TMTB EOD Wrap

On the road today so a bit late but here goes…

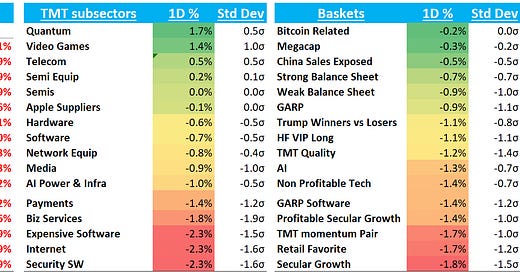

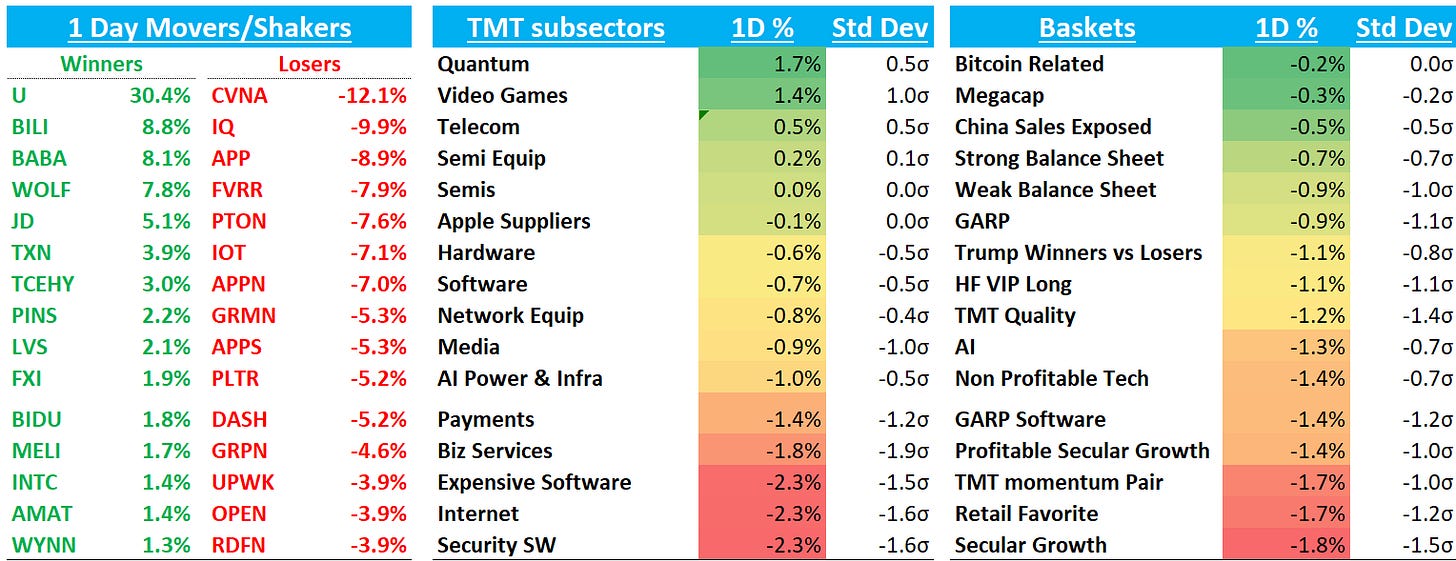

QQQs - 40bps but lots of red on my screen today. Software down close to 2% while semis finished flat. A bit of an unwindy day, especially in internet as internet investors increasingly getting more comfortable owning Chinese Tech names as BABA print was a clean beat across the board. Large cap internet favs took the brunt of the flows: DASH -5%; META - 1.2%; AMZN -1.6%; NFLX -1.8%

Software -2% earnings/tea leaves finally catching up to the overall sw index as we’ve seen weaker prints/neg follow through from INFA, DDOG, MANH, MSFT, NOW, NICE, and BILL and weaker price action post prints even from co’s that beat like CFLT, MNDY, HUBS which have failed to follow through on the upside after decent T+1 moves (along with an outsized move to the downside for TWLO). Add to that concern from Fed budget cuts (list of federal exposed software names here) which has taken down retail darling PLTR -15% in the last two days. Expensive software is also a sub sector which has had heavy retail support and retail heavy stocks generally begin to underperform mid Feb as we called out yesterday. A bit of unwind in U +30% (investors excited about model release in Q2/2H share gains) / APP -8% (hit by bear cave report as well).

Semis finally getting some help from analogs over the last few days post ADI’s print as more investors feeling confident in the cyclical turn there — next big catalyst: expect most co’s to sound positive again at the big MS TMT conf in early March.

So lots of cross currents happening underneath the indexes…let’s get to details - onto the recap…

Post-close earnings:

BKNG +2% trading higher following EXPE/ABNB with a great beat across the board. 13% RN growth vs bogey 10% and guide 6-8% and GB CC growth at +18% vs bogey 10-11%. Revenue CC was also +15% which cleared the bar of the street at +9%. Surprisingly, alt accommodations +19%, growing faster than VRBO and ABNB. Q1 room night guided to 5-7% vs bogeys of 7%, but will be deemed conservative given huge beat they just put up and leap day/easter timing year. FY25 GB guided to at least 8% vs bogeys of HSD…stock is well-owned and expectations had risen after EXPE/ABNB, but not much to not like as guide will likely be seen as v conservative given the big Q4 Beat. Mgmt was bullish on travel demand on the call and co initiated dividend.

XYZ -7% ok Q4 (GPB accel’d to 10% vs street at 9%), but GP of 14% missed street by 1%. Q1 guide weaker as Q1 GP guide of 11%, 2% below street due to 1% fx headwind, lapping leap year, and tough sq banking cops. Q1 normalized GPV expected to grow in the high single digits, but including FX and leap day closer to 6-7% vs street at 9-10%. Q1 AOI guide of $430M below street at $458M and bulls at $460M+. Reiterated “Rule of 40” by ‘26 and expects to exit ‘25 at or above this line.

AKAM -8% after inline Q4 and Q1/FY guide below:

AKAM GUIDANCE: Q1

- Guides ADJ EPS $1.54 to $1.59, EST $1.61

- Guides revenue $1.00B to $1.02B, EST $1.04B

F/Y GUIDANCE

- Guides ADJ EPS $6.00 to $6.40, EST $6.82

- Guides revenue $4.00B to $4.20B, EST $4.25B

- Guides ADJ operating margin 28% to 28%, EST 29.2%

RESULTS: Q4

- Revenue $1.02B, +2.5% y/y, EST $1.02B

- Security revenue $534.6M, +14% y/y, EST $534.5M

- Delivery revenue $317.8M, -18% y/y, EST $313.4M

- Compute revenue $167.5M, +24% y/y, EST $167.2M

- ADJ EPS $1.66 vs. $1.69 y/y, EST $1.52

RNG -2% Trading down after softer subscription # and guide

RNG GUIDANCE: Q1

- Guides software subscription revenue $587M to $592M, EST $604.6M

- Guides ADJ operating margin 21% to 21.5%, EST 21.2%

RESULTS: Q4

- Revenue $614.5M, +7.6% y/y, EST $612.4M

- Software subscription revenue $589.7M, +7.7% y/y, EST $592.1M

- ADJ EPS $0.98 vs. $0.86 y/y, EST $0.97

- ADJ gross margin 77.3% vs. 78.4% y/y, EST 77.6%

- ADJ operating margin 21.3% vs. 20.5% y/y, EST 21.2%

Internet

NFLX - 1.8% continues to act weaker after less than stellar 3p data earlier in the week

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.