TMTB: EOD Wrap

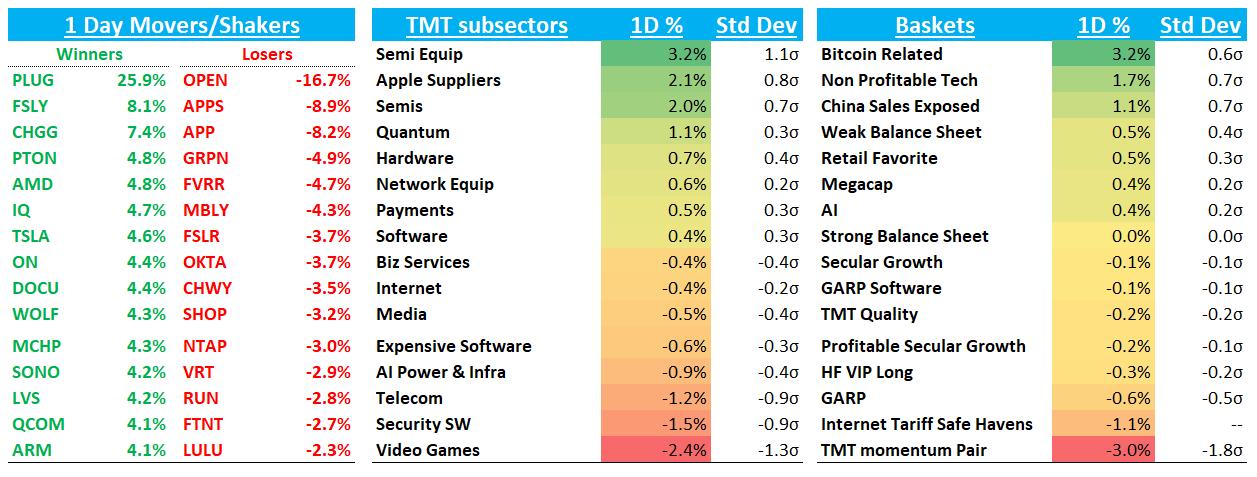

QQQs +15bps. BTC +2.4% acting well again. Yields fell 1-3bps across the cruve while Fed expects stayed pretty steady. Felt like one of those slow early summer days in a fairly boring session. Still waiting for full details of China meetings - so far Lutnick said talks were fruitful and set to continue on Tuesday. AAPL’s WWDC was a big yawn.

Let’s get to the recap…

INTERNET

GOOGL +1.5% following through on better 3p data near the end of last week despite no Gemini announcement at WWDC

AMZN +2% continues to follow through: 3p data continues to show ~3ppts beat for NA and Int’l Retail and Ad checks have been good. Helped by some better news on the China front and news that they were freezing hiring budget for its big retail biz this year, which supports the Retail OI bull thesis (although that news was out friday mid day)

META -50bps after reports they were investing $10B in Scale AI. Edgewater was out talking up a better May. UBS’s ad check today also said something similar with his full year forecast back to 19% after dipping earlier in the quarter to 10%. Overall, their ad check expects 20% growth, slightly accelerating in Q3 and Q4

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.