TMTB EOD Wrap

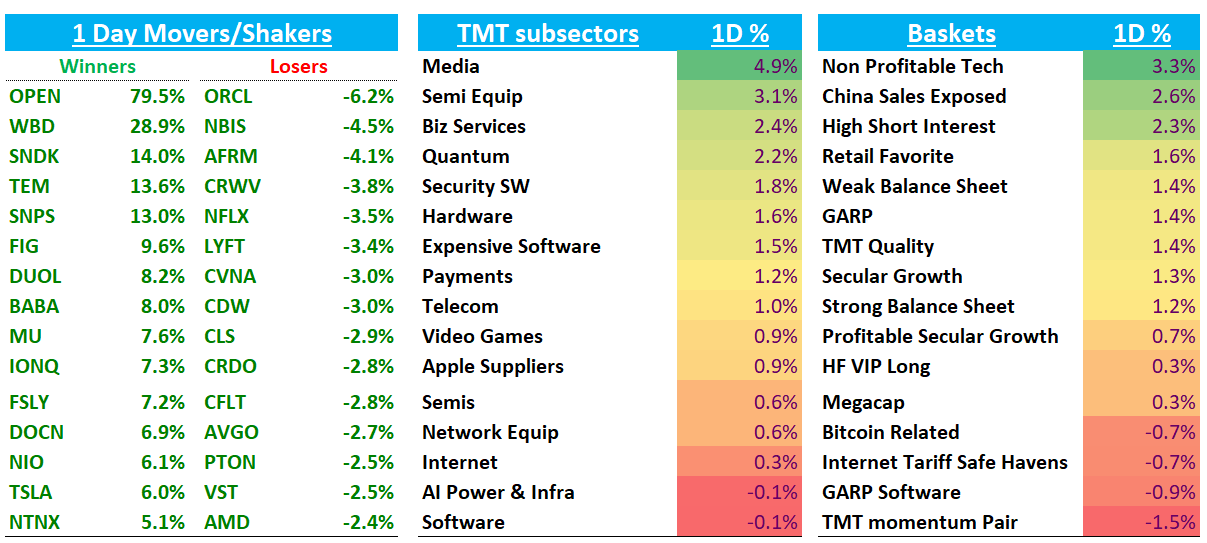

QQQs +58bps hitting ATHs on a relatively slow day in Tech land. 2 Yr yields were flat while the 10 yr dipped 2.5bps to 4%. Fed expects shifted slightly in a dovish direction and continue to expect 3 cuts through the rest of the year - we’ll see what Powell has in store next week.

Post-close, ADBE +3% looks solid as DM NNARR of $500M slightly above bogeys. Raising FY DM revs +100M vs beat by +75M. ADBE guided to F4Q digital media revenue growth of ~9.5% vs our/Street expectations of ~9%/8.7% and FY25 digital media ARR growth guidance was raised by ~30bps to 11.3% y/y growth from ~11% prior. AI inflected ARR up from billions last q to “surpassed $5B” and AI “first” ARR has exceeded their $250M ARR FY tgt

Let’s get to it…

INTERNET

AMZN -17bps struggling to catch a bid post ORCL despite MS making it a top pick and detailing Grocery tailwinds - they think every 1% share captured equals 12-bps of US GMV upside by 2026.

NFLX -3.5% was weak all day on the rumors (then confirmed by WSJ) that Paramount Skydance preparing a bid for WBD. Wells Fargo was out speculating NFLX could maybe pay up for the asset, which helped ding the stock. Having Max and Paramount under one roof would consolidate the two sub scale streamers into a credible No. 2 by library breadth - WBD is at 126M subs vs Paramount at 78M for a total of 200M+ vs NFLX at 300M — the glass half full argument is a consolidated studio could pull back or re-price licensing to NFLX raising NFLX’s content costs and also compete more strongly for ad dollars.

SPOT -2% released their long awaited hi-fi feature but available to all premium subs vs. some hopes of a separate tier for the feature (although mgmt has recently talked about adding features to regular premium subs to help support price increases)

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.