TMTB EOD Wrap

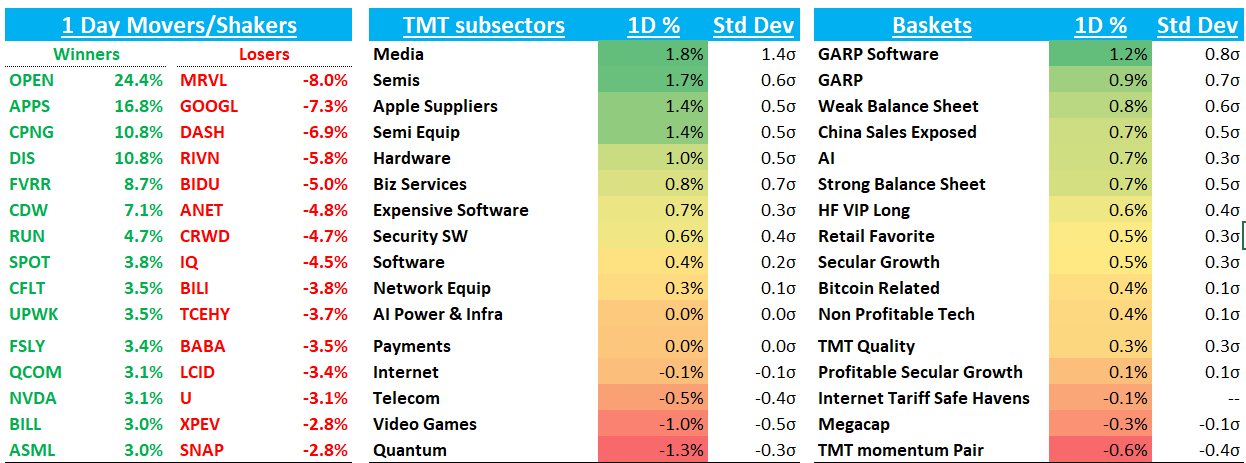

QQQs +39bps - can’t say that was a boring day in Tech as GOOGL -7% on search volumes declining on AAPL’s Safari browser and AI semi complex catching a bid EOD as Bloomberg reported the Trump admin plans to rescind AI chip curbs and won’t enforce Ai diffusion rules which were set to take place on May 15 — result isn’t final yet, but Trump officials are working on a new rule to tighten control over AI chip flows abroad with Gulf heavy states likely getting some relief and SE Asia potentially stricter oversight given re-routes to China. Still light on details but seems like at least a bit more dovish than initial Biden AI diffusion rules. Still, we won’t know for sure until there is an official announcement.

Here’s Bloomberg:

The Trump administration plans to rescind Biden-era AI chip curbs as part of a broader effort to revise semiconductor trade restrictions that have drawn strong opposition from major tech companies and foreign governments, according to people familiar with the matter.

The repeal, which is not yet final, seeks to refashion a policy launched under President Joe Biden that created three broad tiers of countries for regulating the export of chips from Nvidia Corp. and others. The Trump administration will not enforce the so-called AI diffusion rule when it takes effect on May 15, the people said.

The changes are taking shape as President Donald Trump prepares for a trip to the Middle East, where a number of countries including Saudi Arabia and the United Arab Emirates have bristled at restrictions on their ability to acquire AI chips. Trump officials are actively working toward a new rule that would strengthen the control of chips abroad, according to the people, who asked not to be identified because the change isn’t yet public.

The other big story of the day was GOOGL -8% as AAPL SVP Services Eddu Cue testified at the GOOGL DOJ trial this morning saying that search volumes on AAPL’s Safari browser went down for the time in April, saying it “has never happened in 20 years…it’s because people are using Chat GPT app…They’re using Perplexity.” He also added they considered adding an AI provider as search choice into Safri: “"That's something we're actively looking at. To date, they weren't good enough." Cue says "we've been pretty impressed with what Perplexity has done so we've started some discussions…"I certainly would expect that over the coming year that we will add other choices to the search engine choice in the browser, because I think those products are getting better and better.”

One can say that AAPL said this as part of GOOGL DOJ trial where they have an incentive to talk up competition…Still, it all sounds very bad….

We were feeling ok about GOOGL post the print given 3p search data was tracking better but in the last two weeks we heard 1) OAI was going to launch a shopping product, which will arguably be first product released that has potential to eat at a big chunk of GOOGL search revs (personally I’ve used LLMs to refer me to something as large as my recent solar purchase and as small as white wall shelves this morning) 2) search 3p data decel’d in the latest two weeks.

Now we have tangible evidence that adds fuel to the bear case given the above comments from AAPL, especially in light of the 2% paid search growth last q. Ironically, this news came on the back of arguable a good week for Googl AI, with Gemini Pro 2.5 topping the LLM charts.

I shorted some down 5-6% and don’t mind shorting a stock on news like this as we can use the price before today as a decent risk stop price as it’s unlikely it gets back there, and if it does will likely be met with more shorting / selling.

