TMTB EOD Wrap

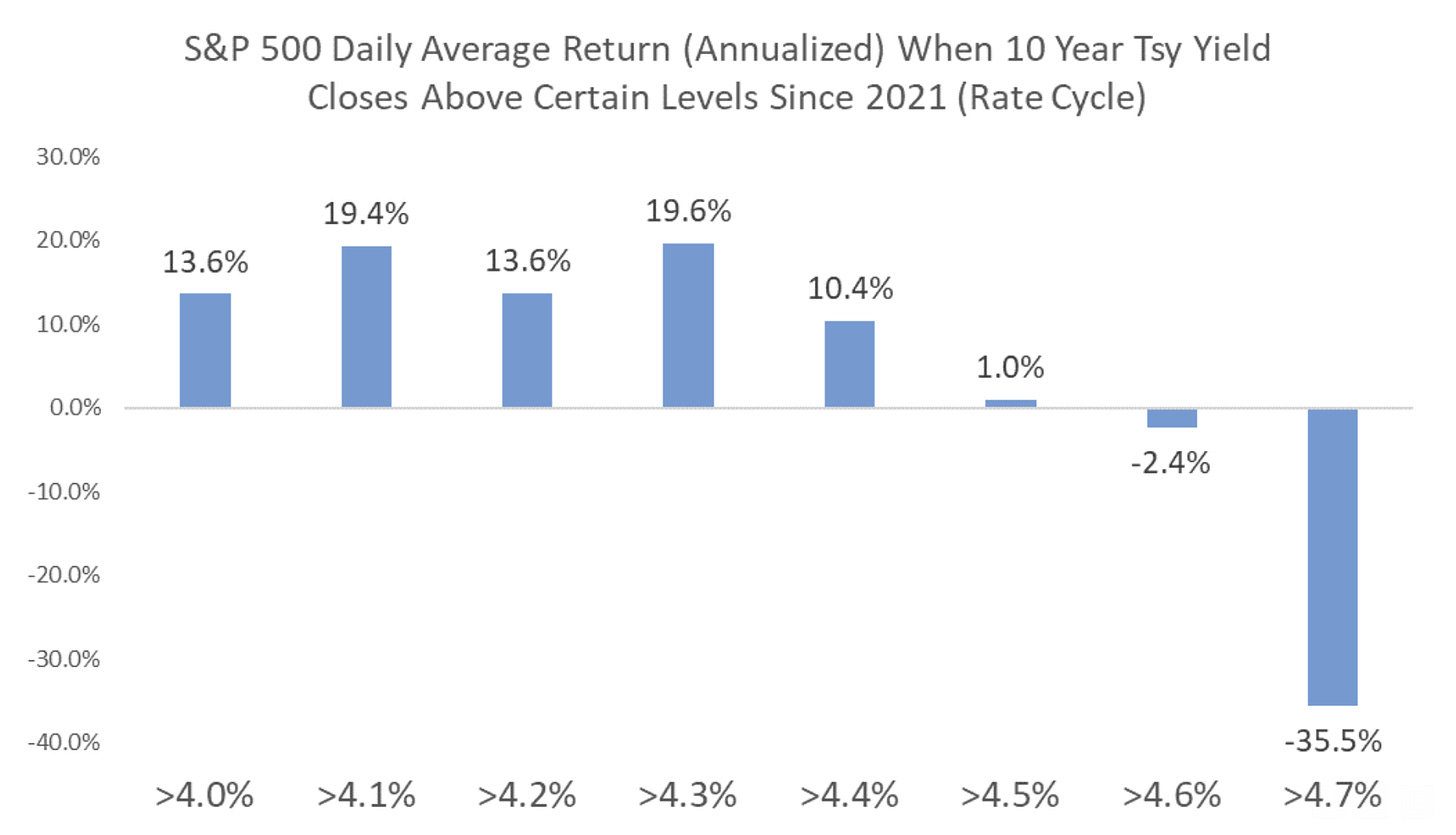

Another risk on day as QQQs +1.6% helped by a cooler CPI and better semi news flow. Treasuries flattish as 10year hovers around 4.5% and 30 year less than 10bps off cycle highs. This chart getting passed around on yields from Raymond James fwiw:

Market only pricing in 50bps worth of cuts this year - that’s down from close to 100bps a couple weeks ago.

Strong price action continues in Tech. This has been a culmination of the past several weeks: what started with “animal spirits” concentrated in tariff safe havens like NFLX, SPOT, etc…started to broaden late last week with names like TSLA and HOOD breaking out. And now the better China news over the weekend and positive semi news flow today (Saudi deals) has $ shifting back into risk assets across the board. Just look at name like COIN +25% on an Index add. or PINS up on bad news. PLTR new ATHs recovering its earnings decline in just a few days. Or tariff safe havens not even being able to be down more than one day (NFLX +2.5%; DASH +3%; RBLX/UBER new highs). Lots of strength across the board. We see no reason why markets won’t continue their upward trend, but we’re on the lookout for price action that doesn’t confirm that (usually would come in the form of breakouts from PLTR/RBLX/UBER/BTC not holding).

Let’s get to the recap:

INTERNET

RBLX +5% to new 52wk highs: 3p continues to track well here.

UBER +4.4% breaking out to ATHs, likely helped by TheInformation reporting that TSLA is late to meet certain milestones in their FSD launch, implying it might not be ready to launch by June: the company hadn’t started testing its cars without a human safety driver as of last month, according to an engineer close to the testing and a former employee. That’s a crucial step required before Tesla can launch the pilot service for customers…CEO also said AV cars coming to Saudi Arabia before the end of the year. We’ve written about the change of perception/sentiment here into UBER as AV/FSD winner - things can move quickly in Tech. Stock has been unbelievably strong…GO-GET conference is tomorrow — last year they announced a bunch of products so more likely coming this year as well

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.