TMTB EOD Wrap

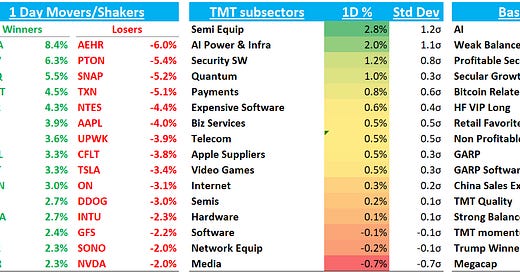

QQQs -70bps as the chop continues. Story today was rotation: IWM +20bps outperformed as flows shifted to small/mid cap stocks with yields falling again. Mega cap was sold: NVDA -2% despite TSM’s strong results; AMZNGOOGL/META all down around 1%; AAPL -4% (lots of questions on this one today - see below); and TSLA - 3.3%.

Treasuries rallied again as yields fell 3-5bps across the curve and market is now pricing in 43bps worth of cuts this year. Fed Gov. Waller made somewhat dovish remarks on CNBC this morning when he talked about the CPI from Wed and said data trajectory means rate cuts in 1H’25. BTC +1%. China flat.

Let’s get to the recap…

Internet

GOOGL -1.3% as M-sci lowered search and YT estimates for Q4, sitting ~1% below street and said Q1 isn’t off to that good a start either. Stock possibly weak with other ad names as well on news Trump/Biden looking for ways to keep US TikTok around.

On that front, SNAP -5%; META - 1%; PINS - 1%; ROKU -1.8% although RDDT +2.5% bucked the trend

RBLX +2.4% - one of the few internet stocks hitting 52wk highs as MS said the direct payments bull case is becoming real as co is now offering 25% bonus to users that make purchase via direct channels (lowering pmt processing to just 3% vs 30% on iOS/Android). They estimate that every 5% of bookings that shifts could add 5% upside to EBITDA. Co doing a good job finding more ways to drive higher monetization and this change a nice tailwind to Q4/Q1 #s

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.