TMTB EOD WRAP

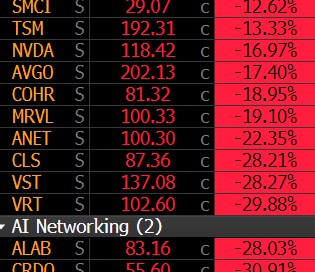

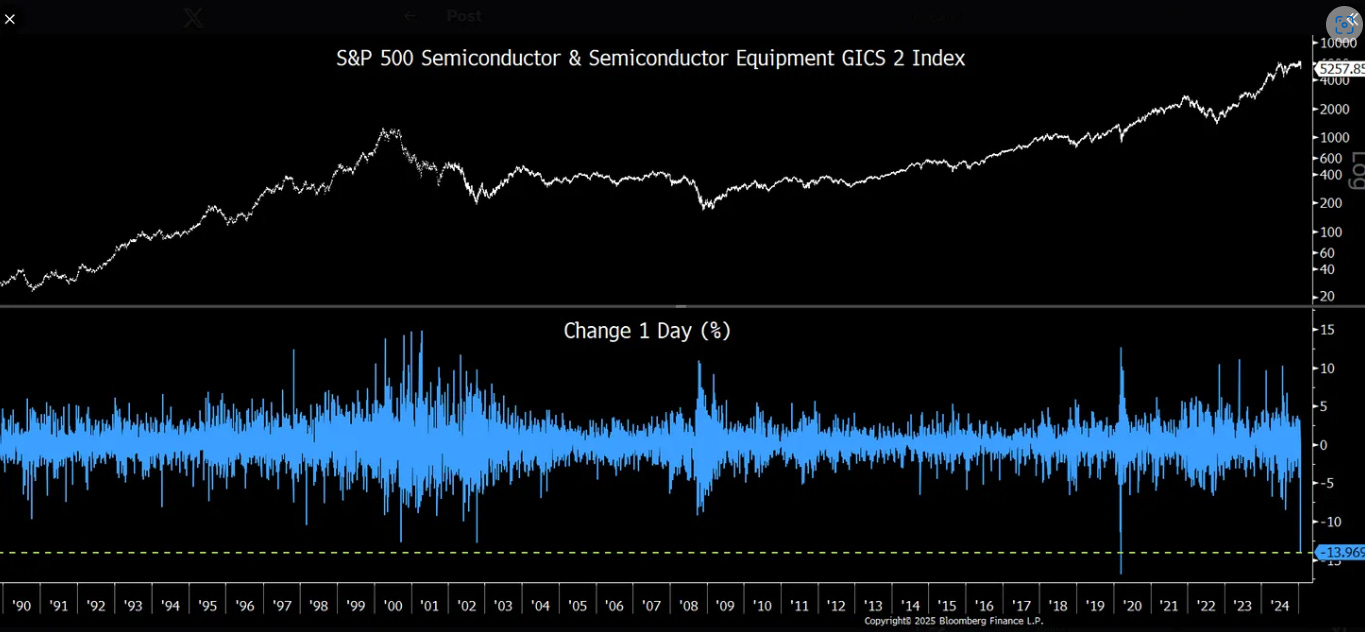

What a day…QQQs -3% as Deepseek took down anything AI capex levered — plenty of names in double digit red territory. Nothing was spared - power, nuclear, memory, AI semis, AI networking, AI storage, AI servers.

Also among the big losers: CIEN -21; PSTG - 9.5%; GLW - 9%; DELL -9%; ORCL -14%; NBIS -37%

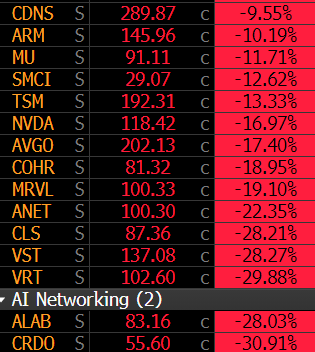

Semi and Semi equip GICS Index -14% today, its worst day since ‘89 except 1 day during pandemic depths (h/t @researchqf):

