TMTB EOD Wrap

QQQs -1.4% as yields shot higher on a poor 20-year Treasury auction and continued worries about debt/deficit implications of the reconciliation bill. Yields were up 4-10bps across the curve. BTC +1.3% continues to act remarkably well in both risk on and risk off markets.

A few charts I’m watching cause us some pause, thinking we’re in for a bit of a digestion period. We’re by no means negative, just a bit more in “wait and see mode.” It’s been a nice little run and we took some chips off the table today.

First, lets start with yields as that’s what the market was focused on today. 30 year breaking out to cycle highs:

10 year hit 4.6% today also breaking out…

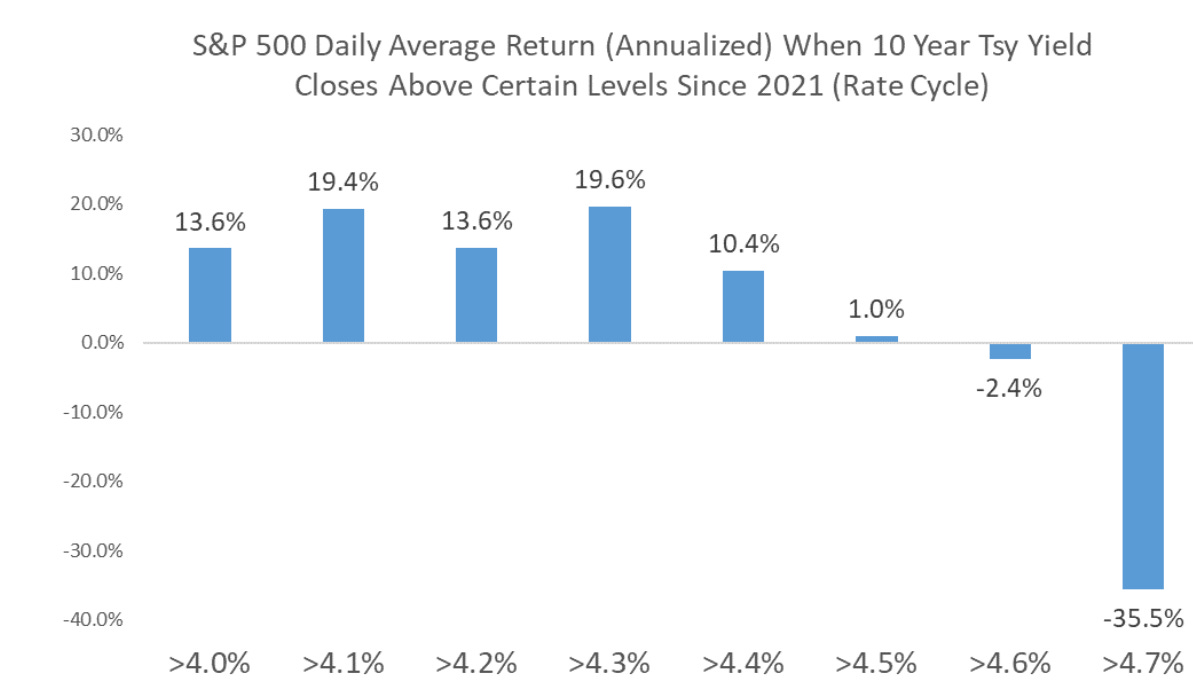

Let’s not forget when 10 year gets close to these levels:

QQQs broke trendline from mid April lows, but still sits above 10d MA:

From a bottoms up perspective, saw CVNA and PLTR confirm false breakouts to ATHs. These were two of the strongest names that led us off the bottom, so I pay closer attention.

Here’s PLTR:

CVNA

(weak 3p data today, not a ton of upside vs street for first time in a while, complete 180 in sentiment from bk company to growth/garp complete…likely needs more digestion):

UBER next?

Post-close SNOW +7% results look pretty solid with a nice beat to product rts (+26.2% vs bogeys of +24-25% and street at 22%). Guide for next q implies 25%. Product revs comp gets 4.5ppts easier so that looks like a conservative # (especially given magnitude of beat: 5 ppts vs. their guide). Another 5ppts beat would imply an acceleration to 30%+ product revs which we haven’t seen since early 2024.

Op margins came in at 9% vs 5%. FY26 Product rev guide to 25% up from prior 24%.

