TMTB EOD Wrap

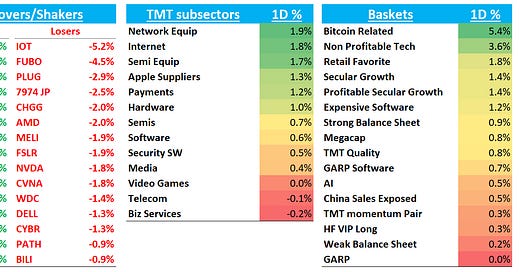

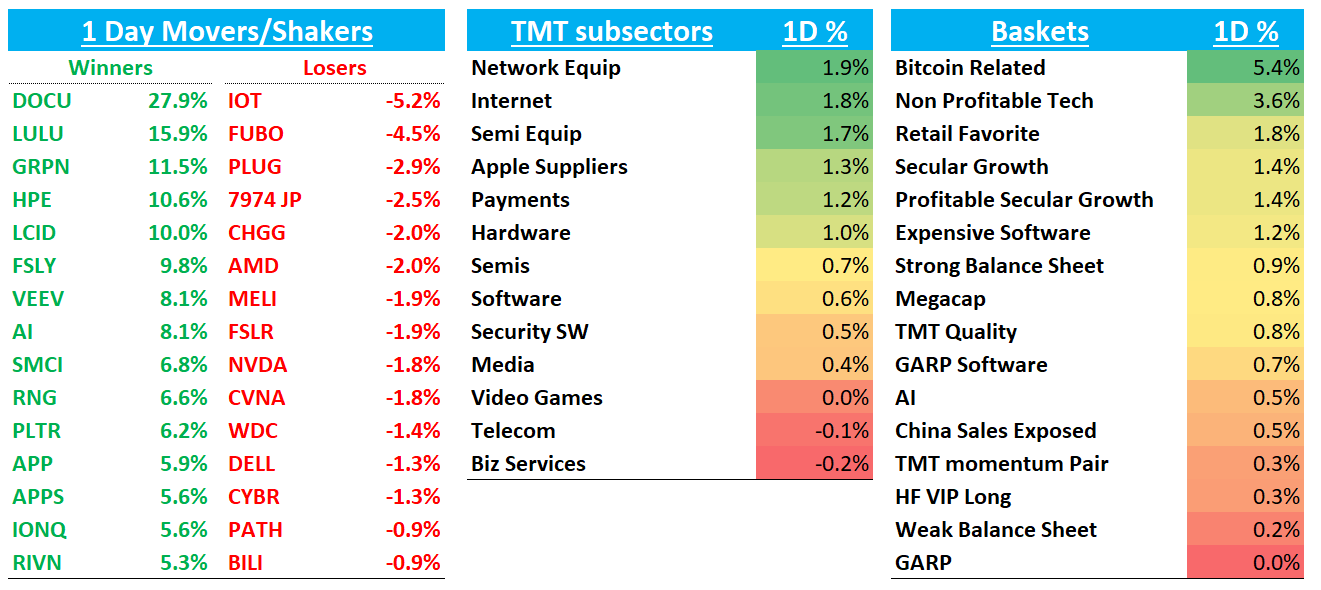

QQQs +90bps after NFP was roughly inline keeping 12/18 fed cut on the table - odds of a 25bp cut climbed to 85%. Treasuries rallied with 2 and 10 year dipping 3-5bps. Crude continues to slide dropping 1.6% while BTC sits almost right at $100k.

WDAY +9% gets the sp500 nod after the close (APP -6% as some were hoping for the add there)

More strength in large cap tech (excluding NVDA -1.8% which continues to struggle to find a bid as investors continue to shift their focus to what are seen are more exciting NT opportunities in the mkt + worries about ASICs ramping). AMZN +3% the standout here as we think this week was a pivotal one for the stock as we think it made the shift straight from AI “mixed” to AI leader after re:invent (in addition, got some positive 3p retail data this morning and a positive ISI note around their rx ambitions - more details in our morning wrap on both). Set up continues to be one of the best in large cap internet (along with NFLX). Ad names rallied as District court upheld the TikTok ruling as expected: META +2.4%, RDDT +6%, SNAP +2.2%. Will be interesting to hear if what Trump says if he gets asked about at the Meet The Press interview on Sunday morning. Non-profitable tech also led the way…

Let’s get to the recap…

Internet

AMZN +3% after +ve retail data at Yipit post BFCM now tracking 4 ppts above street for NA. ISI also said rx could be a 5-10% incremental rev/ebit opportunity

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.