TMTB EOD Wrap

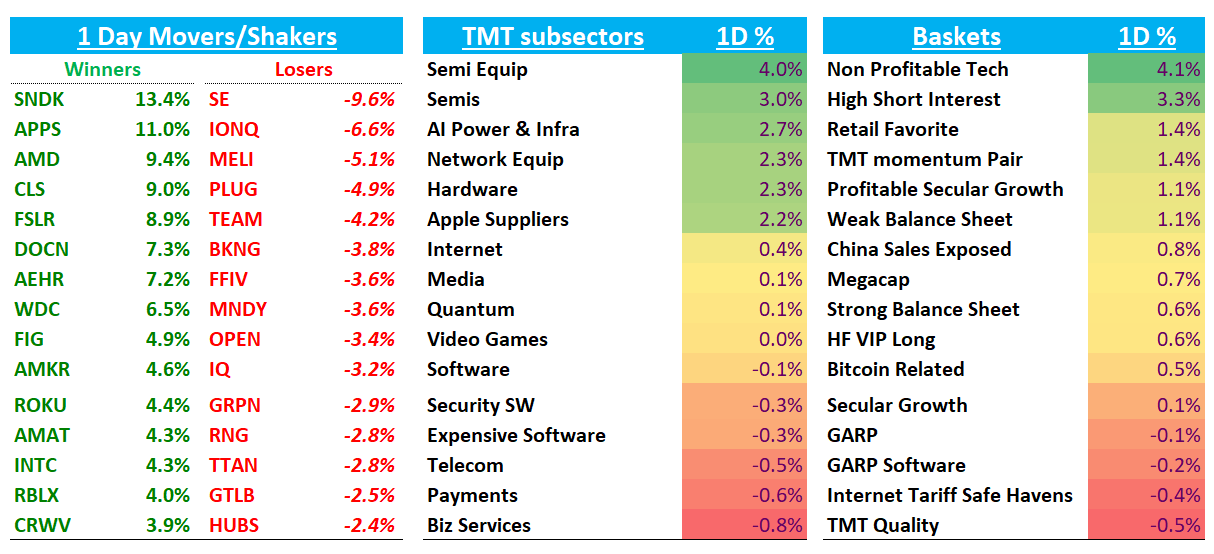

QQQs +71bps as stocks were v strong early but sold off a bit throughout the day. Some pointed to some more hawkish comments from Bessent, but didn’t seem like much new and more posturing. Market continues to price 50bps worth of cuts throughout the rest of the year. Semis went back to leading in Tech despite NVDA finishing in the red as AMD +9.5% led to the way hitting new highs.

Let’s get straight to the good stuff…

AI / SEMIS

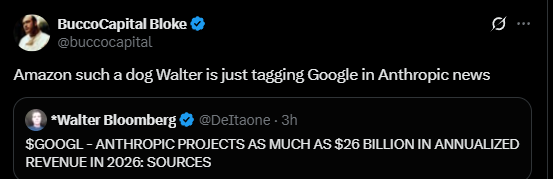

Reuters reported that Anthropic plans to triple revs to $26B in 2026:

The company is on track to meet an internal goal of $9 billion in annual revenue run rate - a calculation of annual revenue extrapolated from the current sales pace - by the end of 2025, the people said. For 2026, Anthropic has set even more aggressive targets: a base case of more than doubling to $20 billion in annualized revenue and a best case of as much as $26 billion, the people said, requesting anonymity to discuss private figures.

Also launched Haiku 4.5, a small AI language model that reportedly delivers performance similar to what its frontier model Claude Sonnet 4 achieved five months ago but at one-third the cost and more than twice the speed.

Link to Podcast here

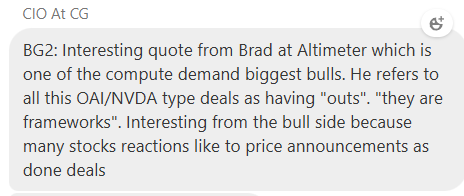

AMD +9% breaking out to new highs on strong follow through following the ORCL purchase news yesterday. Wedbush was out raising PT to $270 (not much new in the note). HSBC was also out raising PT to $310 saying OAI deal implies massive AI revs still underestimated by street, taking ‘26 GPU numbers to $20B vs street closer to $12B and saying they believe AMD has increased its CoWoS allocation to 70-80k wafers for ‘26. Key quote: We believe that the total revenue opportunity for AMD from this OpenAI deal is around USD80bn – more than 10x its 2025e AI GPU revenue of USD7.3bn. Other than that, didn’t see much new other than investors coming to appreciate both r/r and ORCL read-through — while the $1B #s was fairly small, the more important thing was further validation of AMD’s growing role in the AI accelerator mkt with mi4xx.

CRWV +4% as Coreweave announced a major partnership with Poolside, supplying over 40k NVDA GB300 NVL72 GPUs for the AI model developer. CRWV will also act as the anchor tenant for 250MW (up to 750MW) of Poolside’s 2GW Project Horizon in West Texas (the 40k consumers about 100MW). Financial terms weren’t disclosed, but saw that ISI thinks it could add about ~$5B to RPO/backlog based on $3 per GPU hour pricing over 5 years. ISI thinks this and other wins could push backlog above $55B, although this deal closed after Q3.

ARM +1.5% Meta partners up with Arm to scale AI efforts - TechCrunch

Under the partnership, Meta’s ranking and recommendation systems will move to Arm’s Neoverse platform, which was recently optimized for AI systems in the cloud, among other implementations.

VRT +3% as DB raised PT to $216 and said in a “blue skAI” (i like that), scenario EPS could reach $12-16 by 2030 (street at $8.25)

SNDK +13% / WDC +6% / STX +4% / MU +3% as memory back to doing its thing…DRAM/NAND prices continue to ramp

NVDA -40bps continues to act a bit heavy over the past couple of days / AVGO +2%

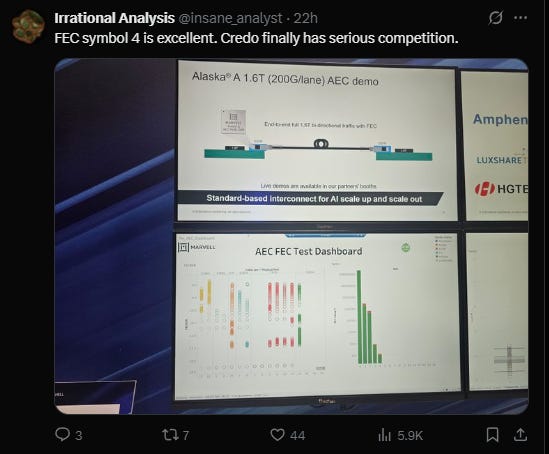

CRDO +1%

INTERNET

RDDT+2% as both Truist and Piper were out positive. Piper said they think US DAUs likely to come in line with street, which is higher than what buyside expecting. Have seen some stabilization in the data since the 2H Sept seasonal decline in the Similar web/Sensor tower data, but pretty inconclusive to me. If data were to uptick in last 2 weeks of Oct, I think set up into earnings could be decent, but still very much unclear whether we get that and so we remain on the sidelines for now.

AMZN -40bps continues to get no love despite the positive Anthropic news:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.