TMTB EOD Wrap

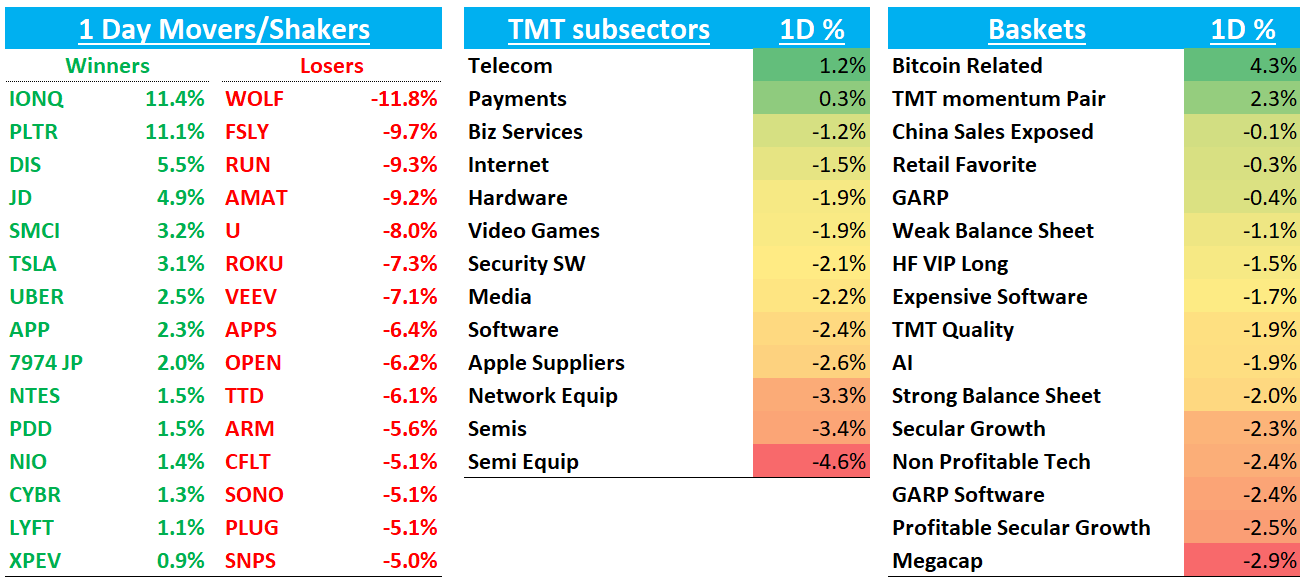

Sorry for the late start - left early to go watch the “Red One", and no I don’t mean the day we had today in Tech. (The movie had a happier ending than the markets today). QQQs -2.4% pulled back and semis -3.4% underperformed again and closed in the red for the 6th straight session, marking its longest losing streak since September 2023. IWM -1.5% and ARKK -1.3% outperformed.

Why the pullback? Heard several things called out, including doubts around Trump tariffs/deficits/cabinet picks as enthusiasm coming down to earth a bit. Market was hoping Trump’s picks would be a bit more establishment and pro-growth/pro-market than what’s been announced so far (although no economic roles have been announced to b e fair). In addition, rising odds of the Fed staying on hold next month (odds of a 12/18 cut stand at 60%, down from 80% a couple days ago), not helped by some hotter data this morning and Powell’s speech yesterday, although Fed still firmly in cutting mode. Despite this, 2 year yields still fell 4bps today. Finally, semi weakness semis to be spreading to the rest of tech not helped by AMAT’s print last night as SOX beginning to roll over:

All eyes on NVDA’s print on Wednesday - we’ll have our preview out this weekend with bogeys. QQQs now only up less than 1% from pre-election, obviously weighed down by semis which are down 4.5% since11/5.

Still pockets of strength today, including in some “Trump” trades: TSLA +3%; PLTR +11%; COIN +9%, IONQ +11% which to me says animal spirits still in play…

Let’s get to the recap…On a day like today, sometimes hard to pinpoint idiosyncratic moves in specific names given broad sell off so take each with more a grain of salt than you normally would…

Internet

META - 4% as Yip said Q4 tracking to 1ppt beat but the last couple of weeks decelerated from 20% to low double digits. Weakness at other ads names following RFK appointment and implications for future ad spend (pharma/HC makes up 6-7% of online spend). BAML called this out but not sure how much I buy it. Still ads names were weaker: TTD- 6%; PINS - 4%; ROKU - 7%; RDDT -5.4%

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.