TMTB EOD Wrap

QQQs +85bps with some positive price action across the board. We added back gross and net today as saw several positive tea leaves that market wants to go higher: seeing several leaders (SNDK, CRWD, SNOW, SHOP, etc.) hit 52wk highs; finally some positive price action in earnings with IBM finishing close to flat after being down 8% and TSLA and SAP with nice red to green reversals; VRT/GEV bounced back nicely after yesterdays sell-off post earnings and APH followed through to the up; spec names/BTC strong a sign risk might be back on.

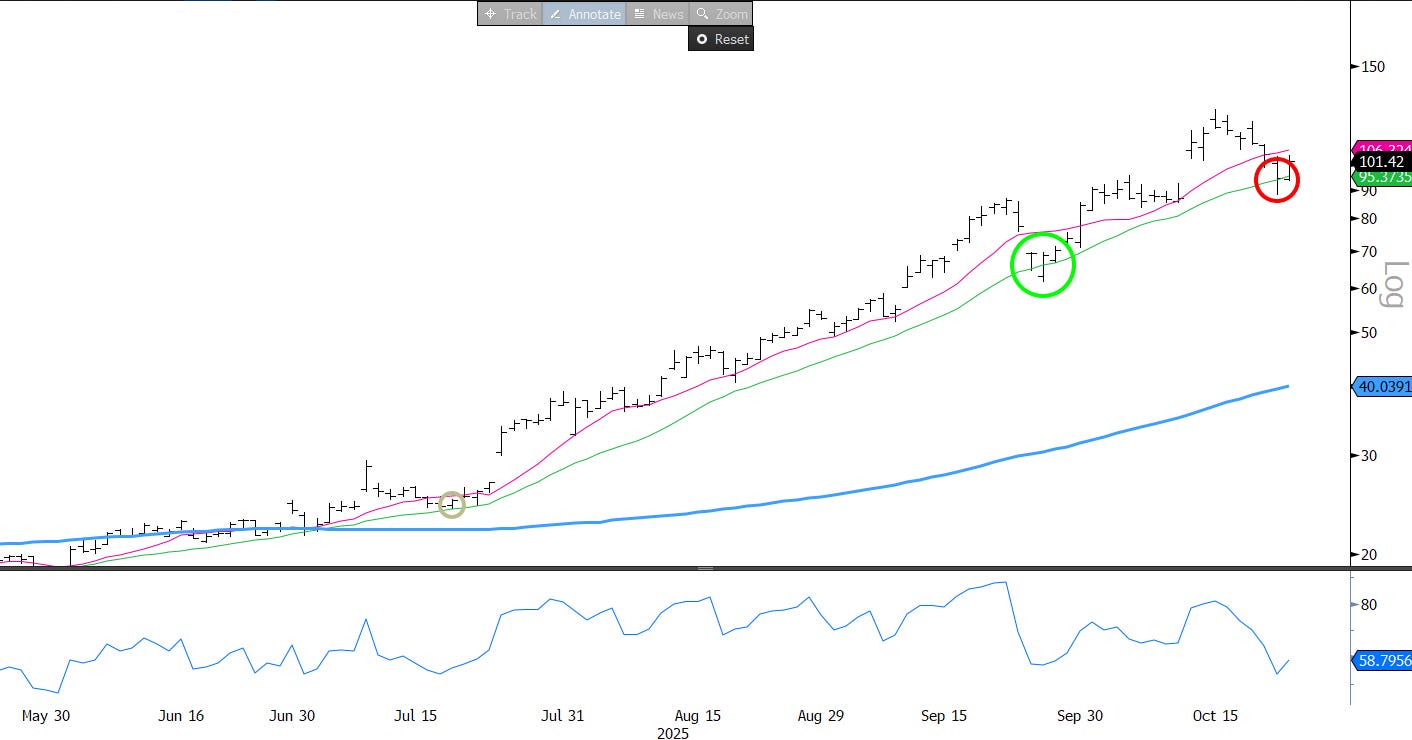

Finally, seeing a lot of leaders bounce of key levels. Just a few out of others that look similar:

BE bouncing off the 20d:

AMD off the 10d

APP bouncing off key support and up through the 10d:

We’re big on risk mgmt here at TMTB but also on finding set ups where we can increase our sizing — we like using charts to help find those. We like adding gross/net on days like today, with the individual chart set ups like they are as it gives us clear “lines in the sand” on many names that would be tea leaves to cut net/gross if the levels were to break. Definitely an interesting environment requiring us to remain nimble, but we also try to always keep a mind’s eye on our bigger picture bullish view.

