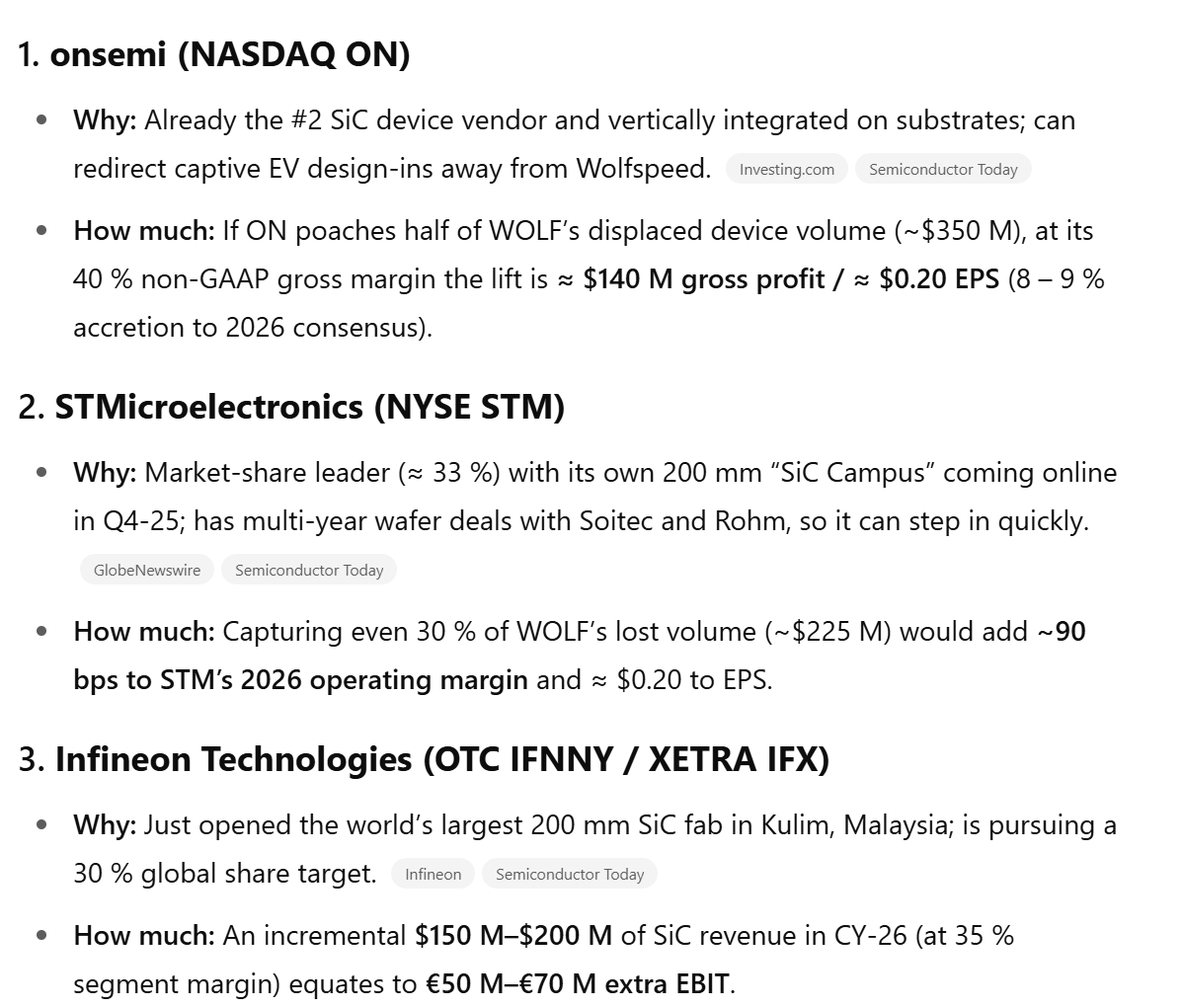

WOLF -44% post close as WSJ reports they are within weeks of filing for bankruptcy…ON and STM the big winners here if WOLF cedes its share to them:

INTC -50bps as Reuters reported they are exploring sale of networking and edge unit

SOFTWARE

MDB flat shaking off a Loop downgrade

PLTR -60bps trying to hold breakout support. Like we said yesterday - this stock at an important junction in the chart. A break lower here would be a tea leaf to us for broader market. Watching closely.

GTLB +2.5% after selling off yesterday on some MSFT Github announcements at Build

NTNX -2% on RJ downgrade

SAP +20bps as Wells initiated at BUY and CEO spoke at Sapphir, outlining its shift toward a unified “Suite as a Service,” integrating apps, data, and AI into a reinforcing flywheel. Joule, SAP’s AI assistant, now spans both SAP and external platforms like ServiceNow, with new agent-based features launched for developers and consultants. Over 230 generative AI scenarios are live, on track for 400 by year-end, with 34,000 customers already using Business AI. BT, for instance, has cut HR workload time by 85%. SAP’s internal AI gains are notable: 30% efficiency boost, 90 minutes saved per consultant per day, and 20% faster support resolution. Its revamped data strategy includes 65% faster processing and full end-to-end automation, accelerating data science delivery by 40%.

SNOW +50bps as Jefferies had some positive checks

ELSEWHERE

TSLA +50bps: Bloomberg in Qatar this morning (also on CNBC post-close, but still haven’t watched that one)…full interview video here…Summary below of bloomberg interview:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.