TMTB EOD Wrap

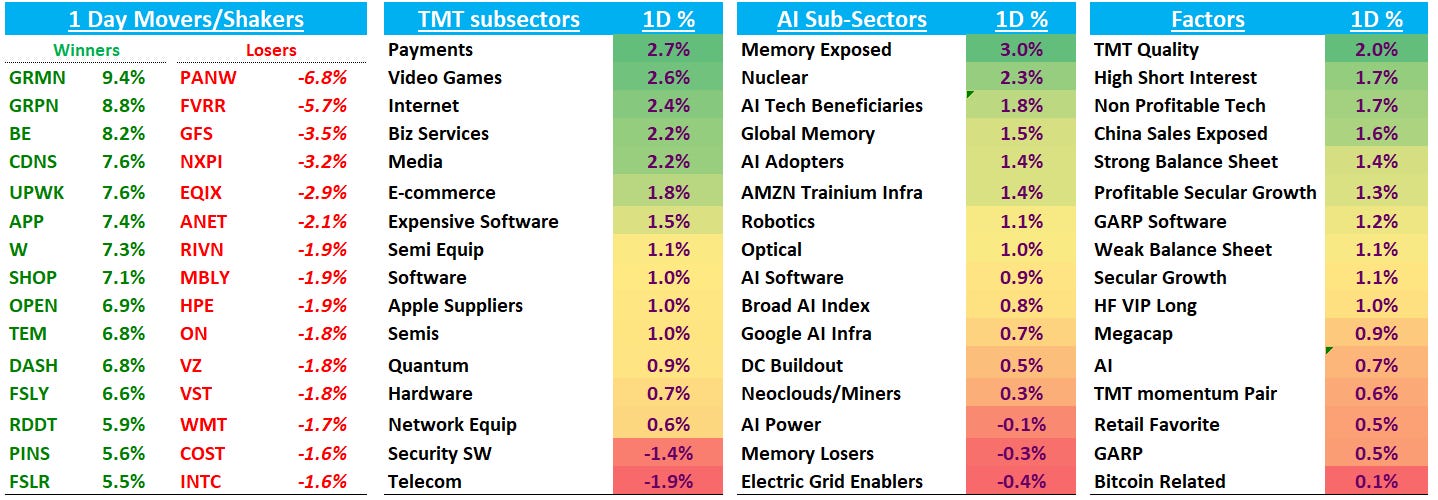

Good afternoon. QQQs +75bps with volume down 20% as software and internet finally got a bid while semis held up well so good breadth overall. IWM +35bps. Yields rose 2-3bps across the curve. BTC -2% continues to be weak no longer participating in equity rallies. Fed expects didn’t shift much.

Post-close earnings:

CVNA -24% with the rug pull as EBITDA whiffed, coming in at roughly $515M vs street around $535M and buyside expecting $600M+. The sting is worse because mgmt had set high expects after guiding FY25 “at or above” the $2.0–2.2B range and ultimately delivering $2.37B, which kept investors hoping for more. Retail units strong at +43% Y/Y and revenue of $5.6B beat street at $5.27B. The real problem beyond the EBITDA miss is the guidance commentary as last quarter they gave specific unit and EBITDA targets, and now they’ve reverted to vague “significant growth” language for both retail units and EBITDA in 2026, while the Street was already baking in +32% EBITDA growth.

DASH +1% looks ok. Volume fine but the Q1 EBITDA guide is the issue. GOV grew +39% to $29.7B (vs. $29.1B consensus) and EBITDA was +38% to $780M (vs. $775M), so the quarter itself was a modest beat. Q1 GOV guidance of $31.4B at midpoint is ahead of the $30.75B Street number, but Q1 EBITDA guidance of $675–775M (midpoint $725M) came in well below the $800M consensus. The shortfall reflects several headwinds: Deliveroo is only contributing sub-$25M in Q1 with about $20M in investment drag, there's a $20M storm impact, and they're seeing higher Dasher costs per order along with seasonal softness and investment spending. For FY26, mgmt saying EBITDA as a percentage of GOV will increase slightly excluding Deliveroo, with the second half materially stronger than the first half so a bit of a hockey stick.

