TMTB EOD Wrap

It’s the first 80 degree day of the new year here in Cali and the QQQs finished +2.2%. It was a good day. Markets were helped by press over the weekend discussing how Trump will be more “targeted” than feared and Trump said today he will “give a lot of countries breaks.” QQQs are now +5% from the lows (still dn 9% from the highs) and popped its head above the 10d/21d MAs, following some names which had already done so late last week. Yields rose on the back of equity gains rising 7-9bps across the curve while Fed expects jumped in a hawkish direction with mkt now pricing in 60bps worth of cuts for the year.

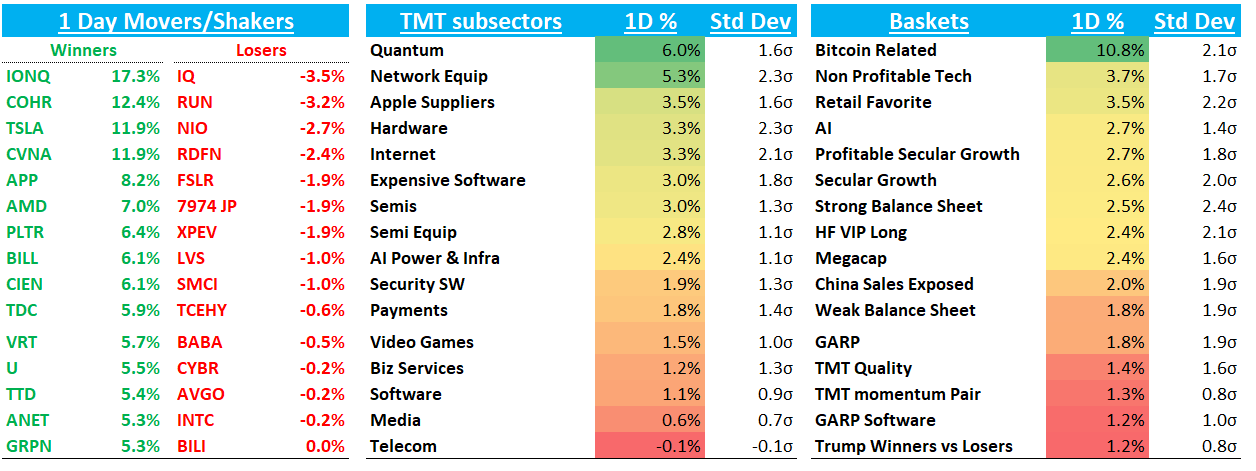

Strength across the board. The names you’d expect to outperform a lot on a snap back day led the way higher; previous long favs like APP +8%, PLTR +6%; RDDT +8%, HOOD +9% or way beaten down names like TSLA +12%. One of our favorite gauges of animal spirits - the Quantum basket - was +6% on the day with IONQ +17%…

Not a ton of idiosyncratic stuff to call out today as rising tide lifted all boats, but we’ll call out what we thought was interesting

Internet

META +4% perhaps helped by RFK Jr. saying he will ban Pharmaceutical ads on TV

PINS +5% as Guggenheim upgraded to Buy as they expect above-market monetization growth during 2025-27, driven by volume growth and AI-enabled advertising improvements. Yipit was also out saying MAUs tracking inline to slightly below street

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.