TMTB EOD Wrap

What a day! QQQs +12% — the 2nd largest single gain in Nasdaq history, although not exactly great company to be in:

Semis with their biggest one day move ever.

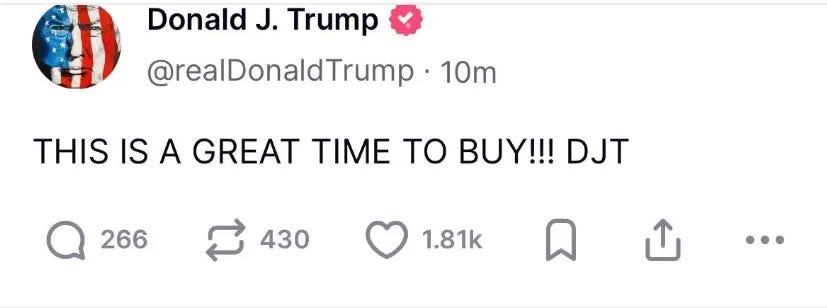

Trump warned everyone this morning:

Soon after he tweeted this out, he announced a 90 day reprieve to all countries except China while keep a baseline 10% tariff on them (and raising China to 125%).

10 year only finished up 2bps while 2 year surged 18bps as Fed expects shifted hawkishly, now pricing in 78bps worth of cuts this year (same where it was before Apr 2nd tariff announcement).

We’re not completely in the clear as still need to worry about slowing growth and China tariffs are likely to wreck havoc on supply chains (as well as potential geo-political issues). Still the worst case is off the table for now: the Bond market is beautiful again, 90 days is a good chunk of time which provides some certainty for investors badly wanting some and 10% is a nice flat rate which alleviates the perception of total chaos. Now a narrative can emerge that this was Trump's plan to begin with - try to ally the world against China (rightfully or not - that’s where we're at now. We like this thread if you want to dive deeper into that narrative). And we go into earnings only having to mainly worry about China exposure from a tariff perspective, which is a lot cleaner than yesterday. Given where sentiment was and levels of de-grossing heading into today, I think the move today is justified and investors felt comfortable increasing back a bit of that net/gross they had taken down. Remember stocks were actually up Apr 2nd post market when investors thought 10% might be universal - China much worse since then, but news flow finally moving in right direction and one can argue Trump and co finally realize systemic risks if they pursue a path like they just did again. And next up are pot’l tax cuts…

With earnings season around the corner, I for one am excited that we might actually get to focus on fundamentals and the thing most of us reading this love: Tech! While our vacation into macro land is/was annoying fun, we’re hoping today provides at least a bit of a window where we can go back to focusing on things that typically matter for tech stocks.

We’re even getting excited thinking about being able to unfollow this guy (at the very least notifications might be able to come off):

Lots of big moves today (plenty of names +15%+) and we won’t really go through them on a name by name basis - that would be a bit silly on a day like today. Still, some important pieces of Tech news came out:

GOOGL +9.6% reiterated $75B in capex at Cloud Next

NVDA +19%; Trump administration backs off Nvidia's 'H20' chip crackdown after Mar-a-Lago dinner - NPR:

When Nvidia CEO Jensen Huang attended a $1 million-a-head dinner at Mar-a-Lago last week, a chip known as the H20 may have been on his mind.

Following the Mar-a-Lago dinner, the White House reversed course on H20 chips, putting the plan for additional restrictions on hold, according to two sources with knowledge of the plan who were not authorized to speak publicly.

The change of course from the White House came after Nvidia promised the Trump administration new U.S. investments in AI data centers, according to one of the sources.

AI semis seem like a good place to be. Good news flow, less exposed to eco slowdown, and pot’l catalysts with OAI release schedule over next few weeks.

In internet, ad names which had been hit the hardest given eco fears fared the best: RDDT +25%; SNAP +22%; PINS +14%; META +15%; ROKU +16%

AMD +24%: Will be hosting “advancing AI 2025” even on Thursday June 12

Travel names like DAL +22% and UAL +26% led the way higher in SPY; not surprising given I heard from several tech investors they were playing airlines earnings…

CVNA +25% stands out as one that was hit especially hard given eco/credit risk name is associated with despite 3p data holding up well so far (actually accel’d in most recent week)

CRM +8.7% (underperformed) as Clev said tracking in line to slightly below due to elongating sales cycles; Clev was more positive on ZS +14% / PANW +13% basically saying security demand holding up decently

TSLA +22%: posted this yesterday:

Still have some China risk here though…

We always like to look at stocks with relative strength at the beginning of a bounce to see who could be the leaders if the rally continues. Below you will find how stocks have done since Apr 2nd’s “Liberation Day.”

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.