TMTB EOD Wrap

QQQs +1.2% helped by some nice beats in Tech (SHOP, ALAB, ANET) along with AAPL squeezing as they buddied up to Trump announcing $100B of investments in the U.S. QQQs now back above 10d/21MAs.

Some more post market Trump news:

TRUMP ON TARIFFS: SAYS U.S. WILL IMPOSE “VERY LARGE TARIFF” ON CHIPS AND SEMICONDUCTORS WE WILL BE PUTTING IN 100% TARIFF ON ALL CHIPS NOTES THERE WILL BE NO CHARGE FOR COMPANIES BUILDING OR COMMITTING INVESTMENT IN THE UNITED STATES

TRUMP SAYS $AAPL AND $NVDA WILL AVOID TARIFFS THANKS TO U.S. INVESTMENTS

Seems like everyone will be exempt no?

MU +2% TXN +3% AAPL +2%

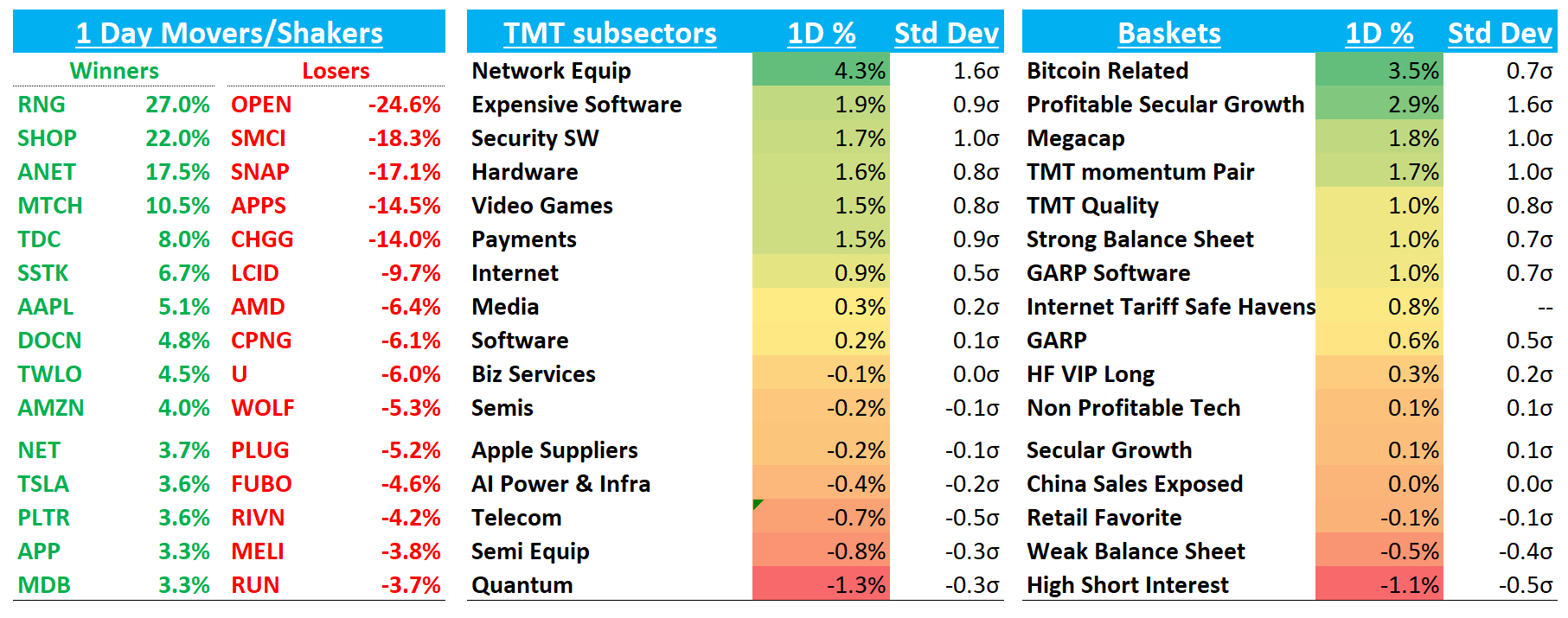

Price action post-earnings has improved over the last 2 days with favored longs like SHOP +22% and ANET +17% rallying hard and finishing above where they opened. Names like RDDT NET and PLTR are following through after beats and RBLX getting some juice back. AMZN +4% AAPL +5% a couple names crawling back up after earning gap downs. AMD -6% finishing off its lows. Seeing plenty of names hit 52wk highs: DASH RDDT SHOP PLTR NET AVGO etc.

In other words: price action today was opposite of what we saw the first 2-3 weeks of earnings and looks to be favoring bulls now…

Let’s get to it…

INTERNET

SHOP +22% on a clean beat and raise where GMV accelerated to 31% for the first time since late 2021, driven by international +49% and B2B along with strong payments penetration. Not much to nitpick from the bears with the accelerating GMV numbers as helps the stock re-rate higher even before we get into an optionality from AI. Bulls continue to point to SHOP’s large TAM, strong competitive position, enterprise market opportunity, and materially ramping profitability, although bears will say at 75x ‘26 EBITDA this is all priced in. We aren’t involved in the short/medium term (although we lean positive), but we continue to like SHOP as one of our long-term holdings as we are believers in the nascent AI agentic/chatbot tailwinds — which haven’t even started to materialize — on this best-in-class compounder. Some thoughts on our long-term view from our weekly this past sunday:

The emerging AI-related bull case captivating some investors is the optionality in agentic commerce: agent-led buying through chatbots, voice assistants, and Perplexity search plugins could open a new top-of-funnel channel. Shopify merchants benefit from incremental traffic without cannibalizing their storefronts, and Shopify still monetizes those AI-initiated checkouts at its standard take rate…We have no great read on the quarter or near-term, but we own a small position in our long-term account and are believers in the AI margin and GPV tailwinds that SHOP should begin to more significantly benefit from in ‘26.

RDDT +6% new 6 months high approach the $230 peak from Feb, which we think will act as a magnet near term

RBLX +5.5% as data continues to track well above street for q3. We still love it despite the post-earnings sell off.

UBER flat: sold beat and raise although mobility was a bit weak. $20B buyback. Nothing in the print or call to shift AV debate one way or the other. Some quotes from the call:

“In terms of AV, it is very, very early… Commercialization is going to take time, but we’re going to be in the lead. Austin launch continues to go really well; Atlanta launch has been great. In both cases, the average Waymo is busier than 99 % of our drivers in completed trips per day.”

“We see three different business models coming: the merchant model (fixed dollars per trip/day), the agency model (rev-share, like today’s driver take-rate), and an ownership/licensing model where a financing partner owns the cars and pays software fees.”

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.