TMTB EOD Wrap

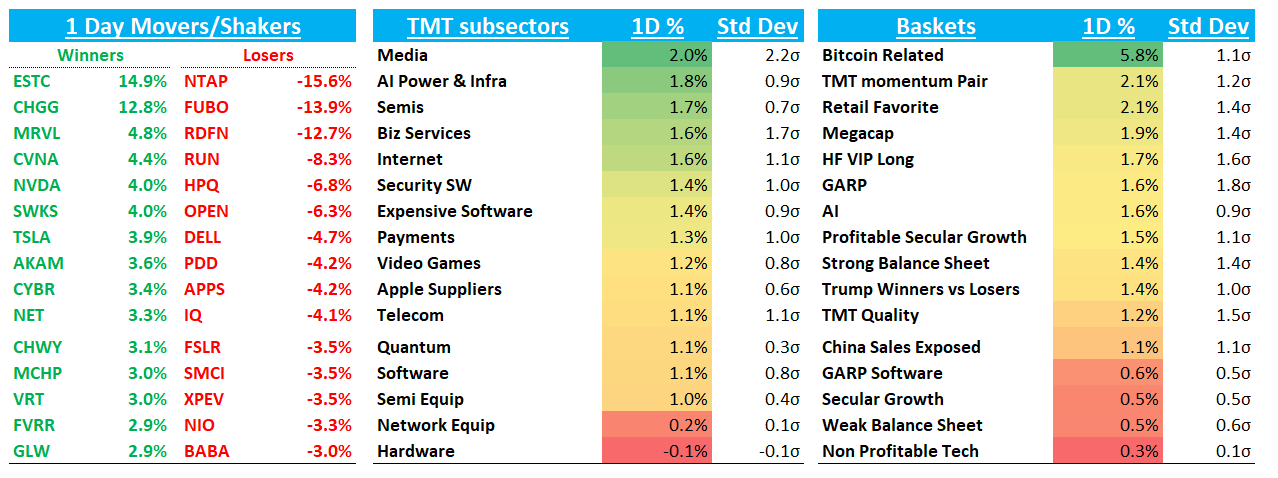

Be very brief today - a bit late as I left early to enjoy the warm Cali weather after a fun long week ... QQQs +1.6% with a nice EOD rally as stocks were down 50bps at 1:30pm and finished well in the green by the close. QQQs bounced nicely right off the 150d. Yields rose 3-6bps across the curve following personal spend/PCE data at 8:30am and Atlanta’s Fed Q1 GDP tracker which fell from -1.5% from prior figure of 2.3%. At what point does narrative shift from growth scare to Fed having some cover to beginning cutting again given weaker growth/future DOGE cuts? On that front, fed expects moved in a dovish direction w market pricing in 70bps worth of cuts. We’ll have some more thoughts on the market this wkend.

Not a ton of idio news today so just cover a few items:

APP +1.5% (+2% in post) as they announced modification of buyback plan. The company's Board of Directors authorized the modification of the share repurchase program as follows: (i) $500M shall be immediately available for repurchase of shares of the company's Class A common stock, notwithstanding the amount that otherwise would have remained available during the quarter under the prior Free Cash Flow limitation, and (ii) the Current Limit shall be increased in future quarters by the amount of Free Cash Flow generated in the preceding fiscal quarter, with the Current Limit and any increases to be carried forward and remain available for future repurchases if not used and the aggregate amount that may be repurchased not to exceed the Existing Repurchase Maximum Amount.

Long way of saying they want to do a more aggressive repurchase.

NVDA +4% after dipping below $120 for a bit, which is the price where we think r/r gets really interesting. At $120, 25x street CY25 EPS is less than 10% down from here. 25x is near the bottom of the range where stock has traded since 2016:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.