TMTB EOD Wrap

Good afternoon. QQQs -40bps with a bit of a late day rally as market continues to chop. IWM +23bps outperformed again. Volumes remained subdued down 20-40%. Retail has been aggressively buying Tech over past few days. Some covering going on in HF land, especially internet/sw, but still hearing a lot lack of conviction. Yields were flat. Fed expects held steady with next cut expected for 6/17

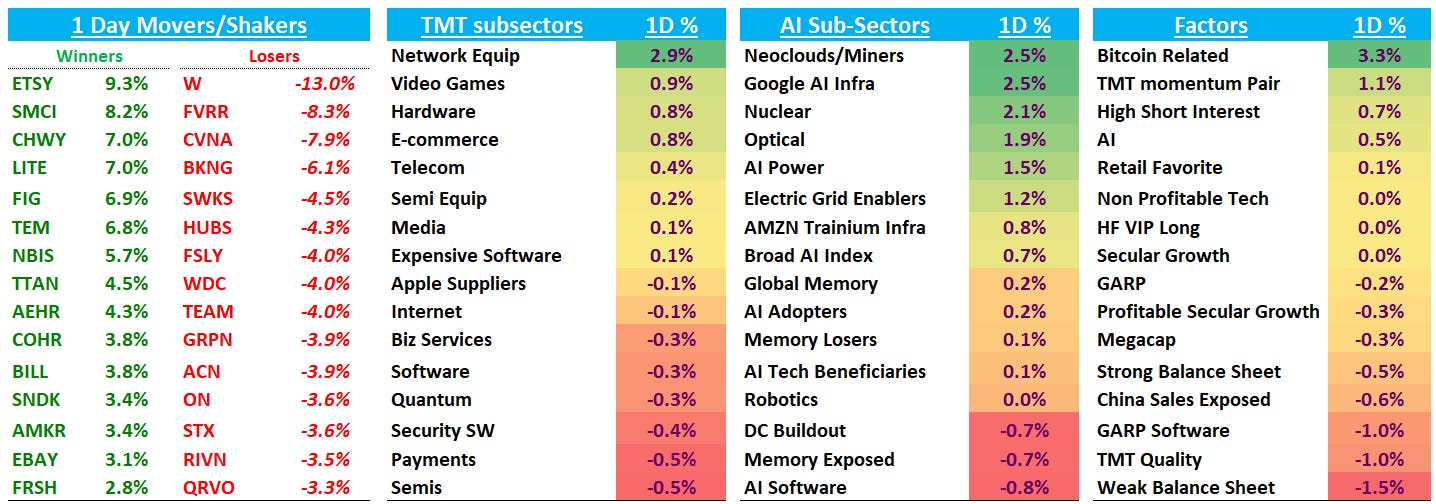

From a sector perspective in Tech, strength concentrated in AI infrastructure and connectivity: Network Equipment (+2.9%), Neoclouds/Miners (+2.5%), and Optical (+1.9%) all leading. Bitcoin-related names and high-beta AI pockets also outperformed, while semis and payments lagged modestly. Factor-wise, momentum and high short interest worked, while quality, megacap, and weak balance sheet cohorts underperformed.

Let’s get to it…

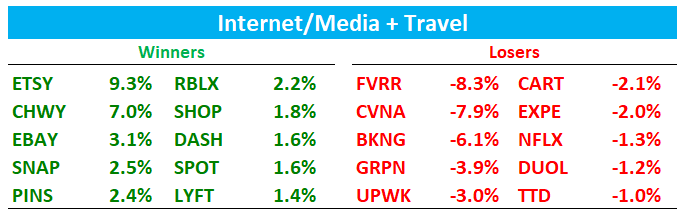

INTERNET

NFLX -1.3% as reuters was out saying Netflix has ample room to increase its offer in battle for Warner Bros, although unclear what sources they were exactly citing.

BKNG -6% as print didn’t alleviate bear fears around AI as Q1 EBITDA growth well below street, the headlines #s optically boosted by fx, and FY26 margin expansion framework (+50 bps) is meaningfully below prior consensus (+110–120 bps), and management explicitly tied that to incremental investment. For bears, that means “even with the transformation program, BKNG has to spend more just to keep growth where it is,” which supports a lower multiple in a market already sensitive to the AI narrative. Macro commentary wasn’t great either: lower U.S. ADR/shorter stays.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.