TMTB EOD Wrap

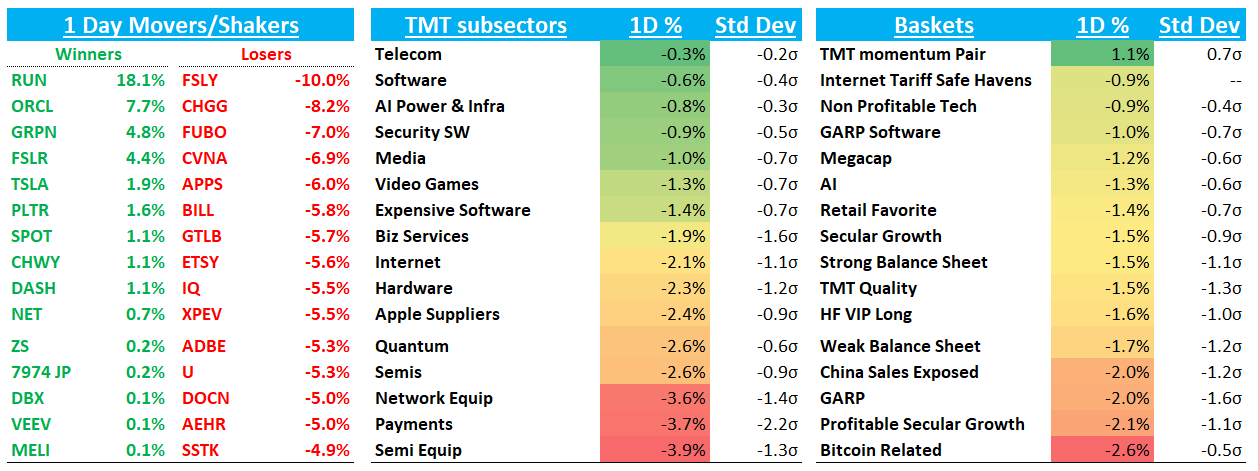

QQQs -1.3% on what still felt like a sleepy summer Friday despite the Israeli strike on Iran. Weirdly, yields rose with 10 year +4bps as market continues to price in 50bps worth of rate cuts ahead of the Fed next week.. Crude jumped 8%. There was also a report on Bloomberg talking a trade deal with Vietnam that would set a tariff rate at 20-25%, which is 2x the 10% baseline tariff most assuming Trump winds up imposing (h/t VK). I’d happily pay 20-25% more for that delicious Guava juice from Vietnam I get on Amazon.

#10! Just need to get on the II ballot next year…

Fairly quick one today as relatively slow news/research day….Let’s get to it -

INTERNET

ETSY -6% a combo of 3p data turning negative again this week + the following from SCMP

Up a quick 30%, now down a quick ~15% in a few sessions…How quickly sentiment/narrative can flip both ways in Tech these days…that’s why we started TMTB!

CVNA -7% as JPM lowered NT estimates on margin compression saying EBITDA might fall below street for first time in a couple years.

RBLX +2% more new highs - getting close to the century mark

RDDT +2% continues to act decently as we likely start hearing some positive sell side checks as we get closer to quarter end.

Travel names weaker given geo-political concerns: EXPE -3.5% / BKNG 4% / ABNB -2.4%

SEMIS

AMD -2% as no major surprises from AI day yesterday other than Altman getting on stage talking up Mi400 — for those interested Sam Altman starts at 1:55 - link here…also saw this in Semianalysis post, which was out mid-day:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.