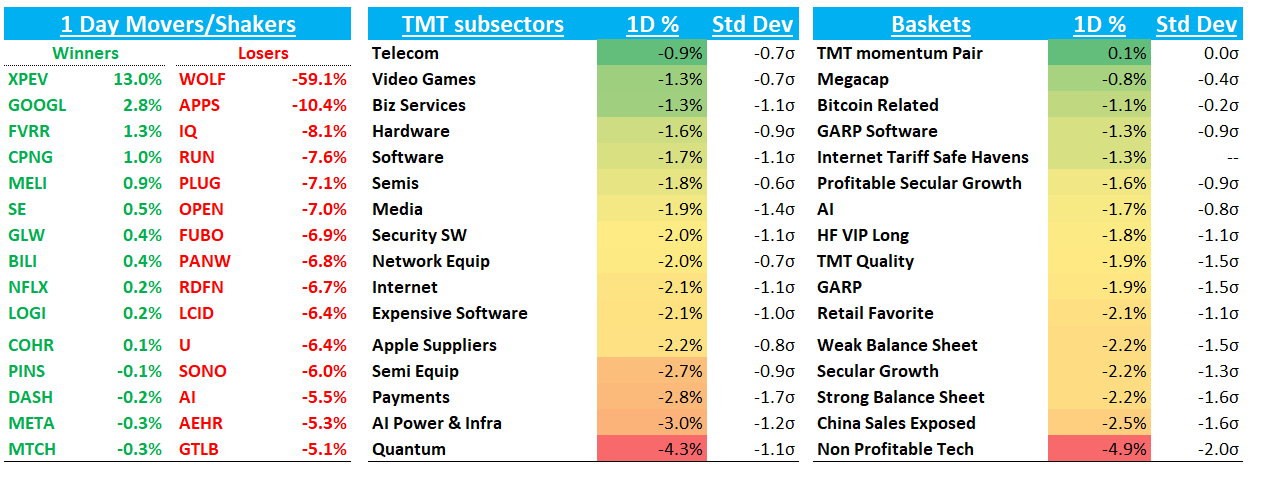

Let’s get to the recap:

Internet

GOOGL +3% as sell-side came away almost universally positive from Google I/O. The AI narrative here seems very much like a barbell to us. On one side, you have the

potentiallikely cannibalization of traditional search revs from Gen AI. On the other side, you have GOOGL ramping up AI monetization and a company with immense scale and resources that seems to be shipping more and better AI product with Sergey back. Some very cool products announced yesterday (just check out the tweets on the new Veo 3 video model). TheInformation has a good rundown of the stuff announced in the earlier part of the week and upbeat sentiment among developers.

The upbeat mood fueled excitement among developers about Google’s progress that had already been building for months. Developers we spoke with said that Google’s release of its Gemini 2.5 Pro model in March marked the start of a noticeable shift in how developers feel about its conversational AI models. One said that Google’s push to quickly make the model available in popular coding apps like Cursor was one big driver of this vibe shift.

Meanwhile, Google’s smart glasses demonstration also put the company ahead of competitors like Meta Platforms. Google employees showed how users could ask Gemini voice questions and receive answers verbally or via a visual overlay on the glasses. Meta’s glasses, which have been a surprise consumer hit, don’t yet have an augmented reality display element, although it’s unclear how long it’ll take for Google’s glasses to actually make it to market.

Google also highlighted some interesting research they’re doing in new AI model architectures. The company announced its Gemini Diffusion model, an ultra-fast text-generating AI. What makes this model extra interesting, though, is the fact that it uses a technique called diffusion that’s typically reserved for image-generating models. Instead of trying to guess the most likely next word in a sentence, this diffusion model starts with a paragraph of random text and then narrows it down to something more coherent. This makes the text generation process much faster. (It’s also what made Inception Labs, another startup developing similar text diffusion models, go viral in February.)

What to do with the stock? We stay away both on the long and short side as the set up seems a bit too muddied. The trade into I/O, coupled with bottomed out sentiment and better 3p data was where the easy money was made (we missed it.). The 3p dataset is a bit mixed: Y

. Youtube a wild card. Risk/Reward here seems $145/150 at the bottom $190 on the up so skews up slightly and we wouldn’t be surprised to see it grind up a bit. Probably doesn’t go under $145 unless search gets worse. We like simple and clear and this one doesn’t fit the bill right now, so we pass. But from a consumer and Tech fan, happy to see GOOGL putting out so much cool stuff.

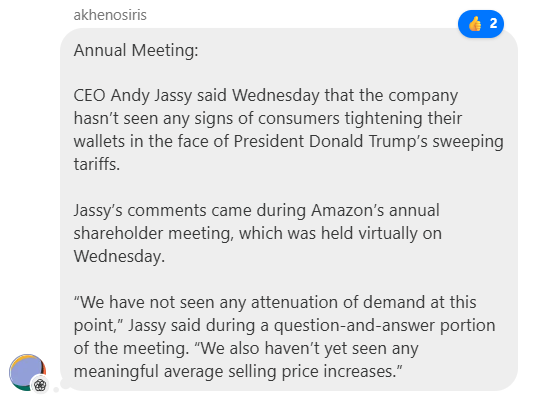

AMZN -1.4% Jassy sounded good at the annual shareholder meeting, with jives with what 3p data has been telling us: Retail tracking 4-5 pps above street. From TMTB Chat:

RDDT -9% - Stock getting hit following an Apptopia piece:

“We pulled cross-app overlap for users of the Google Chrome app to see if they were using Reddit at the same rate as in past months. It looks like there was a sharp drop in Google Chrome users also using Reddit in October 2024, the first full month after Google started incorporating Gemini into search results. There was a bounce back after that initial drop, but April and May 2025 show another drop in Chrome users also using Reddit.”

This was sent out to subscribers yesterday early so not sure it’s completely the source of the move today. New Street had about 10-15 buysiders with CRO and COO yesterday - didn’t really get much color other than that (likely get a note recapping it tomorrow - my guess is the note sounds good). Also likely investors coming out of GOOGL’s I/O thinking Google is going all in on AI, which isn’t good for RDDT. With stock down 25% since earnings in less than a month, prob not a bad spot to take a little bit of chips off the table. Let’s not forget the famous Warren Buffet Axiom: always short a stock with a good meme:

CVNA -3.4% on some weaker Yipit data

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.