TMTB EOD Wrap

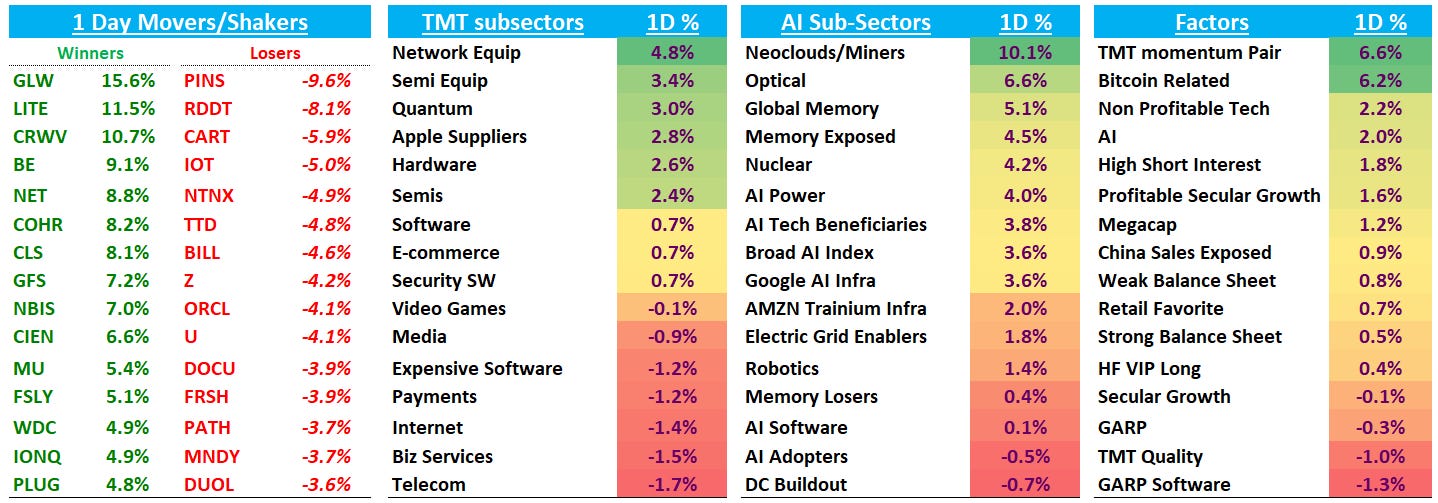

Good afternoon. QQQs +90bps now up 4 days in a row, outperforming IWM by 300+ bps over that stretch and getting close to ATHs. In tech, Optical, networking, and semis outperformed, with strength across hyperscaler-exposed names and global memory (+5%+). Neoclouds/miners and AI power were standout AI sub-themes helped by CRWV’s DB upgrade. In contrast, the Great Software Bull Market of 2026 was over after 3 days with plenty of app sw names down. Factor wise, momentum factors broke out to the upside today with GS TMT Mo pair breaking out to ATHs. Front end of the curve dipped while the long end rose 2-4bps. Fed expects held steady.

Post-close earnings:

TXN +8% as revs were a touch light for the q, but guiding Q1 to be 2% better q/q (vs expects for flat) and GM 55.9% vs street at 54.9%. Capex a little below expects ($925M vs Street $1.25B) driving FCF upside to $1.33B vs Street $885M.

STX +7% with a solid q as GMs came in at 42.2% vs street at 40.6%. EPS 3.11 vs street at 2.83 and bogeys of $3+. Stock was slightly down but then ripped a quick 10% on positive demand commentary saying they are already taking orders for 2027:

Our near-line capacity is fully allocated through calendar year 2026, and we expect to begin accepting orders for the first half of calendar year 2027 in the coming months.

Further out, visibility is strengthening based on the long-term agreements in place with major cloud customers through calendar ’27. Additionally, multiple cloud customers are discussing their demand growth projections for calendar ’28, underscoring that supply assurance remains their highest priority.

We will continue to meet strengthening demand through our strategy to maintain supply discipline and satisfy exabyte growth through aerial density advancements, without increasing unit production volume in the December quarter.

FFIV +10% on a big product revenue beat at $410mn, up +11% y/y and well ahead of consensus estimates of $356mn, marking the company’s sixth straight quarter of double-digit product growth, with no visible impact from recent security incidents. Management raised FY26 guidance to reflect the $0.85 EPS beat, now forecasting (1) revenue growth of 5–6% (vs. 0–4% prior), (2) non-GAAP EBIT margins of 34–35% (vs. 33.5–34.5%), and (3) non-GAAP EPS of $15.65–$16.05 (vs. $14.50–$15.50). On the call, focus will be on any quantified impact from the security incidents and whether higher input costs could pressure ADC and broader enterprise IT hardware demand.

Let’s get to it…

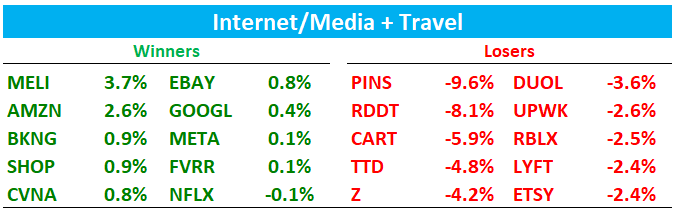

INTERNET

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.