TMTB EOD Wrap

QQQs - 4.25% giving back about 1/3 of yesterday’s gains as yields continued to climb While the 2 year fell 6bps, the 10yr/30yr rose 7/12bps respectively despite a solid 10 year auction. The dollar declined 1.8%, which was the worst day since Nov 2022. In the past 30 years, only 4 other times has $ dropped 1.5%+ while yields have moved higher, increasing anxiety with the move up in the long end of the curve. While the systemic/tail risks and extreme uncertainty seem to have been set aside for the time being given Trump’s reprieve yesterday, investors continue to worry about China tariffs and knock on effects on both the supply chain, geo-political relations, and the economy + biz confidence, all of which carry their own uncertainty. The continued rise in yields isn’t helping either. While investors added exposure yesterday, more stabilization is needed along with price action that is more dominated by fundamentals rather than by flows before gross/nets begin to improve sustainably. Tech investors remain very uncertain of how earnings season will look like (I’ll have more on this topic over the weekend).

Tomorrow morning, we get a slew of bank earnings and Michigan confidence survey for Apr.

BTC -4%. Crude -3.5%. China flat was in the green late afternoon, before reports that Trump admin considering delisting Chinese cos:

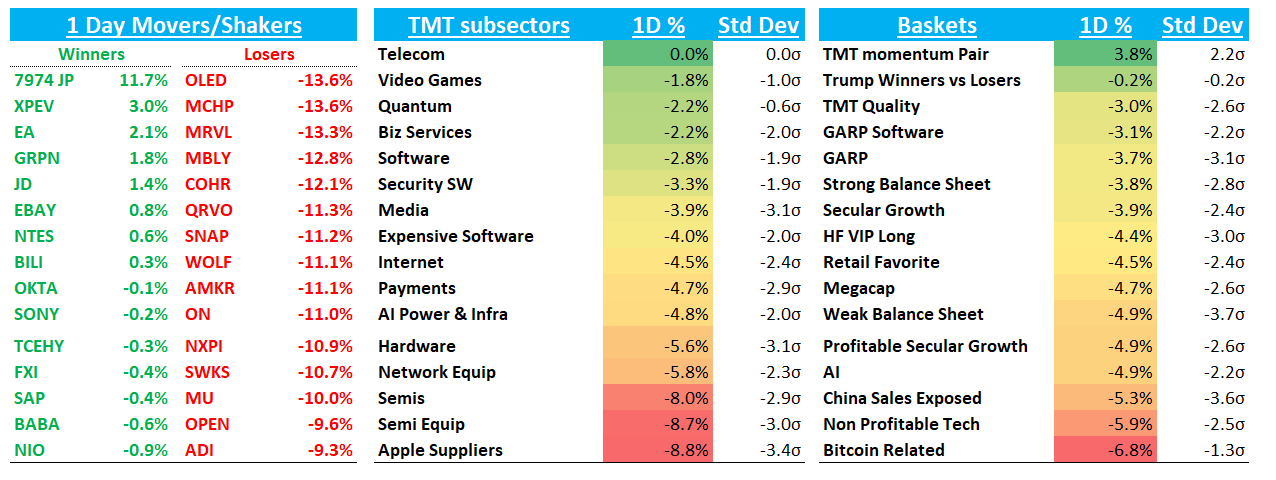

SOX -8% led the way lower today after its record breaking day yesterday with many names down 10%+. Defensive sectors Telecom (flat) and video games -2% outperformed.

Let’s get to it…

Internet

EBAY +80bps the only green on my scree

Ad names weak as Piper had some weak checks saying ad buyer sentiment has turned more negative prior to prior checks: TTD -9%; RDDT -8%; SNAP -11%; PINS -7%. ROKU -7% as

AMZN -5% as Jassy was out with his annual shareholder letter and also on CNBC:

Bloomberg also out reporting AMZN seeking partners for $15B warehouse expansion plan which “would reverse its post-pandemic construction slowdown.” Not a great read for OI bull case, but if they were concerned around demand, not likely something they would be doing either.

