TMTB EOD Wrap

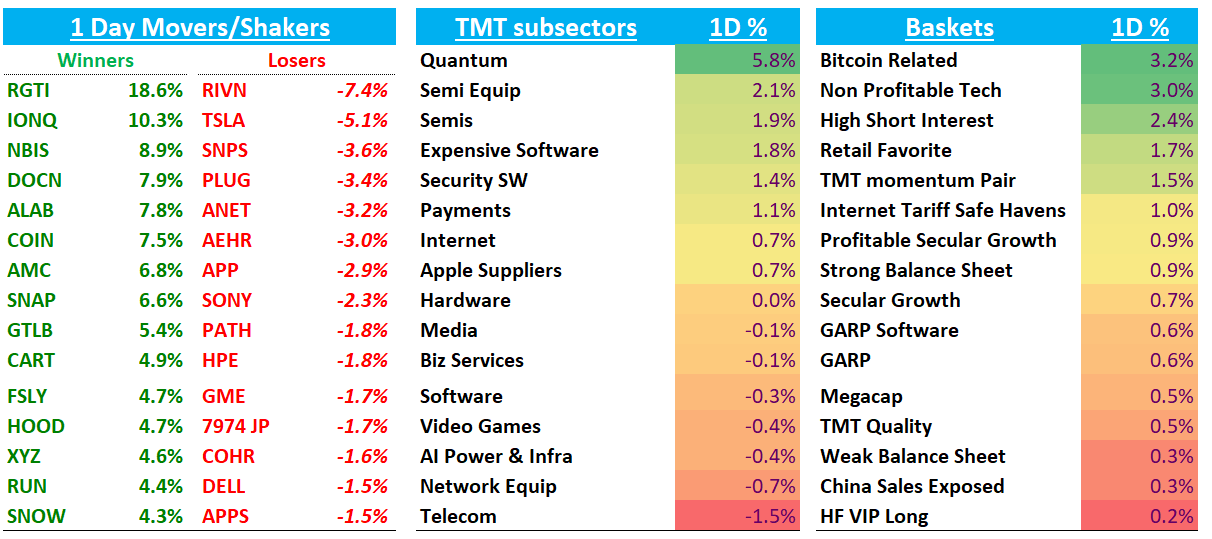

QQQs +41bps as crypto related stocks caught a big move today as ETH and BTC tested multi week highs. Non profitable shorts and Momentum both rallying today, while semis continued their outperformance, led by semicaps as investors continued to digest the crazy 900k wafer capacity numbers called out by Altman yesterday. Treasuries ended flat and Fed expects continued to price in 2 more cuts before the end of the year.

Relatively slow news day - let’s all catch our breath before the OAI Dev Day Monday.

Let’s get to it…

INTERNET

META +1.1% handling the Sora hype like a champ. Bulls pushback on the Sora fears say all that Sora content (or other AI video gen content) eventually gets posted to Instagram and that META will eventually catch up in capability (just like they’ve always done in the past a la TikTok threat).

SNAP +6.6%: Prepared had a post on thoughts on why an OpenAI acquisition of SNAP would make sense, which basically came down to OpenAI lacks the built-in reach of Meta/YouTube/X; SNAP is a shitty stock, but a thriving biz with ~1B MAUs/~500M DAUs, deep Gen Z penetration, and daily camera/AR habits. Snap + OpenAI would fuse Sora-grade creation into messaging, Stories, Spotlight, and AR—driving stickier user behavior and richer ad/commerce surface + creator-cost synergies would help deal be accretive given OAI disti advantage.

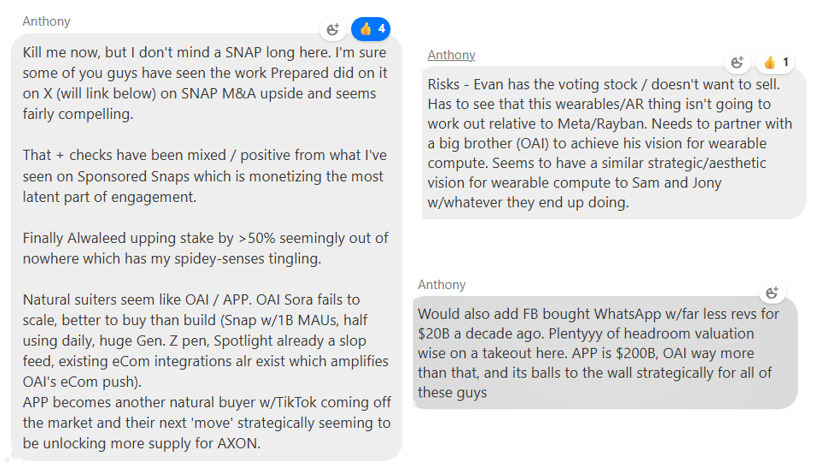

TMTB reader Anthony shared his bull case on SNAP as a possible takeover target (first 3 words are my favorite and why I stay away from SNAP…):

LYFT +3.6% after being positively mentioned on CNBC as a takeout target

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.