Not sure what’s going on the call, but stock +4% now…

EBAY +6% clean beat and raise. Q4 well ahead while revs guided to $3.00–3.05B versus the $2.79B street # and EPS of $1.53–1.59 versus $1.48. Q4 itself showed solid upside. They also announced a $1.2B acquisition of Depop and added a $2B buyback. ETSY +15% on the Depop sale

FIG +17% great numbers and now we’ll see it will hold tomorrow - should be a good tea leaf for AI disruption names. Q4 revs of $303.8M +40% growth and beat the guide by about 3.5%, same magnitude as last q Customers with over $40K in ARR came in at 13,684, largely in line with sell-side estimates. EPS was $0.08 vs. $0.07 consensus. The real catalyst was the FY26 guide calling for ~30% revenue growth vs street expects in the mid-20s range. Focus will be on Ai disuprtion their AI tools on the call.to monetize. That narrative will be what drives the stock from here.

BKNG +2% looks solid and doing a 25-1 reverse stock split (effective apr 2). Q4 room nights grew +9% to 285M (vs. 277M consensus) and bogeys of +7-8%, gross bookings were +16% to $43B (vs. $42B), and EBITDA $2.2B vs $2.11B. Revenue was $9B vs. $8.73B.

The initial FY26 guide calls for low-double-digit bookings growth (high-single-digits cc) vs Street at ~9%, and EBITDA growing faster than revenue (street has +12%), with adjusted EPS growth in the mid-teens. Q1 guidance was mixed: room night growth of +6% at the midpoint slightly below Street’s 7%, but bookings growth of +15% at midpoint is ahead of the 13% consensus. Q1 EBITDA growth of +10–14% looks light.

Let’s get to it…

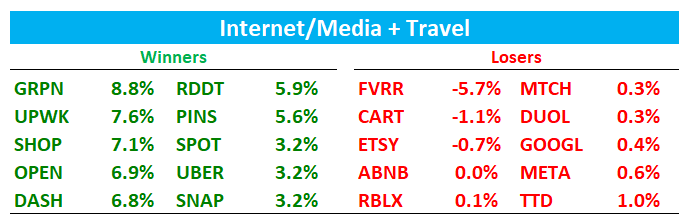

INTERNET

AMZN +1.8% as Nowak at MS said AWS should be able to sustain 30%+ growth while talking up Agentic AI as a tailwind, Baupost initiated a position in Q4, Bernstein had a note saying early Feb web data pointing to big Jan accel for AWS, and TheInformation had an article talking up how AWS has gotten 50% of Anthropic’s GP on selling its AI via AMZN while saying they expect to pay the big 3 clouds at least $80B through 2029.

SPOT +3% shaking off news that GOOGL’s (+40bps) AI music maker coming to Gemini app. Here’s the Verge:

Google has given Gemini the ability to spit out AI-generated music, courtesy of DeepMind’s latest audio model. Beta access to Lyria 3 is rolling out in the Gemini app, enabling users to generate 30-second tracks based on text, images, and videos, without having to leave the chatbot window.

The new music-making tool is available globally starting today in English, German, Spanish, French, Hindi, Japanese, Korean, and Portuguese, with plans to expand in the future. Access is limited to Gemini app users who are 18 years or older.

We think that’s pretty positive tea leaf of price action - no longer are sw/internet names going down 10% on an AI headline news. After last week, we think SPOT has one of the cleaner narratives in large cap internet as the GM beat alleviated the main bear fear and shifted the conversation back to the LT drivers: ill growing users at scale, proving durable pricing power, and structurally expanding margins as it layers higher-margin revenue streams (Marketplace, improving Ads, audiobooks/podcasts/video) on top of a massive music subscription base. We think AI is more likely to increase content supply and engagement rather than disintermediate SPOT, which is has the dominant distribution.

SHOP +7% as Stratechery was out debunking the bear agentic AI case. Not much new in his article but came down to this:

There are three advantages for being the entire infrastructure of an e-commerce business. First, it will be very difficult for any existing business to replace Shopify. Second, Shopify is the best choice when getting started because it provides everything you need. Third, Shopify is actually the best placed entity to offer AI tools to merchants because it operates over the entire business, which means they have the entire context and data necessary to make AI truly useful.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.