TMTB EOD Wrap

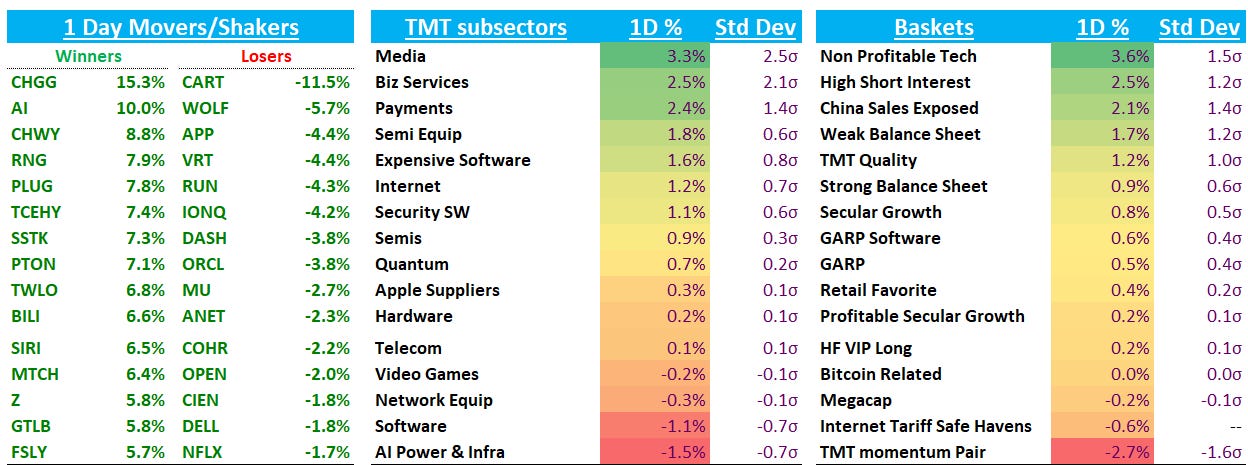

QQQs finished roughly flat, but again the price action underneath the surface continues to dominate. For 2nd straight day, IWM outperformed the QQQs, this time by close to 200bps as excitement over the beginning of a rate cut cycle builds. From a factor perspective non-profitable tech and highly shorted stocks led the way higher, outperforming consensus longs by 300bps+.

VitalKnowlege - as always - has the astute read:

Why did tech struggle during the Wed session? Tech is generally sought out by investors for its economically agnostic growth drivers, meaning the industry (esp. AI-levered companies) are expected to perform well regardless of the broader GDP landscape. However, many believe the resumption of Fed easing will provide a boost to overall growth backdrop, in which case tech, with its guaranteed growth, loses some of its appeal

In other words: there is a shift into more GDP-sensitive names, which means small/mid-caps, analogs, ad exposed names, etc. outperformed.

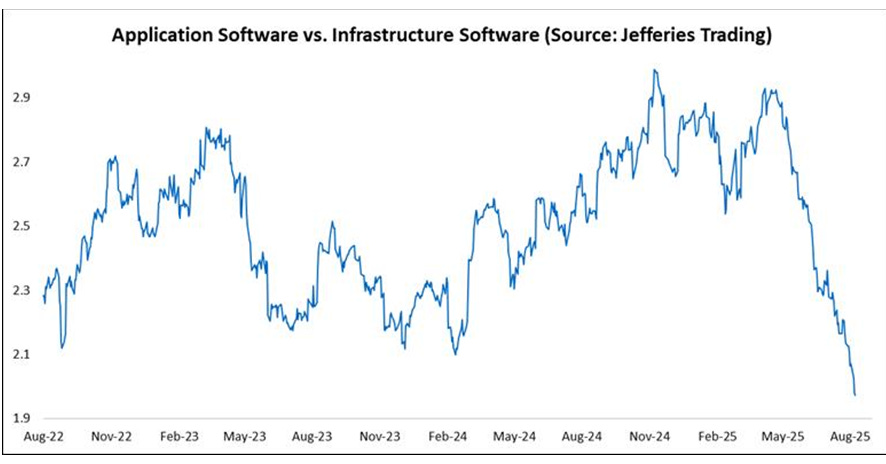

Software finally caught a bid and we saw some unwind of the long infrastructure S app sw trade, which has been on a massive run for the last few months: Names like ORCL -4%; MSFT -1.5%; NET -1.5% and PLTR -1.5% all finished in the red.

Semis led the way higher too - but surprise surprise - similar to yesterday it was analogs driving us higher post-NXPI/MCHP at Keybanc yesterday and news of price hikes at TXN.

