TMTB EOD Wrap

QQQs +1.4% as investors didn’t really seem too flummoxed with Middle East headlines as buying continued with QQQs now only ~1% away from new highs. Yields popped a bit rising 2-5bps across the curve while Fed expects didn’t shift much. Eyes on Fed meeting on Wednesday.

We were busy post-close writing about a potential big 180 narrative shift in RDDT — you can find the post here (preview below - full post available for Pro Tier subs).

Let’s get straight to the recap…

INTERNET

RDDT +6.8% as they called out better demand trends in a Linkedin Post:

The data from Ahrefs, which tracks clicks a website is estimated to receive from unpaid (organic) results on Google’s SERP, points to a big increase in June traffic, while every other website is declining. This data jives with Sensor tower data that is showing an uptick in June for the first time since late February - the data has steadily been declining since late February from 10%+ y/y growth to close to 0% y/y at the end of May and has now bounced back to 2.5% y/y in early June on tougher comps. (The comps get easier as we head through earnings in late July, so it’s likely we continue to see an improvement in the data)

What is going on here? Could it be another Google algo change helping RDDT? Or is something bigger and more permanent going on, something big enough to cause a complete 180 in narrative which would mean DEFCON 1 for shorts: namely that AI Overviews/AI Mode is actually helping RDDT. We think it is.

META +3% after saying ads will appear in Whatsapp for the first time. ISI was out in the afternoon attempting to quantify the impact. With 1.5B+ MAUs and targeted ARPU of ~$6 by FY28, ISI estimates WhatsApp could generate $10B+ in annual ad revenue and $5B in operating income, lifting Street FY28 estimates by 4% and 5%, respectively. ISI believes the platform’s robust 1P data and lower content load compared to Twitter position it well for monetization.

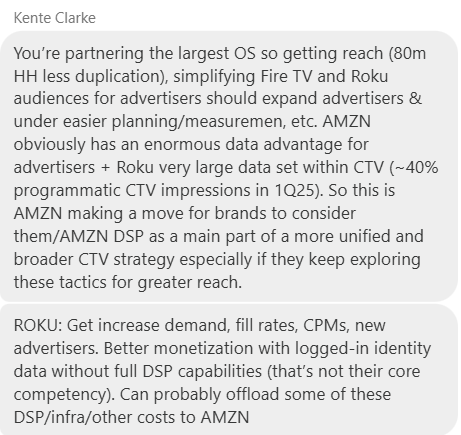

ROKU +10.5% after announcing deal with AMZN DSP to pool advertisers. Our friend Kente Clarke gave us some good takeaways after talking with IR in TMTB Chat:

Cleveland was also out positive in the pre calling out better demand driven by unique ad formats

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.