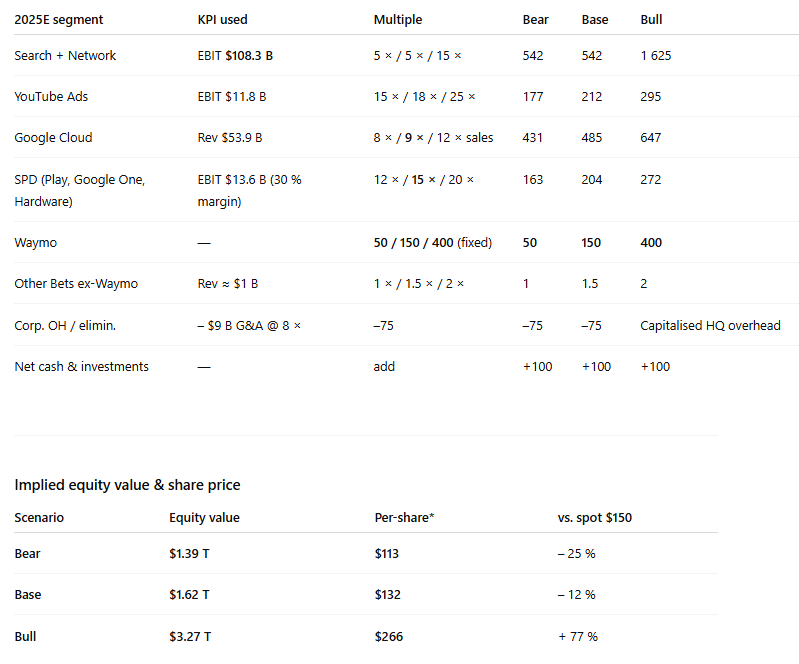

I think $140 first stop. Below that, I think bulls will try to point to a SOTP to defend the stock. Here’s my guess at SOTP using Search=5x EBIT; Youtube = 18x EBIT; Cloud = 9x sales; Waymo $150B…Comes out at ~$130. Obviously plenty of assumptions - maybe Youtube/search multiples too low, maybe Waymo too high - made here, but talking to other investors that’s where I think most find support on SOTP basis. Means bulls likely adding a bit above that so we think $140 a decent NT tgt for GOOGL. Stock is obviously not loved and a bit crowded on the short side…

Just trying to do broad strokes here….Feedback welcome.

For AAPL -1%, just another data point that the $20B in annual payments from Googl might be more at risk arguing that AI users go directly to the app so search → AI transition is not a good one while bulls will say they’ll be able to monetize something similar with AI deals

Side note: The GOOGL trade is one I would typically size up aggressively once AAPL news came out. I caught it, but in smaller size. Just feel like I’m rusty given so much focus on the macro — other tech investors I talk to feel the same way. When the rules constantly change, tough to gain confidence in sizing something. Hopefully things are settling down…I am noticing more idio factors driving stocks these days - for example for a few weeks tariff save havens traded in-step with each other. Today for example, SPOT/NFLX significantly outperformed RBLX/DASH (both have idiot factors weighing on them). A good sign for stock picking going fwd.

In macro land, i’ll let VK take it away: “We felt the overall Fed message was fairly consistent with expectations – economic conditions are fairly decent right now, but outlook uncertainty is ratcheting higher, and Powell (like everyone else) is sitting back and waiting to see how things unfold” Powell said nothing concerning had shown up in the data. Fed expects held steady at 3 cuts for 2026.

Let’s get to the recap…

Internet

NFLX +1.5% and SPOT +3.8% continue exhibit remarkable strength and arguably GOOGL dollars will shift some $’s into these two. SPOT is hitting ATHs. I’m going to exclude the one weird Trump movie tariff day and say NFLX is up 13 straight days and is also flirting with ATHs.

RDDT -4% in sympathy with GOOGL. Inception short: A structural short within a structural short…

RBLX -50bps a bit of a digestion week given the Fornite iOs release

META +1.6% / AMZN +2%

DUOL +1% more ATHs

SHOP +70bps as M-sci called out strong April trends. They report tomorrow.

DASH -7% follow through after yesterday’s mixed results as investors question why they are making 2 acquisitions at the same despite solid GOV growth.

CPNG +11% on decent results + $1B buyback….Bulls see CPNG as a relative safe haven in the face of tariffs, thanks to zero U.S. exposure and room for further margin improvement. Bears continue to pointn to potential ripple effects from tariffs, softening domestic demand in Korea, and growing threats from aggressive Chinese competitors.

UBER -2.5%: Missed Q1 GB on bookings per trip pressure calling out mix shift to int’l rides, decel in US airport trips, and less insurance cost inflation passed through, but guide implied these factors stabilize q/q and mgmt said we “shouldn’t be looking for a deceleration"." Overall, bull case stays intact here and this is a stock that has done a 180 in perception since the beginning of the year and bulls are increasingly confident UBER will be a winner in future AV world (we tend to agree - next potentially sentiment changing catalyst is TSLA FSD rollout in Austin then Waymo/UBER in Atlanta in late summer).

Semis

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.