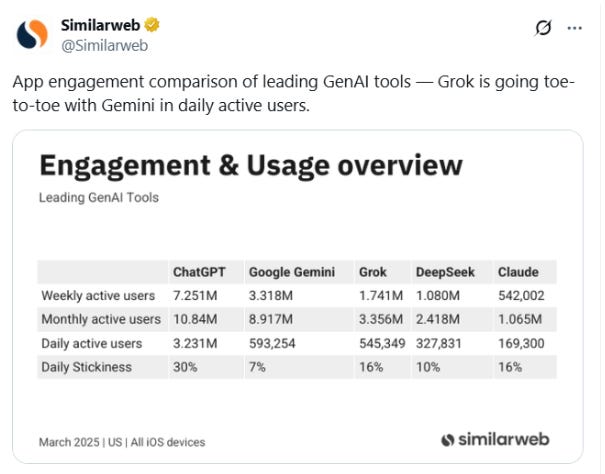

GOOGL -4% outperformed a bit today as news flow from Cloud Next positive around their agent 2 agent offerings as well as 7th gen TPU “Ironwood". Cloud CEO Thomas Kurian doing the rounds with an interview on Stratechery and Big Tech, where implied that Amazon's in-house models are "terrible," emphasized the distinction between inference and training—with ongoing efforts focused on cost optimization—and noted regarding scaling laws that pre-training continues to yield improvements, although at a reduced rate compared to the past.

RBLX -2% as opco upgraded to buy saying that after talking with an expert on Roblox's rewarded video ads initiative, Opco reports "meaningfully more confident" that the Google Ad Manager partnership will enable RBLX to build a substantial programmatic video ad business, projecting programmatic ad revenue reaching $100M (run-rate) by 4Q25 and $200M by 4Q26

UBER -2.4% some decent outperformance as Austin/Waymo partnership ramping up faster than other previous Waymo launches. Bulls will say this shows power of partnering with a platform like UBER as it can turbo charge a market entry while bears will say these rides are margin dilutive and don’t increase market share. We think the former more bullish take is the right read from the Yipit data.

Semis

TSMC -4.8% after reporting revs grew +42% y/y in Q1

NVDA -6% outperformed other AI semis today. SemiAnalysis’ Dylan Patel said GPU servers are largely exempt given Mexico assembly hub. Joe Moore at MS also had some bullish checks said Blackwell is sold out and demand continues to be “price insensitive” while inference demand at LLMs continues to drive strength. He is also hearing of customers redploying GPUs from Training to Inference along with Hopper demand getting strong again. AMZN also re-iterated capex although Jassy said 'AI does not have to be as expensive as it is today, and it won't be in the future” singling expensive chips and saying “inference will also get meaningfully more efficient in the next couple of years with improvements in model distillation, prompt caching, computing infrastructure, and model architectures.”

We continue to think NVDA one relatively safe hiding spot from tariffs and slowing econ given AMZN/GOOGL just re-iterated capex, H20s no longer banned and seems GPU servers exempt for now. One potential thing to look out for is next Deepseek release over the next couple of weeks.

Other Ai names mixed: ANET -4%; ARM -6%; MRVL -13% (didn’t see anything here other than Jassy’s comments which didn’t seem negative); AVGO -7%; CRWV -13.5%

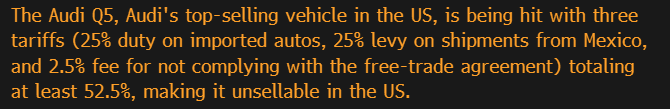

Analog weak as well: ON -11%; NXPI -12% as worries around auto makers continue:

ADI -9%; TXN -7% less exposed to autos

AI networking weak: ALAB -8.5%; CRDO -11%

Software

PANW -2.8% outperformed as HSBC upgraded to Hold from reduce

OKTA flat as sell side was generally positive following their annual Showcase event

APP -4% despite an upgrade at MS

Elsewhere

EA +2% as m-sci said Q tracking stronger than expected on Live and “Split Fiction” tailwinds

DELL -6% held in fairly well vs other AI names today. MS had a chart showing new weighted average tariff rate only 4% vs. prior one of 32% so seems like DELL was spared a big hit.

AAPL -4%: unclear if and when exemptions will actually come as AAPL airlifted 600 tons of Iphones from India to beat trump Tariffs. MS had a little Math on the name today. Morgan Stanley calculated that if India meets 60% of US iPhone demand by 2026, the remaining 25M Chinese-made iPhones would face $17B in tariff costs at 125% rates. MS believes Apple could absorb over half this amount by shipping only premium high-margin models from China while maintaining current gross margins. If suppliers share 50% of the remaining $7-8B burden, the tax-adjusted impact would represent only "~$0.30 EPS headwind, or just 3.5% of CY26 Street EPS" including India's 10% tariff.

DIS -7% as China banning import of some films and Bernstein had a mixed note on the name saying they face a “three-body problem”

TSLA -7%:

Tweets:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.