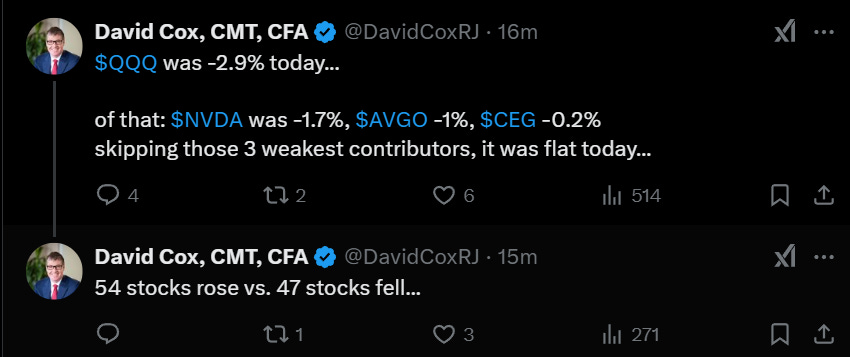

Still, there was healthy rotation under the surface with software and internet names benefitting as the selling was mainly isolated to those AI capex levered names:

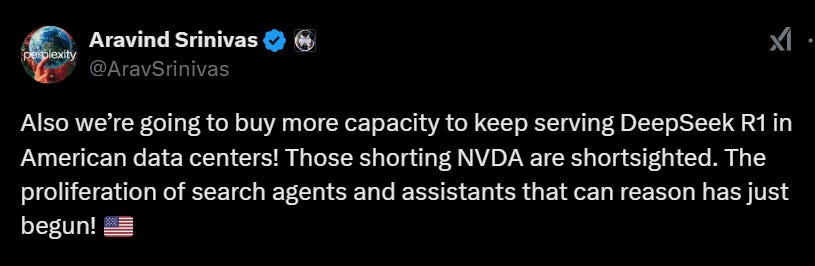

Didn’t hear a many investors trying to defend the move in AI semis yet - most thinking we need to hear from MSFT on Wednesday first before we get any relief given Nadella has been ahead of the curve here. The bulls point to Jevons paradox (and we agree long-term this means more compute) but pushback is 1) no hit AI app yet means we aren't at inflection yet 2) is this the last time inference costs take a big leap lower?...timelines compressed....given AI moving much faster and things shifting much quicker than people used to, hard for people to look 2-3 years out and say: "oh yeah, jevons paradox.” The moves today were humbling and for many the reality of what Deepseek means has now sunk in. NVDA’s statement didn’t say much:

"DeepSeek is an excellent AI advancement and a perfect example of Test Time Scaling. DeepSeek’s work illustrates how new models can be created using that technique, leveraging widely-available models and compute that is fully export control compliant. Inference requires significant numbers of NVIDIA GPUs and high-performance networking. We now have three scaling laws: pre-training and post-training, which continue, and new test-time scaling.”

I liked this take from Gavin:

Conclusions: 1) Lowering the cost to train will increase the ROI on AI. 2) There is no world where this is positive for training capex or the “power” theme in the near term. 3) The biggest risk to the current “AI infrastructure” winners across tech, industrials, utilities and energy is that a distilled version of r1 can be run locally at the edge on a high end work station (someone referenced a Mac Studio Pro). That means that a similar model will run on a superphone in circa 2 years. If inference moves to the edge because it is “good enough,” we are living in a very different world with very different winners - i.e. the biggest PC and smartphone upgrade cycle we have ever seen

That’s one reason today and QCOM -50bps and QRVO -1.5% outperformed.

Instead of the usual roundup today, just call out a few standouts outside of AI semis:

Software names strong: HUBS +4%, CRM +4%, TEAM +1%, 3 of the AI Agentic names acted well as the thinking is lower inference costs means both lower pricing → better demand and better margins

Cloud Consumption names decent as well: MDB +1%; DDOG +80bps; CFLT +66bps

Internet names that stand to benefit: RBLX +15bps; META +2% (potential for less capex going fwd means better FCF and U.S. leader in open source)

PINS +1.8% → Yipit said Q4 global MAUs finished slightly above street while pinner retention and engagement growth accelerated in Q4

MSFT - 2% ahead of earnings on Wednesday: worth performance despite ties to OAI. Shifting value to the app layer is good for MSFT. Less capex spend on compute is good for MSFT. And Satya now seen again as the guy leading from the front.

AMZN +20bps : From yesterday’s weekly:

Main take away coming out AMZN’s re-invent conf was that their strategy was “predicated on the ideas that AI becomes a commodity not something eternally special.” That supports our view we wrote about in December that the narrative on AWS has changed from “AI loser” to potentially “AI leader.” Better AI is also likely to drive improvements in ad-tech, logistics, robotics, and cost-to-serve.

GOOGL - 4% → Mixed feedback as some say more search risk as more operators/AI agents for consumer means less people have to go directly to Google. MS also had this tidbit this morning: “YC’s Garry Tan says anecdotal reports suggest that Google referral traffic to websites is down 15% on a year ago as people stop clicking on links and increasingly rely on AI.” 3p search estimates continue to track below street for Q1 so tough uphill climb to face here

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.