Post-close, INTC +7% on better numbers although guide is a bit light. Commentary on the call pretty positive around CPU server demand saying they are seeing LTAs in servers and current demand outpacing supply, a trend they expect will persist into 2026. Good read-through for AMD

3Q revenue/GM/EPS of $13.65b/40.0%/$0.23 vs Street at $13.16b/36.1%/$0.01

CCG revenue of $8.5b vs. Street at $8.00b

DCAI revenue of $4.1b vs. Street at $3.98b.

Q revenue/GM/EPS of $13.3b/36.5%/$0.08 vs Street at $13.40b/37.1%/$0.09

Notes from Coatue’s Michael Barton podcast all the way down…

Let’s get to it…

AI/SEMIS

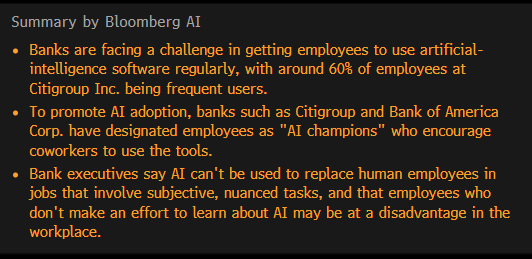

Banks Working to Get Staffers to Use AI More Regularly, CTOs Say (Bloomberg)

BofA made a good point on the above article: banks are risk averse and care about security and compliance - fact they are pushing employees to use AI very bullish for adoption.

SNDK +13% ripping to new highs as NAND prices continue to rip. Saw FundaAI say that they are hearing CSP’s aggressively quoting 40% price hikes for SSD in Q1 for as much inventory as possible. Prices continue to ramp and investors like the exposure here as you get get immediate upside to GMs and EPS from pricing — no need to wait until ‘26 like other AI names.

WDC/STX +4-5% as Edgewater was out positive saying supply further tightening as LTAs extend to YE27 and converting into POs given hyperscale demand. They raised their nearline price forecasts.

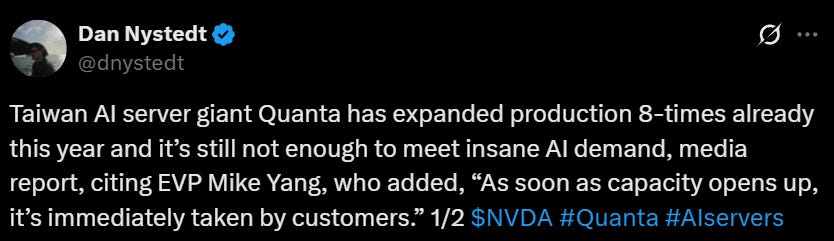

MU +4% shaking off some negative comments from Jefferies around HBM4 as DRAM spot continues to ramp - new closing highs. Good take from JT:

NBIS +7.5%: Avride, one of the non-core Nebius businesses focused primarily on autonomous vehicle technology, secured up to $375M in commitments backed by both Nebius and Uber (bloomberg). The new capital will be used to further product development and help expand Avride’s fleet to 500 autonomous vehicles in new geographies, with the first 100 launching later this year in Dallas in partnership with Uber DA Davidson was out with a note saying they think Avride should be valued close to $10B

SMCI -9% after cutting its Sep-quarter revenue outlook to ~$5B (vs prior $6–$7B and Street ~$6.5B), blaming “design win upgrades” and delivery timing that shift sales into December

TER +4.5% as they’re one of the main beneficiaries from AMZN’s big robotics push.

BE +7.5% nice bounce after yesterday

Quantum strong after a WSJ that the USG was thinking about investing in certain companies although Reuters was out later refuting it.

INTERNET

EXPE -5% / BKNG -2.6% after weaker Wynham Hotel earnings. They missed and cut the guide but mgmt also said: ““Chat Perplexity Gemini are reshaping how guests book hotels and it is presenting a unique opportunity for us to continue to reduce our dependency on OTAs”

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.