TMTB EOD Wrap

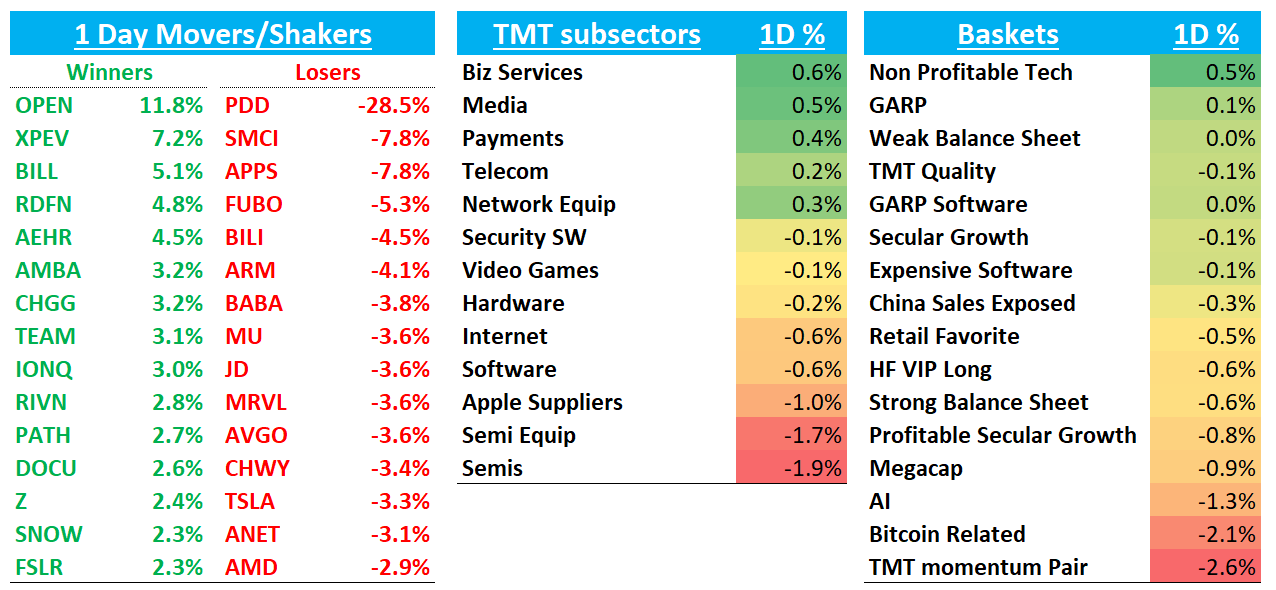

QQQs -90bps as IWM +30bps outperform. Treasuries have a modest bid, with yields flat-to-down 2bp across the curve with 10year yields making 52wk lows. Fed expectations are holding approximately steady, with the market pricing in a 33bp rate cut on 9/18 and ~103bp for the year (h/t VitalKnowledge). The same factor outperformance as Friday continued with non-profitable tech outperforming and TMT momentum underperforming, along with semis + AI. Should continue to be slow days outside of barrage of earnings wed/thurs evening in TMT. Let’s get to it…

Internet

Big story is PDD -30% after commentary saying competition was increasing, revenue would be challenged, and they would continue to invest heavily. Heard theories this was a little of BS (in other words: more bark than bite) as founder just became richest man in China and aware of how regulators treated Jack Ma - just chatter around the street passing along. BABA -4% and JD -4% dropped as a result as increased competition likely a head…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.