TMTB EOD Wrap

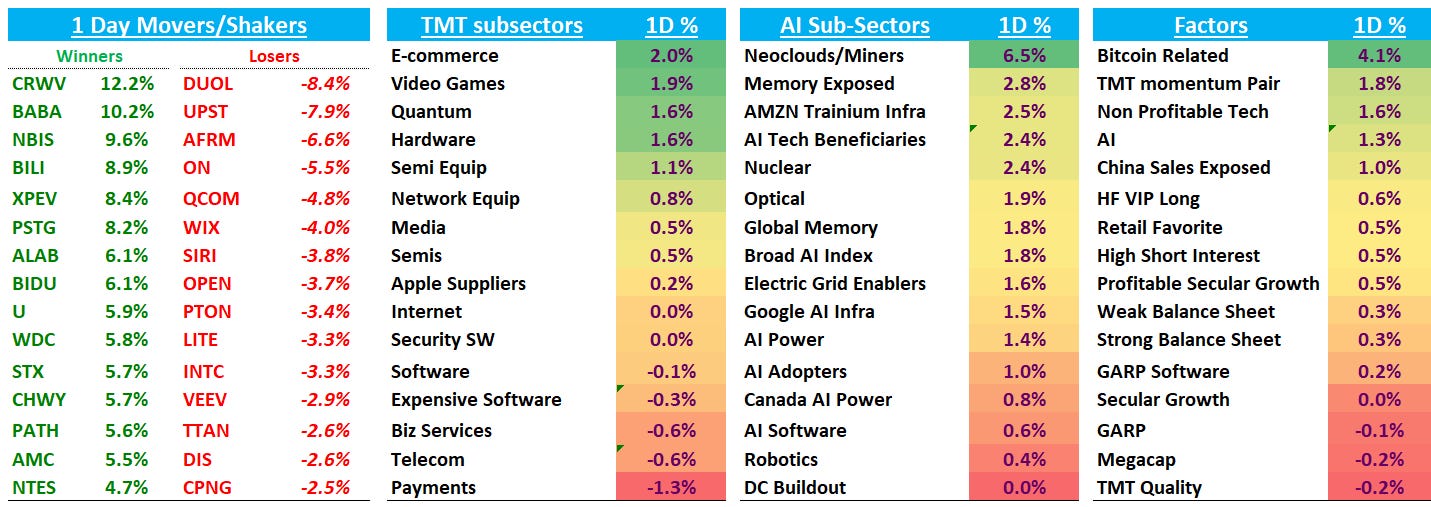

Good afternoon. QQQs +8bps slightly up today after bouncing back after initial losses given the Powell criminal investigation news. Fed expects now expect a cut in June vs 4/29. Hasset and Warsh remain tied at 40% for replacing Powell according to prediction markets. 2 year yield was flat as the long end rose 2-2.5bps.

Let’s dive straight in:

INTERNET

GOOGL +1% as we confirmation they entered into a multiyear deal with AAPL to power Siri. Here’s the joint statement:

“After careful evaluation, Apple determined that Google’s AI technology provides the most capable foundation for Apple Foundation Models and is excited about the innovative new experiences it will unlock for Apple users.”

Funda.ai pointed out that agreement will substantially increase AAPL’s already significant TPU usage on GCP, potentially on scale comparable to Anthropic’s deal with GCP, but likely even more sticky.

RBLX +5% didn’t hear anything here or see any significant inflection in the data but sentiment had reached a nadir (tough ‘26 comps, GTA VI competition, Dec data slowing) so maybe just some covering today. High level, RBLX should benefit from better coding models as they can enable a massive influx of non-professional creators to build sophisticated, high-quality games that were previously impossible for them to make, which all flows through at near zero-marginal cost other than the fees paid out to developers. In theory this should massively increase the flywheel. Interesting spot on the chart as well as it dipped below previous resistance and now bounced back above it (“false breakdown”). Would like to get more positive here (we still like all the longer term drivers we were bullish on when we were long the stock last year), but its a HF/data heavy stock and the narrative there just makes it tough for us to get excited.

RDDT -22bps as Piper pointed out positive checks from their ad buyer conversation saying new technology, increasing monetization, growing audience, adding video have all contributed to better performance. Mahaney at ISI initiated at buy after the close

BABA +9%

VNET / GDS +9% seen as biggest beneficiaries from H200s

SHOP +2% as sell side was positive on the agentic commerce announcements.

NFLX flat as we learned that Paramount is suing WBD over the NFLX deal saying that it intended to nominate directors to the Warner Bros. board to help advance the deal

SPOT -2% continues to act weak. Good thread here in TMTB with some back and forth. The debate here centers around — among other things — the tension between bullish expectations for revenue re-acceleration and a major US price hike versus bearish skepticism regarding the mathematical feasibility of hitting gross margin targets. While bulls think 2026 margins beating the Street—driven by pricing power and compounding ad growth—bears argue that sticky royalty rates make those goals unrealistic and that audio ad budgets remain structurally inferior to video, along with confusion about commentary from IR whether price increase will be $2 or $1.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.