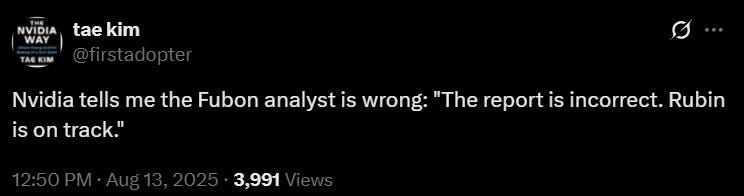

AMD +5%+ NVDA -90bps was the big story of the day as Fubon put out a note in the morning saying Rubin was delayed (Edgewater) , then supposedly told clients offline that it was only components and not the chips. One of our readers JT had some good color on why the timing of things in the note didn’t make sense in a TMTB chat thread here. And he was right as NVDA denied the report near the close.

We have some more thoughts on what it means for AMD the stock below…

In macro land, yields dropped 5-6bps across the curve and Fed expects shifted in a more dovish direction with market now pricing in 27bps worth of cuts on 9/17 and 64bps over the course of the final three meetings (9/17, 10/29, 12/10). Bessent calling for 50bps rate cute has given Powell good cover to cut 25bps without looking like he’s caving. We get the PPI tomorrow morning and we’ll see if that adds fuel for Powell’s Jackson Hole talk next week.

Ok let’s get to the recap…

INTERNET

AMZN +1.4% as they announced they are expanding Same-Day Delivery to include perishable groceries in 1K+ U.S. cities, allowing Prime members to order fresh produce, dairy, meats, and frozen meals alongside non-perishables, with free delivery on orders over $25. Sell-side was generally positive on the announcement. Read-through here for DASH -4% WMT -2.5% and CART -12% was negative as means more competition….On AMZN, get the sense investors v focused on AWS data right now looking for any hint of uptick (we’ve already heard of checks calling out slightly better capacity in July) - we’ll see what we hear over the next few weeks.

RBLX -2% as saw on X game was blocked in Qatar. A lot of other seemingly normal freedoms are banned in Qatar (I just asked ChatGPT) so not sure we can read much into this.

Midcaps strong: CHWY +9%; MTCH +6%; RDDT +5% price action strong (up in normal tape, up in unwind tape); ETSY +5.4%

Housing related strong as well: W +5.5%; Z +6%; RKT +7% (all beneficiaries from lower rates with RKT one with most leverage)…eco sensitive ad names too: ROKU +4.5%; PINS +3%; TTD +2%

EBAY +4% continues to rip post earnings…

Large cap generally weaker: GOOGL -70bps (should get Mehta decision any day now…); META -1.2%; NFLX -1.7%

SEMIS

AMD +5.4% as Fubon had a few positive snippets in their report other than the Rubin delay: they are now at 100k CoWoS at TSM, which would be higher than previous high from MS at 80k. Based on Fubon’s #s, you get something close to $17B+ in GPU revs next year, assuming 20k ASP for mi355x and 30k for mi400x. Previous bulls were $14-$16B, so that’s as high as I’ve heard.

What to do with the stock? Right now AMD leans more towards being a vibe/narrative stock right now as $12B or $15B or $18B in GPU revs hard to disprove at the moment and who knows? High level out view is that over the next 3-4 months is that AMD should at least be hitting new highs. You can make an argument that their competitive positioning will be improved in ‘26 vs when stock peaked in early ‘24, and AI demand is definitely better now with more confidence in sustainability of hypercaler/sovereign spend.

Near-term, we wouldn’t be surprised if we get some digestion.

#1: We’re probably at peak good news today (Rubin delay + a 100k TSM CoWoS #). Unlikely we get any datapoints in the near-term that take the buyside numbers higher.

#2 We’ve been following this analog closely with AMD and it would point to some further near-term digestion. We first posted this analog in TMTB chat here in Mid May under $120 in June, which gave us confidence in initiating an AMD long. It has continued to work since then:

TMTB readers know we love a good analog. We don’t think analogs are crystal balls, although we do think history tends to rhyme. Instead, we use analogs a few ways: 1) when everything is lining up and tracking the analog, it gives us confidence to size up a trade when we already have a view on it 2) it allows us to risk manage and 3) when an analog breaks after closely working for a long time, in our experience it usually is a strong signal that the stock wants to go the other way.

This AMD analog is telling us: potential digestion near-term. That also jives with our fundamental/RoC view (peak good news today) and the Demark weekly sell signal which triggered today.

So what are we playing this?

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.