TMTB EOD Wrap

QQQs -1.3% with IWM outperforming QQQs by almost 200bps. Silver +6%. BTC +3%. Yields down 3-4bps across the curve as Fed expects continue to pencil in 7/17 for the next cut.

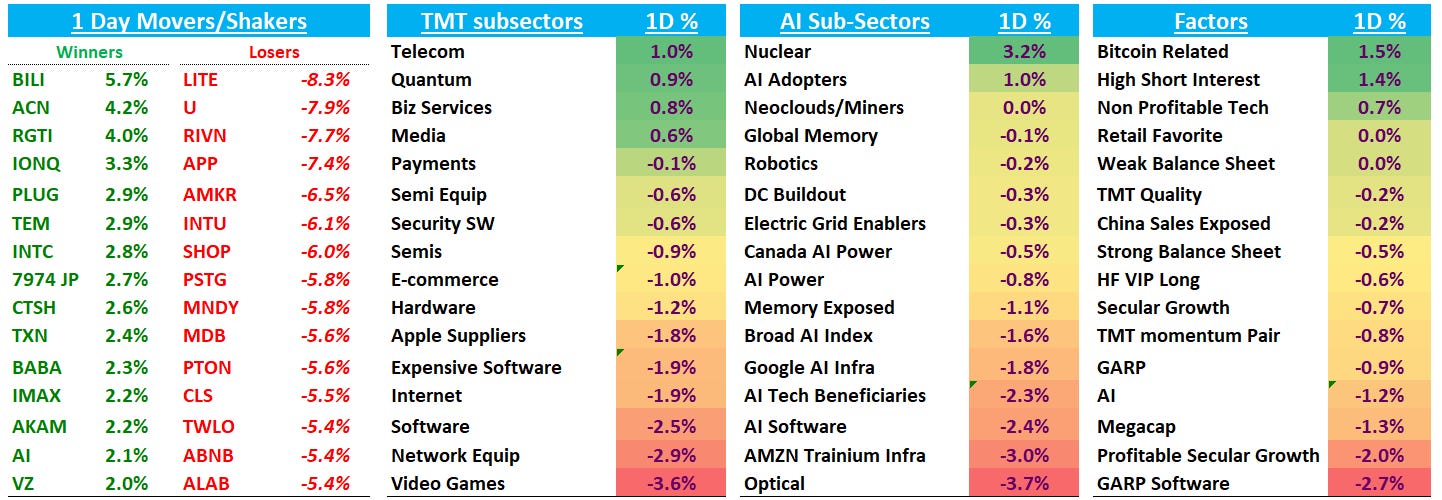

Not any great broader narratives in the Tech tape today as it seemed like broad risk off price action — to us it just felt like some digestion in many consensus names after a strong YTD start — with pressure concentrated in software, internet, video games, and AI-linked subsectors, while defensives and select cyclicals outperformed. AI software, optical, and AMZN Trainium-related infrastructure were among the weakest AI buckets and YTD winners like semi equip were down as well. On the factor side, megacap, GARP, and profitable secular growth underperformed, while high short interest and bitcoin-related names outperformed.

We get TSM eps tomorrow although stock doesn’t typically move a ton on earnings.

Let’s get to it…

INTERNET

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.