TMTB EOD WRAP

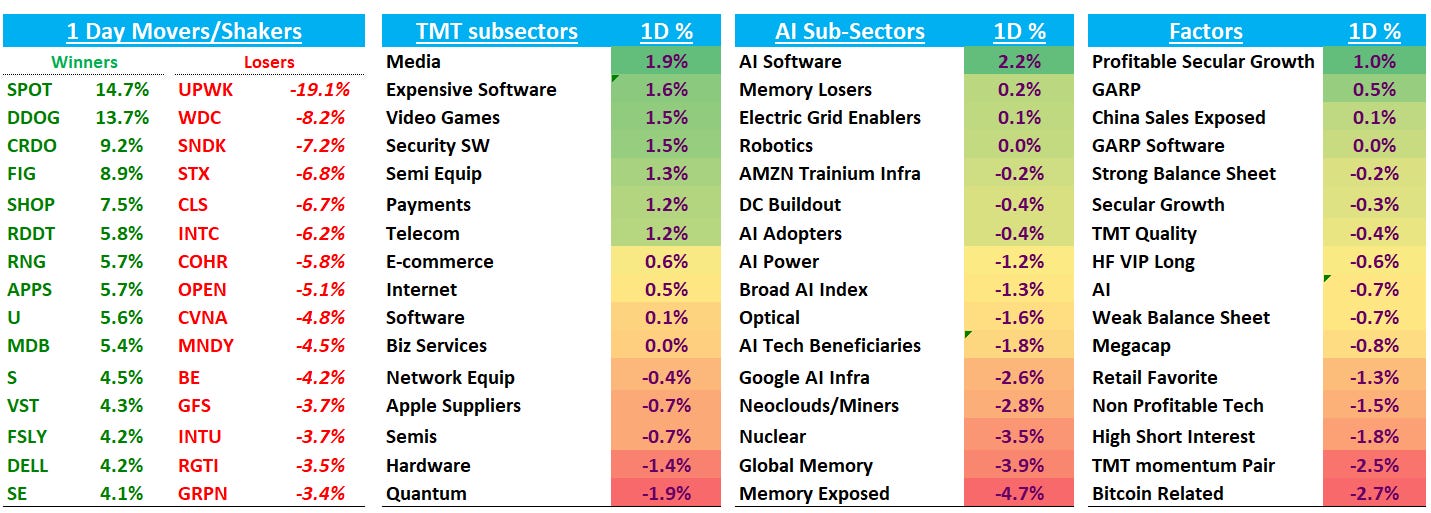

Good afternoon. QQQs -45bps ahead of the jobs report tomorrow. SPY -25bps despite equal weighted SPX up while IWM outperformed QQQs by 20bps. Yields fell 4-7bps across the curve after the weaker retail sales report and what is expected to be a soft labor report tomorrow.

Post-close, NET +10% after putting up 34% growth vs bogeys of 31-32%, another 300bps+ accel while guiding to 30% vs bogeys of 29%. Call going very well. Should help activate narrative of them as agentic AI winner. Expects were high after Prince’s buzzed tweet last week which everyone saw, but if they beat the guide by same amount implies another accel to 35% next q and keeps accel story alive. After MNDY’s miss, then DDOG’s beat and now NET (assuming it holds), we’re beginning to see a bifurcation in software after consumption all got lumped in with the bad stuff over the last couple of weeks.

Let’s get to it…

INTERNET

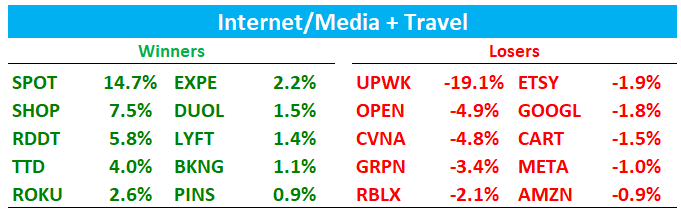

SPOT +15% as the Q1 GM guide stole the show helping alleviate some bear fears that GMs have peaked. Mgmt reiterated price increases should outpace net content cost growth in 2026, which addresses investor concerns that label economics/wholesale moves would cap margin expansion. Stock had been used as a funding short and short interest was near highs so this print goes a good way to helping bulls get back in the saddle where they can get back to talking about the LT drivers: still growing users at scale, proving durable pricing power, and structurally expanding margins as it layers higher-margin revenue streams (Marketplace, improving Ads, audiobooks/podcasts/video) on top of a massive music subscription base. On AI, mgmt pushed back on fears with the argument that Spotify is the scaled distributor where the “cultural moment” happens, and AI is more likely to increase content supply and interactivity (raising engagement/retention) than disintermediate Spotify. Bears nitpicked on the Q1 rev guide below street and fact ad revs declined y/y despite fx tailwinds and that Q4 op inc included sizable social charge benefit while mgmt hedged on linearity of margin improvement saying margin progression variable depending on reinvestment timing.

SHOP +7.5% following through on yesterday’s 3p strength as Moffet Nathanson and Canadian Bank ATB upgraded to Buy, both saying they see agentic commerce as a tailwind rather than a headwind. Company reports later this week.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.