This will be the last post of 2024. Thanks for a great year and see you in 2025!

What’s in store for January?

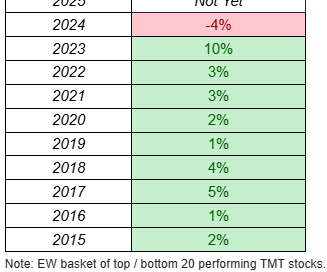

I liked this table from our friend J. Favuzza at Jefferies (always has great charts) that shows that 9 out of the last 10 years prior year TMT laggards have typically outperformed prior year leaders:

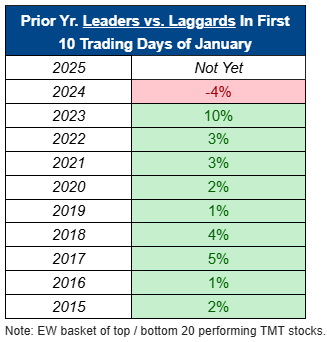

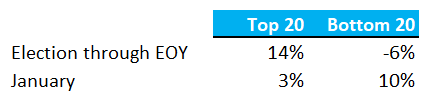

Only year it didn’t happen was this year. I also wanted to look back at the last Trump election to see how performance compared in the names that did well from the election through the end of the year to see what we might be in store for in January. For names in the QQQs I took the Top and Bottom 20 best performing stocks from election day 2016 through the end of the year and compared the median performance to median performance of those names in January:

What this says is the best 20 performing stocks from the election through the EOY in 2016 underperformed the worst 20 performing stocks in that same time period in January 2017 by 7% (3% vs 10%):

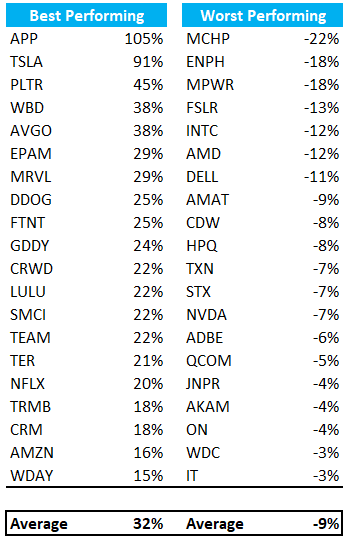

Both of these things say it might be good to be on the lookout for some mean reversion in January, although every year and every stock is different. Best and Worst performing stocks since the election through Tuesday of this week:

We’ll also have a lot more political cross currents in January as we go into Trump’s election: Tariffs, regulatory environment, tax relief, staffing decisions, deficits, debt ceilings, immigration, etc. That’s not to mention the hallmark, somewhat chaotic communication style of Trump. Does market get excited about inauguration as it augers in more de-regulation/business friendly environment or does it get concerned around the aforementioned?

QQQs -45bps with some anemic price action today after yesterday’s rout. SOX - 1.6% despite NVDA being in the green. This chart stood out to me today:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.