TMTB EOD Wrap

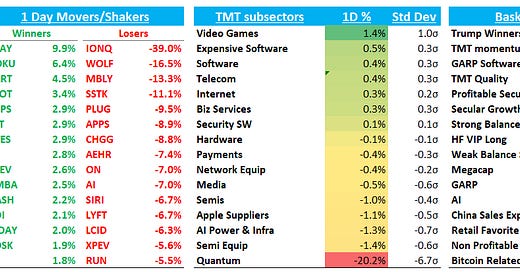

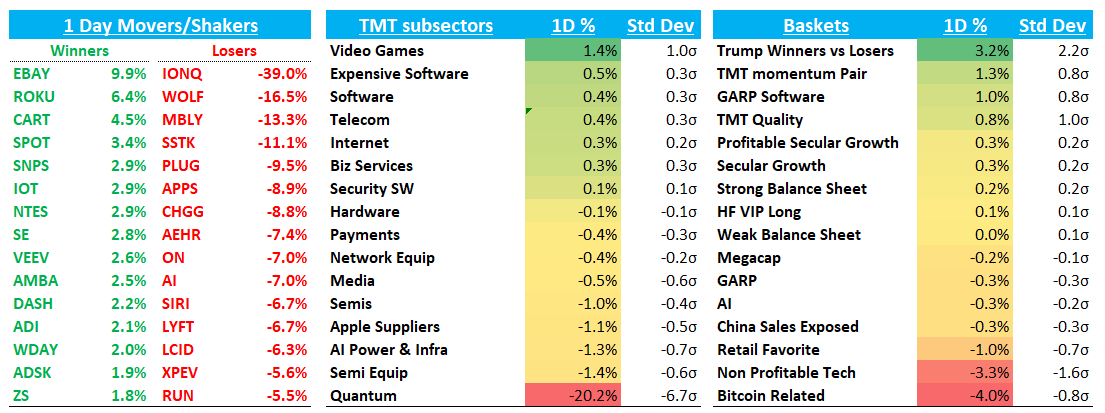

QQQs flat after a volatile session. Treasuries saw some gains as Waller and FOMC minutes weren’t as hawkish as feared and decent 30-year auction in the afternoon helped. Market off tomorrow and we get NFP tomorrow morning. BTC - 2%. Trump winners outperformed Trump losers by 3% after hawkish Tariff comments in early morning. Non-profitable tech -3% helped lower by Quantum debacle.

Post close: Biden to Further limit NVDA, AMD AI Chip exports in Final push…seems a bit incremental than the usual China stuff as they are calling out other countries as well…NVDA - 1% / AMD -1%. Bloomberg:

President Joe Biden’s administration plans one additional round of restrictions on the export of artificial intelligence chips from the likes of Nvidia Corp. just days before leaving office, a final push in his effort to keep advanced technologies out of the hands of China and Russia.

The US wants to curb the sale of AI chips used in data centers on both a country and company basis, with the goal of concentrating AI development in friendly nations and getting businesses around the world to align with American standards, according to people familiar with the matter.

The result would be an expansion of semiconductor caps to most of the world – an attempt to control the spread of AI technology at a time of soaring demand. The regulations, which could be issued as soon as Friday, would create three tiers of chip trade restrictions, said the people, who asked not to be identified because the discussions are private.

Let’s get to it….

Internet

EBAY +10% as META -1% said they would launch a test in Germany, France and the US that will enable buyers to browse listings from eBay on Facebook Marketplace and then complete their transactions on eBay. Reminder, US is 50% of the biz and Germany is the 3rd largest market just after the UK. Would be big positive for EBAY if this would actually go through but still some uncertainty given 1) unclear how exactly roll out would look and 2) META is still appealing EU decision. Still, every $10B in additional GMV is an additional 10% to revs and slightly more to EPS. This would also help the multiple as 1) new avenue of growth and many more eyeballs going to EBAY. One assumes marketplace growing faster than EBAY which could accel growth on a go-forward basis even after initial jump 2) One of the main overhangs on EBAY has been competition from FB Marketplace so this alleviates that.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.